Introduction: The Future of Banking is Online

Why Online Checking Accounts Are the Smart Choice for 2025

Online banking continues to transform personal finance. The best online checking account in 2025 eliminates geographical barriers, empowers people with cutting-edge mobile tools, and delivers better rates than traditional banks. With consumer expectations rising, digital banks are stepping up, offering accounts that combine convenience, transparency, and rewards.

Our Methodology: How We Selected the Top 9 Accounts

To select the top online checking accounts, we reviewed financial institutions offering nationwide access. We analyzed APY (annual percentage yield), transparency, fee structures, security, mobile app performance, and customer service. In addition, we considered FDIC or NCUA insurance, making sure all options guarantee deposit safety.

What to Expect: High APY & Truly Zero Hidden Fees

The best online checking account in 2025 must deliver two critical benefits: high APY and no hidden fees. High-yield accounts ensure your everyday balance grows while sitting in your account. Meanwhile, zero hidden fees mean you keep more of your earnings. Combining both makes these accounts unbeatable compared to outdated traditional checking options.

Understanding “High APY”: Maximizing Your Everyday Money

The Online Advantage: Why Digital Banks Offer Better Rates

Online banks have lower overhead costs than physical banks. Without branches to maintain, they pass on savings by offering high-yield checking accounts. This structural advantage allows them to provide consistent interest rates that outpace traditional checking accounts.

Key Factors for Maximizing Your APY: Direct Deposit, Balances, & More

Banks often reward customers with higher APY when they meet conditions like direct deposits or maintaining certain balances. Understanding these requirements helps maximize returns. Automating direct deposits and avoiding unnecessary withdrawals ensures you consistently earn the highest available rate.

What to Look For: Consistent, Competitive Yields

When evaluating the best online checking account, focus on consistency. Promotional rates often drop after a few months. Instead, choose institutions known for offering steady yields, backed by reliable customer service and transparent terms.

The “Zero Hidden Fees” Promise: Keeping More of Your Earnings

Common Hidden Fees to Avoid (and How Our Top Picks Eliminate Them)

Traditional banks are notorious for fees—overdraft, maintenance, ATM usage, and more. The best online checking account eliminates these, offering free overdraft protection, no monthly maintenance costs, and widespread ATM reimbursements.

The Definition of a Truly Free Checking Account

A free checking account means more than no monthly charges. It also means zero surprise fees for overdrafts, card replacements, or electronic transfers. The accounts we highlight have proven track records of delivering on this promise.

Navigating Fee Structures: The Importance of Transparency

Transparency is essential. Reputable online banks clearly explain their fee structures, allowing customers to understand terms without hidden traps. This honesty builds trust and ensures long-term satisfaction.

The Top 9 Best Online Checking Accounts of 2025

Ally Bank Spending Account

Ally Bank offers a highly-rated mobile app, strong customer support, and no monthly fees. Customers enjoy competitive APY, access to a large ATM network, and overdraft protection. Learn more about Ally Bank.

Axos Bank Rewards Checking

Axos Bank provides tiered rewards that increase APY when customers meet specific conditions, such as direct deposits or debit card transactions. See Axos Bank’s offers.

Capital One 360 Checking

Capital One delivers no-fee checking with early direct deposit, mobile check deposits, and FDIC insurance. Its mobile tools are praised for ease of use. Check out Capital One.

Alliant Credit Union High-Rate Checking

Alliant Credit Union offers a high-yield checking option requiring only one electronic deposit per month. Members gain surcharge-free ATM access nationwide. Explore Alliant Credit Union.

CIT Bank eChecking

CIT Bank’s eChecking account provides a competitive APY, mobile deposits, and free access to thousands of ATMs. Visit CIT Bank.

UFB Direct High-Yield Checking

UFB Direct consistently ranks high for its yield and absence of monthly service fees. Customers benefit from mobile-first banking with strong security. Discover UFB Direct.

Charles Schwab Bank Investor Checking

Charles Schwab offers unlimited ATM fee reimbursements worldwide. This makes it an excellent choice for travelers. See Charles Schwab.

American Express Rewards Checking

American Express brings reward points to checking. Cardholders can earn interest while redeeming rewards through their existing Amex ecosystem. Read about American Express Rewards Checking.

Bask Bank Interest Checking

Bask Bank stands out by allowing customers to earn interest or airline miles with their checking balance. Check out Bask Bank.

Essential Considerations When Choosing an Online Checking Account

Depositing & Accessing Cash: Practical Solutions for Digital Banking

While digital banks lack branches, they provide practical solutions for cash access. Options include ATM networks, mobile deposits, and partnerships with retail stores.

Ensuring Safety & Security: FDIC Insurance and Fraud Protection

All reputable online checking accounts are FDIC-insured up to $250,000. Strong encryption, two-factor authentication, and fraud monitoring provide further peace of mind.

Mobile Banking & Digital Tools: Seamless Financial Management

The best online checking account provides mobile features like budgeting tools, push notifications, and remote deposits. These tools simplify financial management, making it easier to track spending and saving.

Customer Support: What to Expect from Online Financial Institutions

Quality customer support includes 24/7 live chat, phone service, and comprehensive knowledge bases. Banks that invest in responsive support demonstrate long-term reliability.

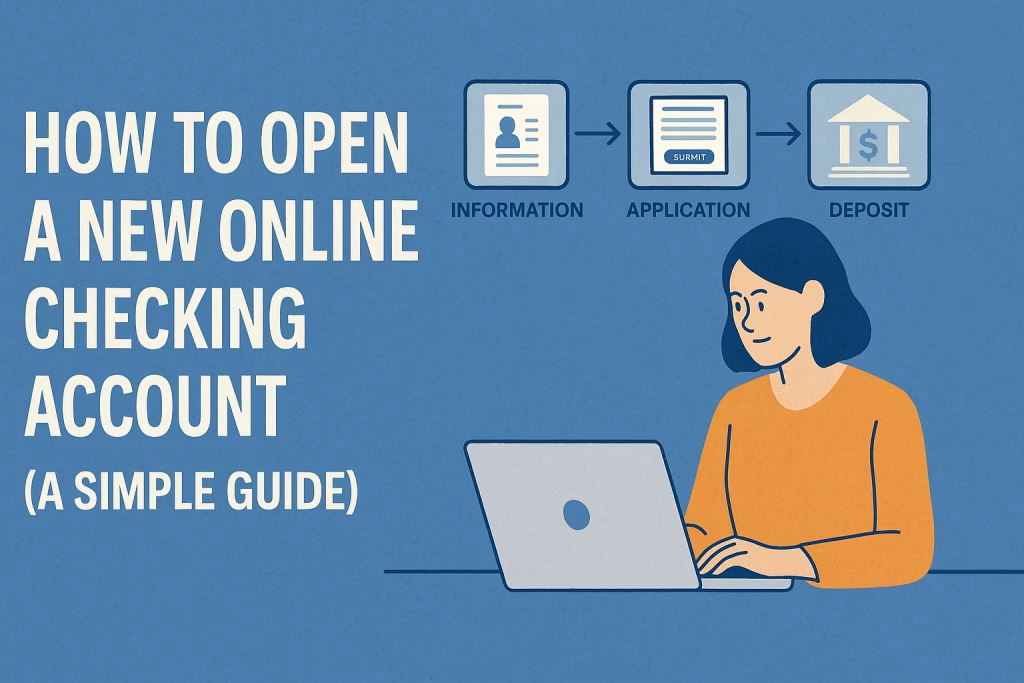

How to Open a New Online Checking Account (A Simple Guide)

Required Information & Documents

You’ll need a government-issued ID, Social Security number, and proof of address. Some institutions may request employment information.

The Streamlined Online Application Process

Most applications take less than 15 minutes. Forms are digital, requiring only your basic details. Banks typically provide instant approval decisions.

Funding Your Account & Setting Up Direct Deposit

Initial funding often comes from a linked debit card or another bank account. Setting up direct deposit ensures you receive paychecks quickly and may unlock bonus APY rates.

Tips for a Smooth Transition from Your Old Bank

Before closing your old account, move recurring payments, transfer funds, and notify employers. This avoids disruptions and ensures seamless banking.

Frequently Asked Questions (FAQs) About Online Checking Accounts

Are online checking accounts safe and secure?

Yes. Accounts are FDIC-insured, encrypted, and protected by multi-factor authentication.

Can I get early direct deposit with an online checking account?

Most online banks provide early direct deposit, allowing you to access funds up to two days faster.

How do online banks differ from traditional banks?

They eliminate physical branches, reduce costs, and pass savings through higher APYs and lower fees.

What if I need to speak to someone in person?

Although branch access is limited, most banks offer phone or video assistance along with ATM services.

How do I know if an account truly has “zero hidden fees”?

Read terms carefully. Trusted banks provide clear fee disclosures. Our top picks consistently deliver transparent fee structures.

Conclusion: Your Path to Smarter, More Rewarding Banking in 2025

Recap: The Power of High APY & Zero Fees

The best online checking account combines high APY and zero hidden fees. These features ensure your everyday balance works harder for you.

Your Next Step: Choose the Best Online Checking Account for You

With options like Ally, Axos, and Schwab, customers can finally enjoy transparent, rewarding, and secure banking in 2025. To deepen your knowledge, explore guides on business banking solutions, digital banking tools, and reviews of neobanks. Choosing wisely today ensures financial freedom tomorrow.

Would love to incessantly get updated outstanding weblog! .

Thanks a lot! I’ll keep publishing fresh content regularly, glad you’re enjoying it.