Finding the best international money transfer solution today requires more than just walking into your local bank. The global payments industry has evolved rapidly, and now customers can choose between traditional banking institutions and an array of digital-first, fintech-driven platforms. This increased competition has created opportunities for senders to access better exchange rates, faster delivery speeds, and complete transparency on costs.

This post may contain affiliate links. If you sign up or make a purchase through these links, we may earn a commission — at no extra cost to you. Learn more.

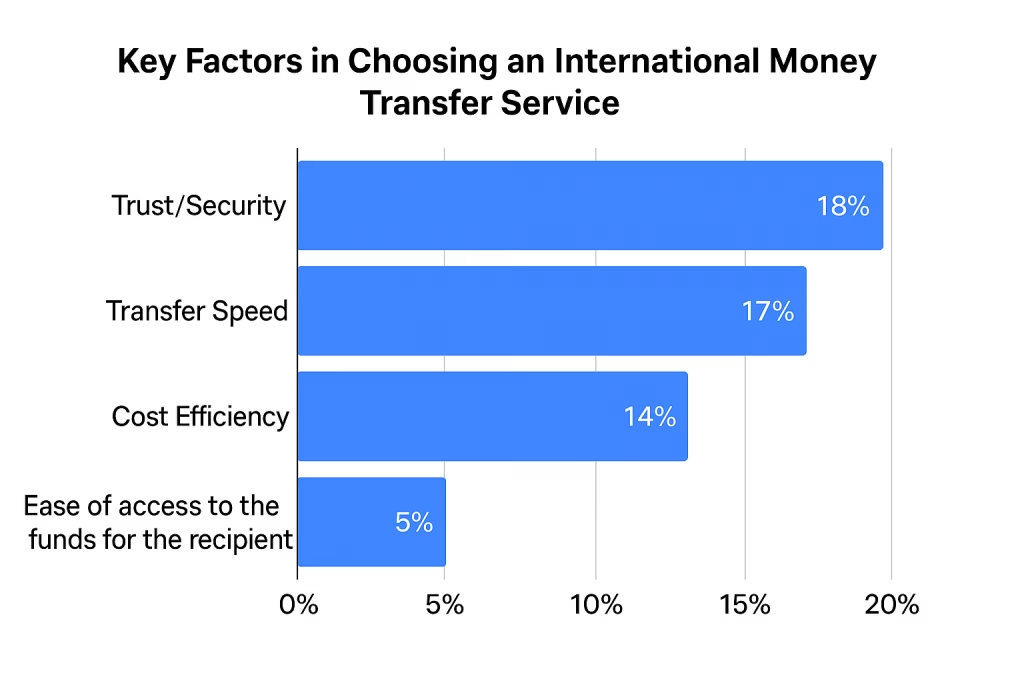

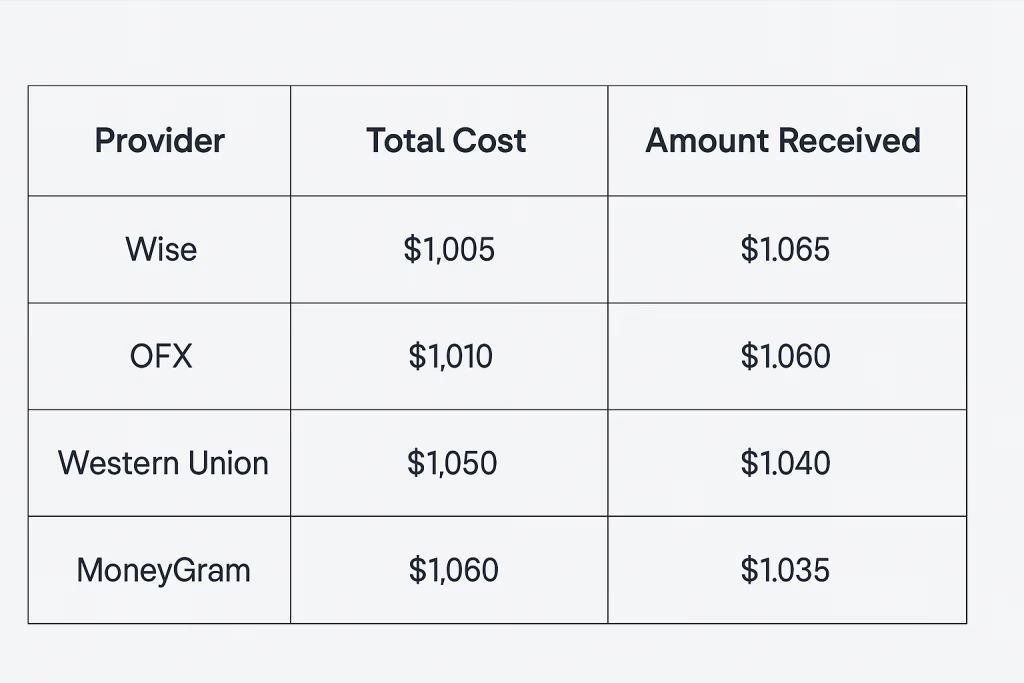

When choosing a provider, most customers focus on trust and security, transfer speed, affordability, and ease of use. In recent years, nonbank services have gained popularity because they tend to offer significantly better value for money compared to high-street banks, which often impose steep flat fees and unfavorable exchange rate markups. For example, sending $1,000 through a major bank can cost $40–$50 in fees alone, not counting hidden costs in the exchange rate. By comparison, services like Wise or OFX can cut those fees by half or more.

According to industry research, trust and security account for 18% of the factors influencing customer choice in international transfers. This priority is closely followed by transfer speed and rate transparency, with people wanting services that clearly display costs upfront and deliver money quickly. Wise is well-known for its affordability and speed, especially when sending funds from a Wise account balance.

Understanding Money Transfer: A Brief Overview

The global remittance market has seen exponential growth in the past decade. In 2017 alone, individuals transferred over $1 trillion across borders, representing just 6% of the global payments market yet generating nearly 40% of all bank fee revenue. This disproportionate figure underscores why so many people are exploring fintech options for the best international money transfer experience.

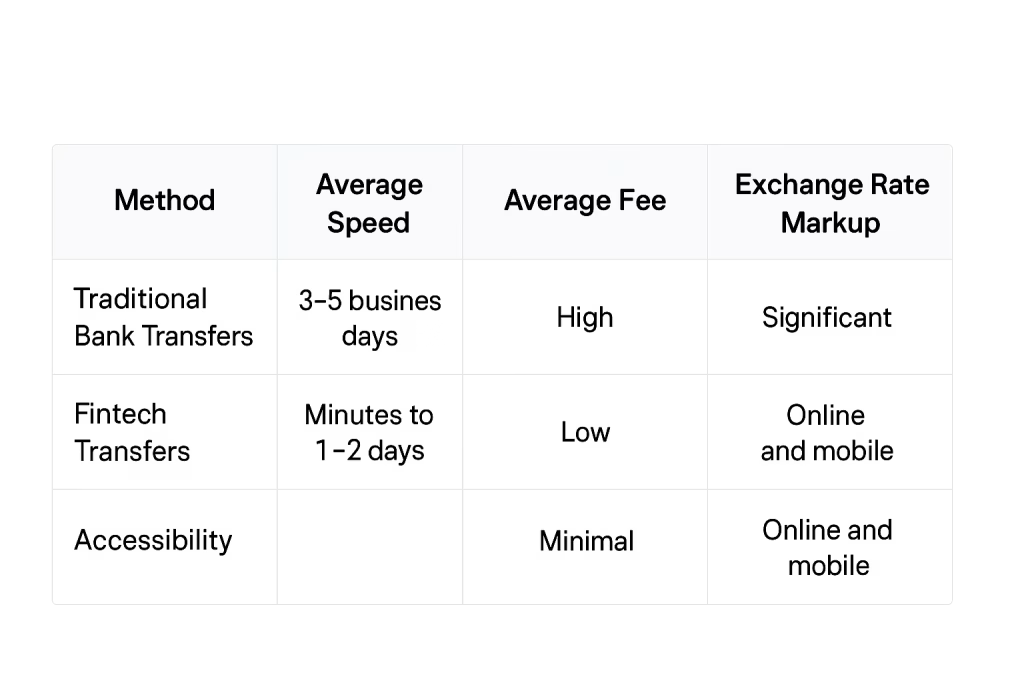

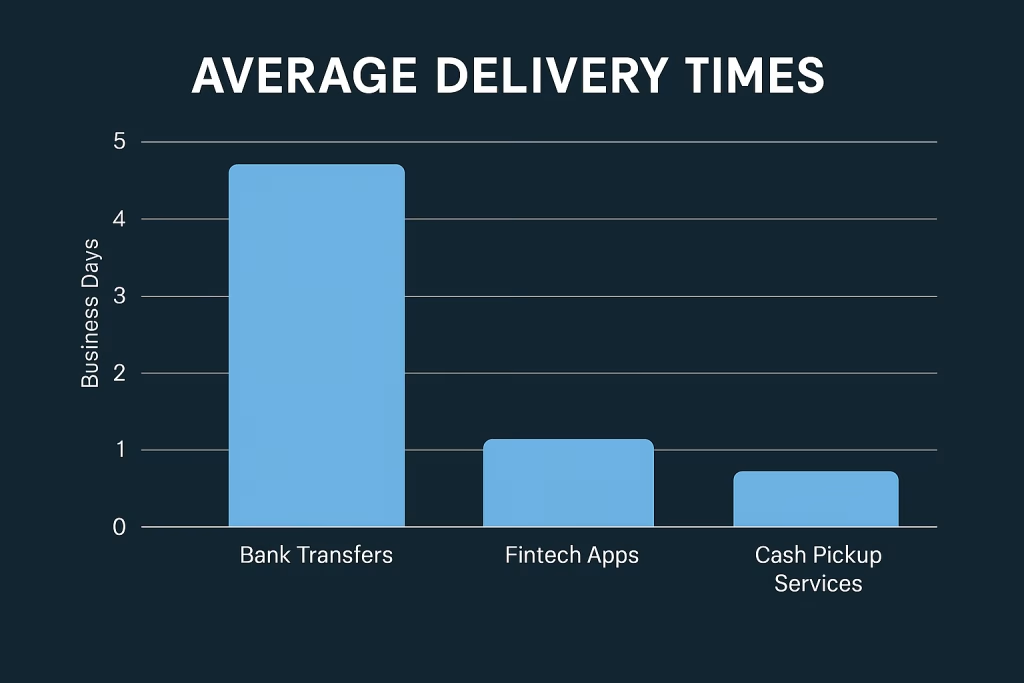

Traditional bank transfers rely on IBAN and SWIFT codes to route funds internationally. These transactions typically take 3–5 business days and often require in-person visits for identity verification. While this method is considered secure, it is rarely the fastest or most affordable.

When choosing between providers, it’s important to weigh:

- Service fees: Some services charge flat fees, others take a percentage.

- Transfer limits: These can vary widely between providers.

- Destination coverage: Not every platform serves every country.

- Delivery speed: Faster often means higher cost.

Modern fintech providers such as Wise and Remitly have simplified the process, allowing you to initiate transfers from a smartphone within minutes. For more comparisons, see Top Remittance Apps with Low Exchange Rates, which explores top-rated services across different regions.

Key Factors to Consider: Speed, Cost, and Security

When evaluating the best international money transfer services, trust and security remain the most important considerations. Reputable providers follow strict regulations, use bank-grade encryption, and implement advanced fraud monitoring systems.

Speed is a close second. For emergency situations, like paying for urgent medical care abroad or covering unexpected travel expenses, instant delivery is essential. Some providers can complete transfers in seconds, while others may take days.

Cost efficiency ranks alongside convenience. Many customers stick with providers they’ve already set up accounts with, especially if they consistently deliver competitive rates. However, the cheapest way to send money abroad isn’t always the one with “zero fees” in big letters. Hidden costs can be buried in inflated exchange rates.

Finally, accessibility for the recipient matters — even if it only ranks at 5% in global surveys. In regions with limited banking infrastructure, cash pickup locations or mobile wallet options are vital for ensuring funds reach their destination without hassle.

Traditional Bank Transfers: The Old Guard

Traditional bank wires still move huge sums across borders. They use the IBAN and SWIFT networks to route payments. Processing usually takes three to five business days. Branch visits for ID verification are still common. Fees are often high, and rates can be poor. Limits can also apply. However, banks remain trusted for very large transfers. Learn more about the network on the SWIFT site and the structure of IBAN.

Wise: High Sending Limits and Transparent Fees

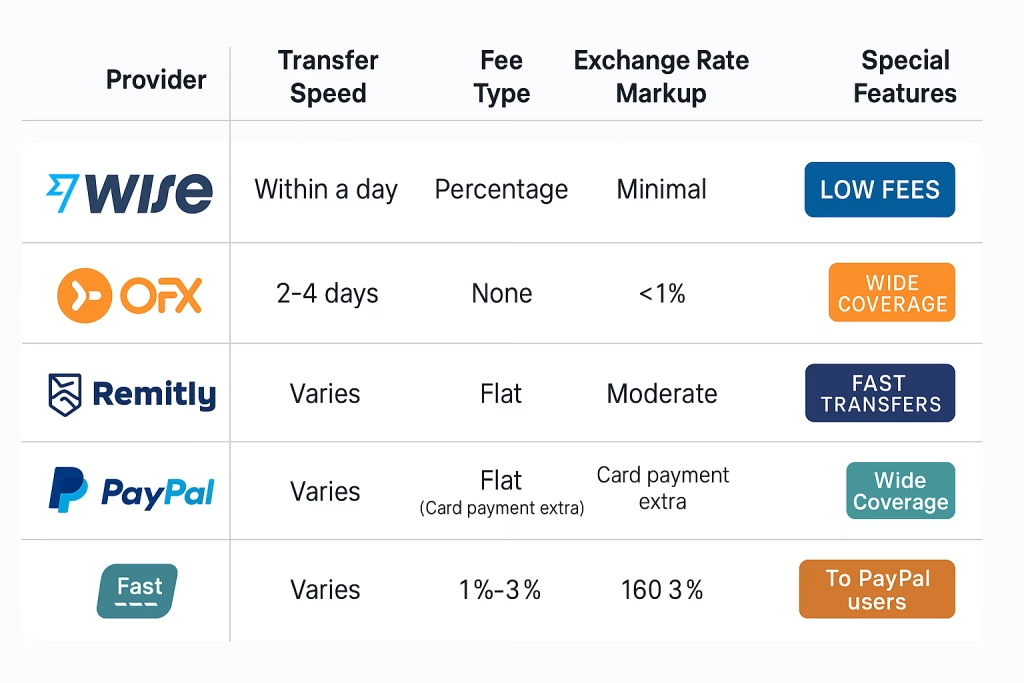

Wise consistently earns a place in best international money transfer rankings because of its honest pricing model and speed. It also uses the mid-market exchange rate, the same rate banks use to trade with one another, without adding a hidden markup.

Key benefits:

- Speed: 64% of transfers arrive in under 20 seconds.

- Cost savings: Up to 90% cheaper than bank transfers.

- Wide reach: Send money to over 70 countries.

- Transparency: All fees shown upfront before payment.

For small businesses and freelancers working with international clients, Wise is one of the fastest international money transfer apps while still being highly affordable. We’ve covered Wise extensively in our guide on How to Send Money from Canada to Ghana, which compares its features to other leading services.

OFX: Minimizing Transfer Fees for Large Amounts

OFX is an excellent choice for high-value transactions. With zero transfer fees and exchange rates typically under 1% markup, it offers strong value for large sums.

Highlights:

- Operates in 170+ countries with 50+ currencies.

- Only bank-to-bank transfers, no cash pickups.

- Delivery in 2–4 business days.

This service is ideal for big purchases like overseas property, paying university tuition abroad, or settling substantial business invoices. If you want to reduce costs on large transactions, OFX is one of the cheapest ways to send money abroad.

Remitly: Speed and Reliability for International Transactions

Remitly focuses on delivering fast, affordable, and secure transfers to a wide variety of countries.

Advantages:

- Multiple delivery methods — bank deposit, cash pickup, mobile wallet.

- Flexible payment methods — bank account, debit, or credit card.

- Reliable customer service with tracking options.

For anyone supporting family members overseas, especially in areas where cash pickup is essential, Remitly offers both speed and reliability.

PayPal: Versatile Solution for Larger Payments

PayPal’s Xoom service allows international transfers to over 160 countries. It’s especially convenient for people already using PayPal for other transactions.

Features:

- Recipients don’t need a PayPal account.

- Bank or PayPal balance transfers capped at a $4.99 fee.

- Card payments available with higher fees.

- Exchange rate markup between 1–3%.

Apple Cash: Convenient and Accessible Transfers

Apple Cash works for domestic transfers within the United States. It lives inside the Apple Wallet app. Payments use Apple Pay and a virtual Visa card. Money moves quickly between Apple users. However, cross‑border transfers are not supported. Therefore, Apple Cash is not ideal for most remittances. See Apple’s guidance on Apple Cash.

Zelle: Simplifying Bank‑to‑Bank Transfers

Zelle powers fast bank transfers between U.S. accounts. Many banks support it directly in their apps. Funds often arrive within minutes. Yet Zelle does not support international transfers. It also requires a U.S. bank account and phone number. As a result, Zelle is unsuitable for global remittances. Learn more on the official Zelle site.

Cash App: User‑Friendly and Efficient for Small Amounts

Cash App supports peer‑to‑peer transfers in the U.S. and U.K. Cross‑border options are limited. It does not serve most international corridors. Cash App is great for small domestic payments. However, it is not the best international money transfer choice for global routes. See support details at Cash App Help.

Western Union: Global Reach with Instant Transfers

Western Union remains unmatched for physical reach. It is often the fastest way to send cash internationally.

Advantages:

- Available in almost every country.

- Supports cash pickup, bank deposits, and mobile wallet transfers.

- Tracking with MTCN codes for added security.

MoneyGram: Quick and Flexible Options

MoneyGram operates in more than 200 countries and has over 400,000 retail locations.

Benefits:

- Bank transfers and cash pickups available.

- Low-cost bank-funded transfers.

- Faster than most banks for the same corridors.

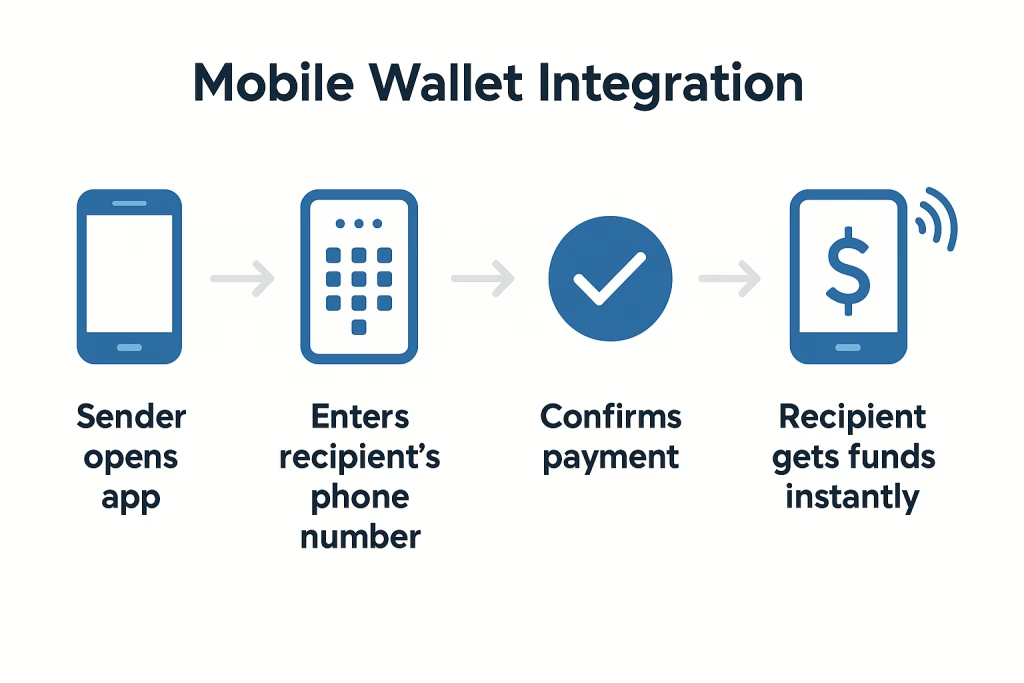

Mobile Wallet Integration: The Future of Transfers

Mobile wallets like M-Pesa, GCash, and Airtel Money are redefining the best international money transfer experience in emerging economies.

Global Network Access: Reaching Every Corner of the World

Providers like Western Union and MoneyGram offer unmatched reach. They combine digital channels with dense retail networks. Fintech platforms like Wise extend coverage through bank and wallet partners. Therefore, even remote areas can receive funds. This reach matters when emergencies strike and access is limited.

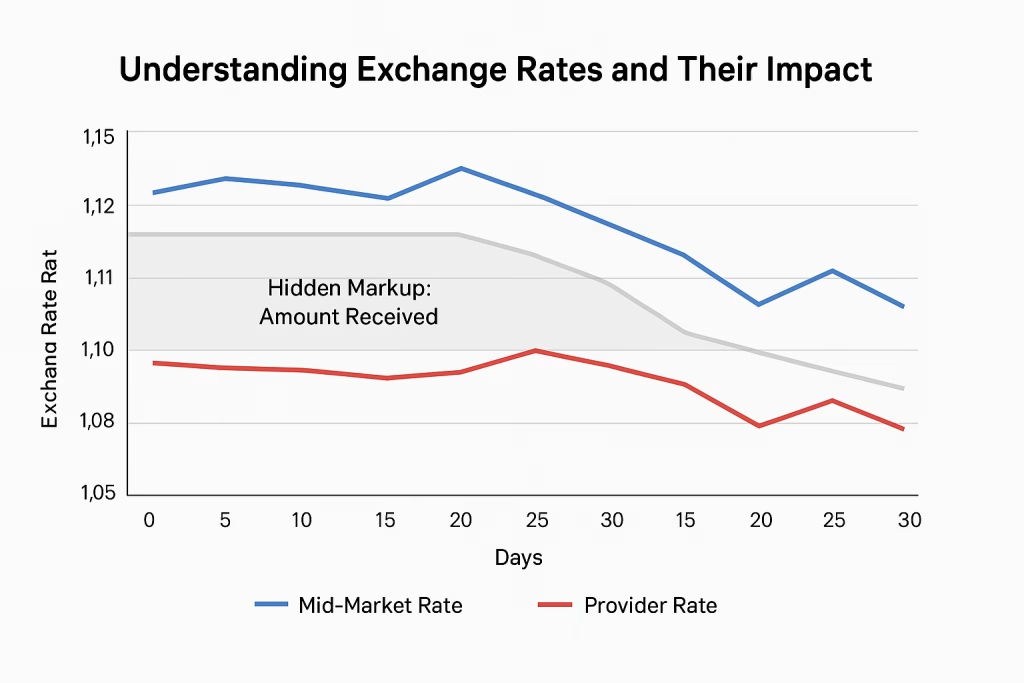

Understanding Exchange Rates and Their Impact

Exchange rates decide how much your recipient receives. The mid‑market rate is the fairest yardstick. Many providers add a hidden markup. Consequently, transfers look cheap but deliver less money. Compare quotes across providers before you pay. Tools from XE, Wise and OFX help you check. This is the cheapest way to send money abroad without surprises. Transparent pricing also signals secure online money transfer services that respect users.

Security Features: Protecting Your Transfers

Security starts with regulated providers. Look for licensing and clear compliance pages. Reputable services use encryption and strong authentication. Double‑check recipient details before sending. Set alerts for large payments. Respect daily and per‑transfer limits. When needed, use escrow or staged payments. Guidance from regulators like FINTRAC and the U.K. FCA explains consumer safeguards. These controls define secure online money transfer services you can trust.

Comparing Fees: Finding Cost‑Effective Solutions

Fees vary widely across providers and corridors. Some advertise zero fees yet hide costs in the rate. Others charge a small, clear percentage. The World Bank tracks this market with its Remittance Prices database. Compare total cost: fee plus rate impact. Often, Wise offers low totals for bank‑funded transfers. OFX excels for large amounts with no transfer fee. MoneyGram is flexible but pricier for cash pickup. Use comparisons to find the cheapest way to send money abroad for your route.

Transfer Times: Balancing Speed and Cost

Speed trades off with price. Card‑funded transfers often arrive faster. Bank‑funded transfers usually cost less. Wise reports many transfers in seconds. Xoom delivers some corridors within minutes. Bank wires can take several days. Choose based on urgency, budget, and payout type. For crises, pay more for speed. For routine payments, optimize for cost. The fastest international money transfer apps give clear delivery estimates before you pay.

Leveraging Partnerships for Better Deals

Traditional banks rely on correspondent networks. Each hop can add costs and delays. Fintechs reduce hops using direct integrations. Some partner with local payout agents and wallets. Others hold local currency pools to avoid conversions. These models cut spreads and fees. Thus, customers pay less and receive more. See how networks work on the SWIFT knowledge base.

Emerging Trends: Staying Informed and Adapting

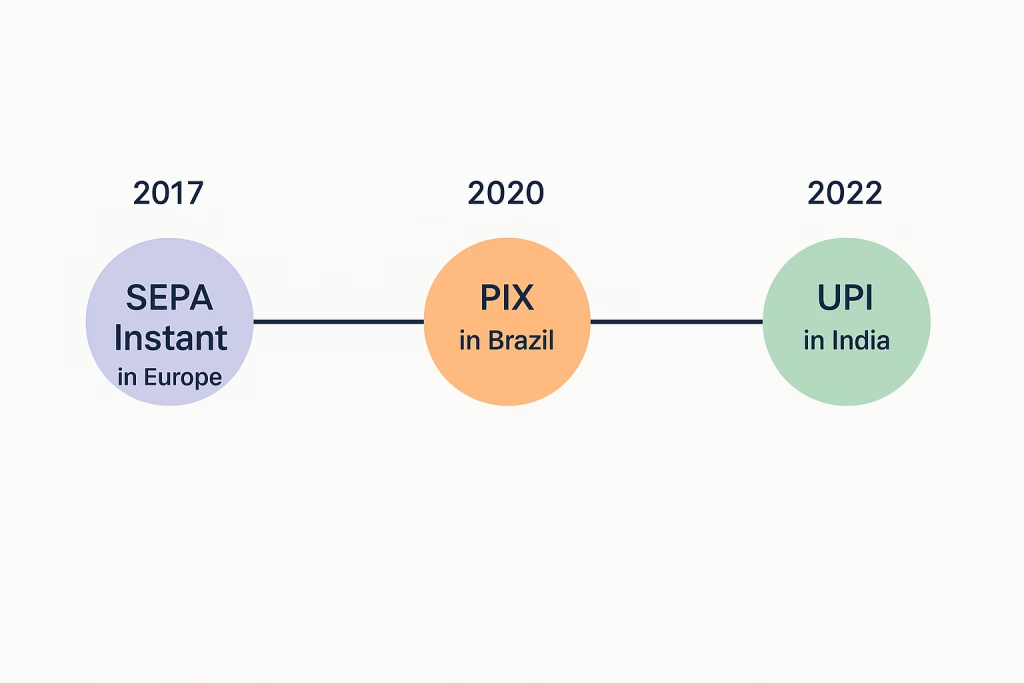

Instant payment rails are expanding worldwide. Examples include Faster Payments, SEPA Instant, and Brazil’s PIX. India’s UPI drives low‑cost transfers at scale. ISO 20022 improves data quality across networks. Compliance tech reduces fraud while speeding checks. More providers publish live fee and rate data. Consumers win with transparency. Therefore, keep comparing options. That habit surfaces the fastest international money transfer apps and the cheapest way to send money abroad for your needs.

Conclusion: Making the Right Choice Based on Your Needs

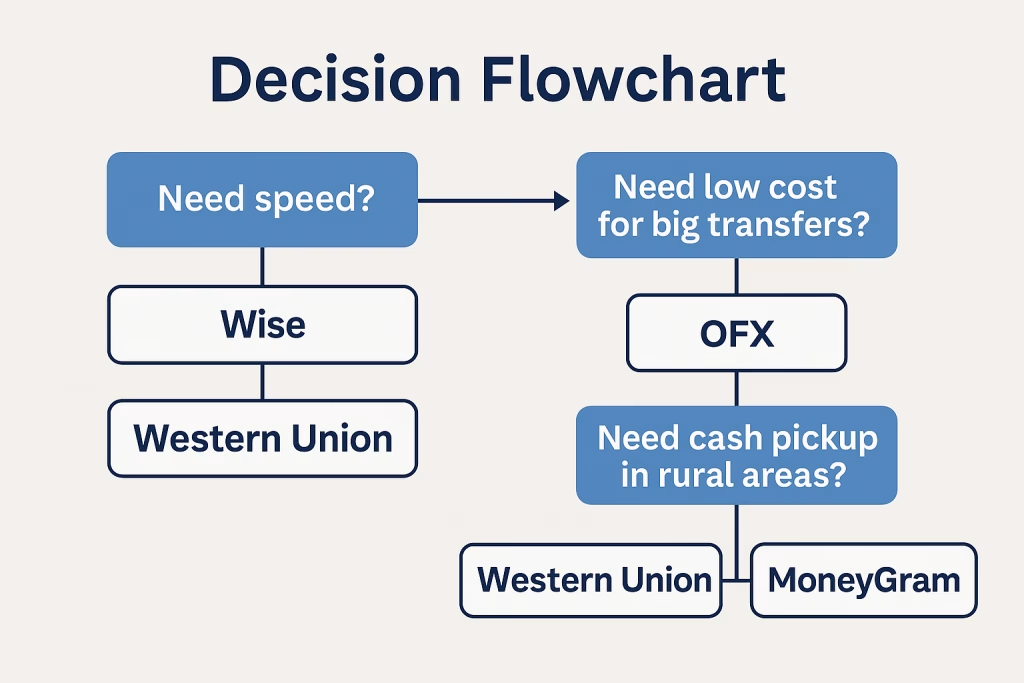

Choosing the best international money transfer service depends on your priorities. Start by defining speed, budget, and payout needs. Compare total costs across several providers. Confirm the exchange rate and delivery time. Favor secure online money transfer services with strong regulation. For large sums, consider OFX. For transparent, quick bank‑funded payments, consider Wise And for cash pickup in remote areas, use Western Union or MoneyGram. Recheck prices often, since corridors change. With consistent comparison, you will find the best international money transfer for each situation.

Wow, awesome blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your website is magnificent, as well as the content!

Thanks a lot! We’ve been blogging for a little while now, and I’m glad you find the layout and content useful. I’ll keep sharing more.