In a region where vast distances and limited infrastructure once posed significant challenges to financial services, mobile wallets are revolutionizing the way people transact in Sub-Saharan Africa. With the growing significance of these digital tools, identifying the best mobile wallets in Sub-Saharan Africa by 2025 is becoming increasingly important. The digital transformation sweeping across the continent is catalyzed by a rising demand for accessible and convenient financial solutions, making mobile wallets a cornerstone of economic inclusion. As we look towards 2025, this article will explore the top mobile wallet platforms leading the charge in enhancing financial accessibility and security, while tackling the hurdles and harnessing the opportunities that lie ahead.

Mobile wallets have surged in popularity, driven by increased smartphone penetration and the urgent need to bridge the financial inclusion gap. People now have the power to conduct transactions, access credit, and manage savings directly from their mobile devices, reshaping the financial landscape in the region. This guide delves into the elements sparking this uptick in adoption and examines how innovative technologies and regulatory frameworks are accelerating the integration of mobile wallets into daily life.

As we navigate the evolving world of mobile payments, we will highlight the key players revolutionizing the sector, like iKhokha and PayGenius, and assess the impact of game-changing advancements such as 5G networks and AI-driven compliance. The article will also address how these changes bolster economic growth and empower small businesses, while ensuring privacy and security in mobile transactions. Together, we’ll uncover the dynamic future of mobile wallets set to transform Sub-Saharan Africa by 2025.

The Rise of Mobile Wallets in Sub-Saharan Africa

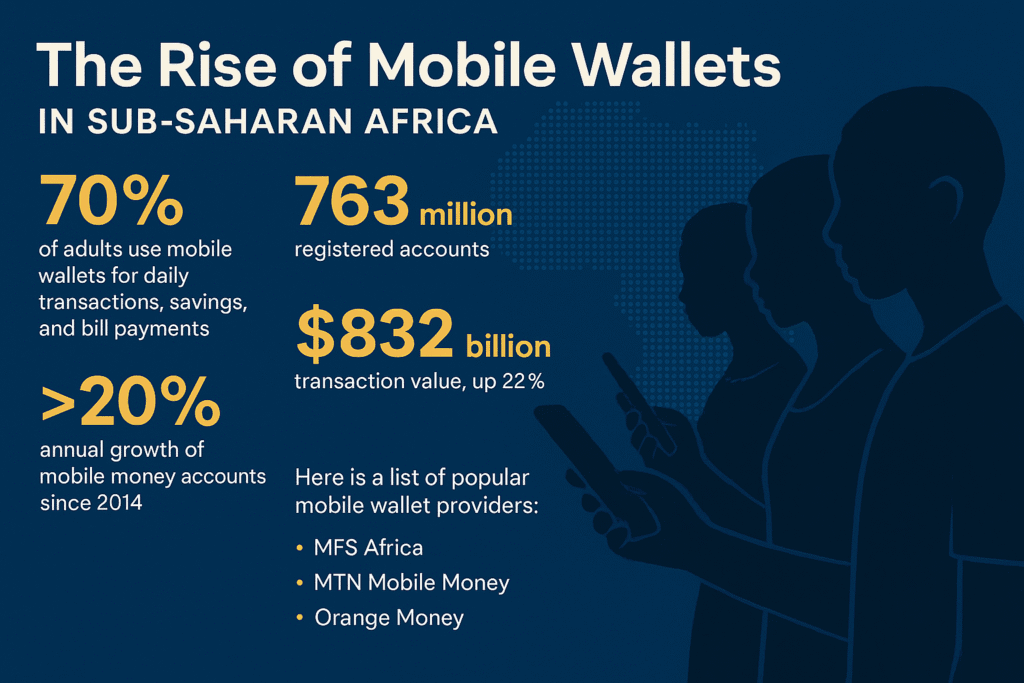

The rise of mobile wallets in Sub-Saharan Africa is reshaping financial landscapes. Over 70% of adults now use mobile wallets for daily transactions, savings, and bill payments. This surge highlights rapid advances in financial inclusion fueled by technological innovations. Mobile money accounts have grown annually by over 20% since 2014, with Kenya leading as 80% of its populace uses such services.

Mobile wallets are pivotal in remittances, with over half of mobile wallet users receiving at least one remittance payment in the past year. MFS Africa alone linked over 320 million mobile money wallets, accounting for 60% of all mobile wallets in the region.

The market observed impressive growth, with 763 million registered accounts and transaction values soaring by 22% to reach $832 billion. The expansion of digital wallets in Sub-Saharan Africa reflects the region’s push towards digital economies and accessible financial services.

Here is a list of popular mobile wallet providers:

- MFS Africa

- MTN Mobile Money

- Orange Money

These players, along with supportive regulatory environments, continue to empower the unbanked population, enhancing access to digital payments and financial services across African countries. MFS Africa’s expansive network facilitates cross-border transactions, as detailed on their official platform.

Factors Driving Mobile Wallet Adoption

Mobile wallet adoption in sub-Saharan Africa is on the rise. Several factors drive this trend:

- Financial Inclusion: Many people lack access to traditional banks. Mobile wallets bridge this gap, offering financial services to remote areas.

- Widespread Usage: In countries like Kenya and Ghana, mobile money wallets have become the primary payment method. This shift boosts the adoption rate for various transactions.

- Transition to Formal Management: People are moving from informal to formal financial systems. This change opens new opportunities for the unbanked and underbanked.

- Social Pressure: There’s a growing expectation to engage in financial activities. This pressure encourages investment in mobile devices, promoting mobile wallet usage.

- Mobile-First Revolution: Increasing smartphone penetration supports the rapid growth of mobile wallets. More people now use digital payments as part of daily life.

These factors are transforming financial services. As mobile money platforms expand, more people can enjoy the benefits. This shift encourages economic growth and reduces reliance on cash transactions in African countries. For a deeper understanding of how mobile technology is reshaping financial services, explore our article on The Impact of Mobile Technology on Financial Inclusion.

Here’s a table summarizing the key factors:

| Key Factors | Impact |

|---|---|

| Financial Inclusion | Access for remote communities |

| Widespread Usage | Boosts transaction adoption |

| Formal Management | Opportunities for unbanked populations |

| Social Pressure | More mobile device investments |

| Mobile-First Revolution | Supports digital payment expansion |

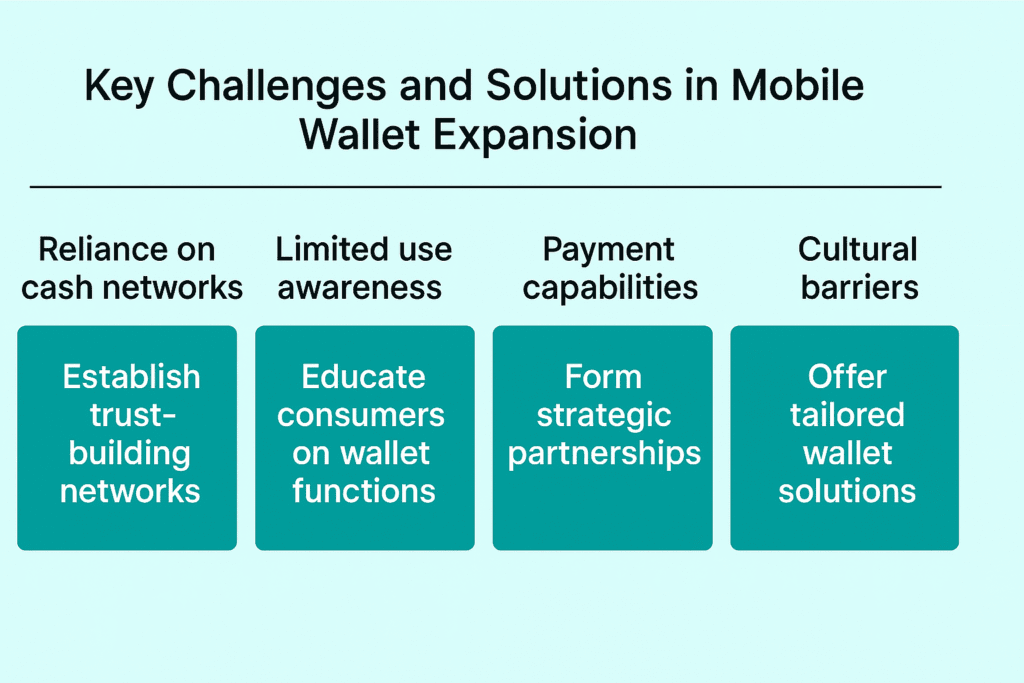

Key Challenges and Solutions in Mobile Wallet Expansion

Mobile wallets are transforming Sub-Saharan Africa’s economy. Yet, their expansion faces challenges. Most transactions here rely on cash access. Almost two-thirds involve cashing in or out. This shows trust networks are needed to boost mobile wallet use.

Education is key. Users must learn about more than just basic functions. Understanding direct wallet transactions can drive broader adoption. Strategic partnerships are also crucial. For instance, mobile operators joining forces with global payment networks like Mastercard. This can enhance international payment capabilities. To learn more about strategies for educating users on digital financial tools, read our piece on Enhancing Digital Literacy for Financial Services.

Solutions tailored to local needs have fueled success. These digital wallets use strong mobile infrastructures. They help advance financial inclusion and boost economic development.

The table below highlights key areas of focus:

| Key Challenge | Solution |

|---|---|

| Reliance on cash networks | Establish trust-building networks |

| Limited use awareness | Educate consumers on wallet functions |

| Payment capabilities | Form strategic partnerships |

Mobile wallets are evolving. They now extend beyond personal finance. They impact corporate cash management and enable larger economic activities. These wallets are poised to play a vital role in Africa’s digital economies. For a deeper comparison between top mobile payment providers, check out our in-depth guide to Africa’s leading fintech platforms.

iKhokha: Facilitating Seamless Transactions

In 2025, iKhokha emerges as a notable player in South Africa’s booming mobile payments industry. With mobile phones driving digital payments, iKhokha capitalizes on the widespread use of mobile wallets in sub-Saharan Africa. Over 70% of adults in this region rely on mobile money accounts for their daily transactions.

iKhokha’s success is closely tied to sub-Saharan Africa’s dominance in global mobile money transactions, comprising 70% of the total. This adoption is pivotal as the continent’s e-payments market is projected to reach $40 billion by 2025.

Why iKhokha Thrives:

- Wide Adoption: Majority use mobile money solutions.

- Transaction Efficiency: Quick and secure digital payments.

- Growth Potential: Contributing to a $40 billion market.

iKhokha benefits from the robust digital economy, ensuring seamless money transfer services. Its presence highlights the shift from cash transactions to digital wallets. This transformation is crucial, given the substantial unbanked population in African countries. By partnering with mobile network operators and financial institutions, iKhokha strengthens its role in supporting international remittances and local mobile payments. Explore iKhokha’s offerings in detail on their official website.

African Payment Solutions: Pioneering Financial Inclusion

In 2025, mobile wallets will continue to transform sub-Saharan Africa’s economy. With over 45% of global mobile wallet accounts located here, the region plays a vital role in digital payments. In 2022 alone, transactions through mobile wallets reached over $830 billion, nearly half of the region’s GDP.

Key Features of Mobile Wallets in Sub-Saharan Africa:

- Remittances: Over half of users receive money via mobile wallets.

- Financial Inclusion: Mobile wallets offer alternatives to traditional banking, important for the unbanked population.

- Access to Financial Services: Users gain more access to credit and investments.

Despite growth in mobile internet, 61% of the population remains offline. Yet, mobile wallets have proven essential for economic activities. Key players like MTN Mobile Money and Orange Money lead the market, helping bridge the financial gap in African countries.

Table: Leading Mobile Wallet Providers in Sub-Saharan Africa

| Provider | Key Regions | Notable Features |

|---|---|---|

| MTN Mobile Money | West & East Africa | Mobile money accounts, wide reach |

| Orange Money | West & Central Africa | Easy international money transfers |

As mobile network operators and financial institutions expand, the future of mobile payments looks promising, driving further financial inclusion across African countries.

PayGenius: The Future of Payment Technology

PayGenius is a leading payment aggregator in South Africa. Partnered with ABSA, it offers a variety of payment solutions. Their services span online, mobile, Point of Sale (POS), and mobile POS (MPOS) systems, integrated with iKhoka.

Key Features of PayGenius:

- Payment Methods: Credit card, instant EFT, and standard EFT.

- Specialized Solutions: Powertime facilitates prepaid services and bill payments through apps, websites, and SMS.

- QR Code Technology: Innovative QR code payment system to enhance user experience.

The company stands out by catering to niche markets. PayGenius’s mobile payment solutions provide flexibility and convenience. This is crucial in boosting digital payments across Sub-Saharan Africa.

PayGenius is shaping the future of mobile wallets by offering secure, fast, and easy payment methods. As digital economies grow, companies like PayGenius will play a key role in expanding mobile money services.

Real-Time Payment Systems: Transforming the Financial Landscape

Real-time payment systems are revolutionizing sub-Saharan Africa’s financial landscape. In 2025, they will play a key role in the region’s digital economies. With 70% of global mobile money transactions occurring here, mobile payment services are making financial services accessible to more people than ever.

Telecom companies have been at the forefront, driving innovation and expanding consumer payments. Mobile money accounts are now the main financial tool. Over 70% of adults in sub-Saharan Africa use mobile wallets for daily transactions. This shift is crucial for increasing financial inclusion in African countries.

The domestic e-payments market in Africa is set to reach $40 billion by 2025. Table below shows the projected growth:

| Year | Projected Market Size |

|---|---|

| 2023 | $25 billion |

| 2024 | $32 billion |

| 2025 | $40 billion |

Key Players in Mobile Money:

- MTN Mobile Money

- Orange Money

These mobile network operators are crucial in providing mobile money services. They offer a range of financial solutions, from local payments to international remittances. The rise of mobile money wallets reflects the growing shift from cash transactions to digital payments, transforming the financial system in Africa. MTN Mobile Money offers a range of services accessible via their official website.

Integrated Payment Networks: Breaking Down Barriers

Sub-Saharan Africa is leading the way in mobile money transactions. With over 600 million users, it handles 70% of the world’s mobile money movements. Key to this success is the integration of digital payment schemes.

Integrated Payment Networks:

- MFS Africa Hub: This platform is bridging the gap across borders. By connecting domestic mobile money systems, it promotes seamless payments throughout Africa.

- Market Growth: The e-payments market is projected to hit $40 billion by 2025. This growth is fueled by robust mobile money services and rising smartphone use.

- Smartphone Penetration: By 2030, smartphone penetration is expected to reach 88% in the region. This supports the adoption of digital wallets and services.

Benefits of Mobile Money:

- Financial Inclusion: Mobile money offers financial services to the unbanked population.

- Convenience: Users can handle transactions, savings, and bills on their mobile devices.

- Economic Growth: These systems are pivotal for building digital economies.

With platforms like MFS Africa Hub, and increasing smartphone use, digital payments will continue to transform financial landscapes in Sub-Saharan Africa.

Role of 5G in Enhancing Mobile Wallet Services

5G technology is transforming mobile wallet services in Sub-Saharan Africa. With increased speed and lower latency, 5G enhances user experiences, making digital payments faster and more reliable. Here’s how it benefits mobile wallet services:

- Faster Transactions: 5G boosts transaction speeds, reducing wait times during mobile money transactions and digital payments.

- Increased Access: Enhanced connectivity allows more people, especially in rural areas, to access mobile money services. This supports financial inclusion in East and West Africa, where many are still unbanked.

- Improved Security: 5G’s advanced features make security measures like biometric authentication more effective. This helps protect users and financial institutions from fraud.

- Innovative Services: Mobile network operators can offer new services, like augmented reality features and enhanced international money transfers.

- Higher Reliability: 5G’s stable connection reduces transaction failures, building trust in mobile money platforms.

5G is critical for the growth of digital economies in African countries. As it expands, mobile wallets like MTN Mobile Money and Orange Money become even more vital for cashless transactions. These advancements pave the way for a more connected and financially inclusive Sub-Saharan Africa by 2025.

AI-Powered Compliance for Enhanced Security

Sure, here is a brief passage on AI-Powered Compliance for Enhanced Security:

AI-Powered Compliance is revolutionizing security in the business world. With advanced algorithms, AI can swiftly analyze vast amounts of data, ensuring that companies meet regulatory standards.

Benefits of AI-Powered Compliance:

- Real-Time Monitoring: AI systems continuously scan for suspicious activities.

- Risk Assessment: AI evaluates potential threats and assesses their impact.

- Automatic Updates: Ensures compliance with the latest regulations.

How It Works:

AI tools utilize machine learning to detect anomalies, identifying potential breaches faster than traditional methods. By automating routine compliance tasks, businesses save time and reduce human error. AI models are trained on historical data, learning from past breaches to better predict and prevent future threats.

For example, AI can track and flag unauthorized access attempts, protecting sensitive data. Additionally, it can provide audit trails, documenting compliance for regulatory bodies.

Overall, AI-Powered Compliance enhances security by providing a proactive and efficient approach to managing regulatory requirements and mitigating risks. By integrating AI into their compliance strategies, companies can protect themselves in an ever-evolving digital environment. Discover how AI is revolutionizing compliance in our detailed analysis: AI Innovations in Financial Compliance.

Economic Impact: Mobile Wallets and Financial Growth

Mobile wallets are reshaping the economic landscape of sub-Saharan Africa. Over 70% of adults in the region rely on them for everyday transactions, savings, and bill payments. This surge improves financial inclusion and empowers the unbanked population. In 2022, these platforms facilitated $22 billion in remittances, marking a 28% increase from the previous year.

A snapshot of the mobile wallet market in sub-Saharan Africa reveals significant growth:

| Metric | Figure |

|---|---|

| Registered mobile money accounts | 763 million |

| Percentage of global total | Nearly 50% |

| MFS Africa’s reach | 320 million wallets (60% of region) |

Despite overall growth, regional disparities exist. Nigeria and Kenya are leading in adoption, while South Africa is less developed. Orange Money and MTN Mobile Money are key players in boosting digital economies and making mobile money transactions easier.

These platforms foster economic growth by enabling digital payments and money transfers. In addition, they reduce cash transactions, enhancing safety and efficiency. As mobile network operators and financial institutions collaborate, mobile money services become more accessible. This trend is crucial for the financial growth of African countries.

Innovations in Cross-Border Mobile Payments

Innovations in cross-border mobile payments are reshaping Africa’s financial landscape. With remittances making up about 6% of Africa’s GDP, efficient payment solutions are essential. Partnerships with banks, like Access Bank and Equity Bank, make these payments simpler for customers.

A strong mobile payment ecosystem is key. Platforms like MFS Africa connect businesses and institutions, enabling smooth mobile money payments. New technologies such as tokenization and improved security measures are boosting e-commerce. This sector is expected to hit $50 billion by 2025.

Multi-method wallets are also gaining popularity. These wallets combine mobile money, cards, and bank accounts. They offer users a seamless way to manage their finances, driven by the need for integrated payment solutions.

Key Trends in Cross-Border Mobile Payments:

- Enhanced Security: Tokenization protects user data, building trust.

- E-commerce Growth: Predicted to reach $50 billion by 2025.

- Multi-method Wallets: Offer a mix of mobile money, cards, and banking.

These innovations support the growth of digital economies in Africa, making mobile money transactions more accessible across the continent. They are vital in transforming the unbanked population’s access to financial services.

Empowering Small Businesses Through Mobile Wallets

In 2025, mobile wallets are transforming small businesses across Sub-Saharan Africa. With simple mobile money services, businesses no longer need cash or physical banks. Instead, a mobile phone and national ID are enough to access the digital economy.

Key Benefits of Mobile Wallets for Small Businesses:

- Ease of Access: Even without formal bank accounts, businesses can start transacting digitally.

- Financial Inclusion: Mobile wallets bridge the gap for businesses in remote or underserved regions.

- Efficient Transactions: Payments, savings, and remittances are faster and safer.

| Benefits | Description |

|---|---|

| Digital Payments | Quick and secure transactions without cash or banks |

| Financial Growth | Enables transition from informal to formal finance |

| Accessibility | Connects isolated areas to financial services |

These mobile money platforms, supported by mobile network operators and financial institutions, are fostering a new financial ecosystem. As more businesses adopt digital wallets, they’re moving toward formal financial management. This shift leads to seamless peer-to-peer payments and salary transactions.

Mobile wallets are not just tools; they’re leveling the playing field for businesses across South, West, and East Africa. Empowering small businesses through mobile wallets fuels the growth of digital economies and financial inclusion.

Mobile Wallets as a Tool for Remittance Efficiency

Mobile wallets are transforming remittance efficiency in Sub-Saharan Africa. In 2022 alone, $22 billion in remittances reached mobile wallet accounts, marking a 28% growth from the previous year. This dramatic increase highlights the growing reliance on digital payments.

More than half of mobile wallet users in Sub-Saharan Africa received at least one remittance through their digital accounts last year. This convenience is vital for people in remote areas, who would otherwise travel far distances to collect cash transfers.

| Year | Remittances to Mobile Wallets |

|---|---|

| 2021 | $16 billion |

| 2022 | $22 billion |

Mobile wallets also play a crucial role in financial inclusion. These tools enable users to engage in modern financial services, filling the gap for those without traditional bank accounts. This shift is part of a larger surge in international remittances, totaling $29 billion in the region for 2023.

Adopting mobile wallets for remittances isn’t just about ease of access. It represents a move towards broader digital economies, allowing more Africans to benefit from global financial interactions. As the unbanked population gains access to these services, the impact will likely grow.

Ensuring Privacy and Security in Mobile Transactions

Ensuring privacy and security in mobile transactions is essential for the growth of digital economies in Sub-Saharan Africa. Mobile wallets are viewed as more secure than physical credit cards. They help reduce risks like fraud and chargebacks. Telecommunications companies play a crucial role. They support mobile money services, ensuring safe and instant transactions.

However, fraud and cybersecurity risks are ongoing concerns. These issues impact user trust in digital wallets. Governments, regulators, and financial service providers must work together. This cooperation should focus on increasing financial literacy and promoting safe financial decision-making.

Regulatory barriers and tax policies can hinder mobile money expansion in some African countries. Yet, maintaining privacy and security is vital for user trust. To address these challenges, it is important for key players to ensure robust security measures.

Key Measures for Privacy and Security:

- Strong data encryption

- Multi-factor authentication

- Continuous user education

These measures build confidence in mobile transactions. They promote the adoption and growth of mobile money platforms in the region. Secure practices will help tap into the vast unbanked population, moving them towards digital payments and away from cash transactions.

The Role of Government and Regulatory Bodies

In sub-Saharan Africa, government policies and supportive regulations have played a crucial role in the rise of mobile wallets. Regulatory frameworks have simplified account creation with just a national ID. This ease of access has been a game-changer, especially for the unbanked population.

The efforts by regulatory bodies to relax rules for mobile network operators, compared to traditional banks, have fueled the growth of mobile money platforms. This has led to a surge in digital payments and mobile money transactions, boosting financial inclusion across the region.

Here’s why regulations matter:

- Access: Simple requirements enable wider adoption.

- Ease: Fewer barriers for mobile network operators.

- Inclusion: Reaches the financially marginalized.

- Efficiency: Supports quick peer-to-peer payments and remittances.

As African governments continue to foster an enabling environment, digital financial services are expanding rapidly. This growth highlights the importance of technology-driven solutions in evolving digital economies.

In conclusion, the proactive role of government and regulatory bodies is indispensable. Their efforts have catalyzed the transformation of financial services across sub-Saharan Africa.

Future Trends in Mobile Wallet Technology

Mobile wallets in sub-Saharan Africa are set to revolutionize digital economies by 2025. The region already processes nearly half of the global mobile money transaction values, with $912 billion exchanged in 2023. This trend is likely to soar, with Africa’s e-payments market projected to hit $40 billion, driven largely by mobile wallets.

Key Trends

- Smartphone Penetration: Expected to reach 88% by 2030, rising smartphone usage will boost mobile wallet capabilities.

- 4G and 5G Networks: The expansion of these networks will enhance mobile wallet features, making transactions faster and more reliable.

- B2B Transactions: Mobile wallets will evolve to support business-to-business dealings, not just personal transfers.

- Collaborations: Partnerships between fintechs and traditional banks will address Africa’s financial inclusion challenges.

| Driver | Impact |

|---|---|

| Smartphone Penetration | Increased mobile money transactions |

| Network Expansion | Enhanced digital payments |

| Financial Innovations | Broader financial services access |

As mobile wallets continue to grow, they promise to transform how financial services operate in East and West Africa. The future is bright for mobile payments in this region, unlocking new opportunities for the unbanked population and boosting the local economy.