Digital wallets are now embedded into the daily lives of Brazilian consumers, and they are increasingly important for small businesses in Brazil. They’re used for everything from financial transactions and bill payments to ride-sharing and food deliveries. In fact, one-third of Brazil’s population relies on digital wallets, with 20% using them daily and another 21% multiple times per week.

Leading this charge is PicPay, Brazil’s top digital wallet platform, which serves over 62 million users. Functioning like a fully licensed bank, it allows customers to save, invest, and make payments all in one app.

Brazil’s digital wallet and prepaid card market is set to explode, reaching $53.42 billion by 2030, with an annual growth rate of 11.1% from 2025 to 2029, according to a report by ResearchAndMarkets.

In brick-and-mortar commerce, the trend is clear. Contactless and mobile wallet usage surged 216% year-over-year. This signals not only a change in payment methods but a cultural shift in how Brazilians manage their financial lives.

Definition and Functionality

Digital wallets in Brazil offer more than basic payment services. They now provide a full suite of tools, such as peer-to-peer payments, bill settlements, savings accounts, and even delivery scheduling.

This broad functionality has made digital wallets for small businesses in Brazil more than a trend — they’ve become an essential financial tool. By embedding into routine behavior, digital wallets are helping Brazilians simplify life while gaining financial autonomy.

Supported by aggressive digitalization and favorable government policies, these platforms are changing how consumers and businesses interact with money. This is particularly beneficial in underserved areas, where traditional banking services are scarce.

Key Features and Advantages

Brazil has evolved into one of the world’s most mature digital wallet ecosystems. Small enterprises now use these platforms for everything from accepting payments to payroll distribution.

More than 33% of Brazilians use digital wallets, with 20% relying on them every day. This statistic underscores how deeply these platforms are woven into economic life.

Platforms like PicPay not only handle transactions but also provide insights for businesses by collecting and analyzing customer behavior. This allows for the creation of alternative credit scoring, an essential innovation for small firms previously excluded from formal banking.

These wallets are instrumental in reducing reliance on cash and enabling microentrepreneurs to track earnings, manage inventory, and build customer trust.

The Role of Innovation in Digital Payments

Brazil’s fintech scene is rich with innovation. Open banking initiatives are bringing banks and tech companies together, resulting in more seamless, integrated financial products.

Decentralized payment options, enabled by blockchain and digital ledger technology, are under active development. Meanwhile, biometric security and AI-powered fraud detection are being adopted to increase consumer trust.

Government initiatives, such as PIX, further fuel this evolution by making real-time, cost-free transactions available 24/7.

This environment of innovation is a key reason why digital wallets for small businesses in Brazil are becoming a foundational element of the economy.

Evolution of Payment Platforms

Brazil’s digital payment infrastructure is robust. Pix, launched by the Central Bank of Brazil, is at the heart of this transformation. With over 140 million registered keys, Pix has quickly become Brazil’s most used payment method.

TED (Transferência Eletrônica Disponível), once a standard for transfers, now lags due to limited hours and fees. Meanwhile, contactless payments have surged — a 216% year-over-year growth in usage proves it.

Platforms like PicPay now operate with banking licenses, offering both convenience and security under one roof.

The Impact of Pix on Real-Time Transactions

Pix revolutionized Brazil’s payment landscape. Available 24/7 and completely free for personal users, it processed more than 26 billion transactions in 2023 alone.

Pix is used daily by 43% of Brazilians. Its reach extends to 13 million businesses, making it a crucial channel for small enterprises.

One in three Pix transactions is a Person-to-Business (P2B) payment. This shows just how essential the platform is for commercial activity and why it’s so central to the success of digital wallets for small businesses in Brazil.

Adoption of QR Code Technology

Brazil is also pioneering QR code technology through the introduction of the BR Code. This universal QR code standard ensures interoperability among wallets, improving both consumer experience and payment safety.

Backed by LGPD (Brazil’s data privacy law), and open banking regulations, the BR Code is designed to balance convenience with regulatory compliance.

This move is part of Brazil’s broader strategy to modernize payments and promote financial inclusion.

Benefits of Digital Wallets for Small Enterprises

Digital wallets are creating opportunities for small businesses across Brazil. With one-third of the population using these platforms, local enterprises can access a wider customer base and reduce their operational costs.

The tools these wallets provide — such as real-time reporting, automated invoicing, and tax integration — give small businesses the same capabilities as large companies. These features enable data-driven decision-making and better financial oversight.

As cash declines and mobile payments rise, staying competitive requires businesses to adapt. Digital wallets for small businesses in Brazil offer the path forward.

Increased Transaction Efficiency

Digital wallets are fast and reliable. Consumers no longer need to carry cash or wait for traditional banking hours. Transactions can be processed instantly, improving operational flow for small businesses.

Platforms like PicPay allow businesses to integrate financial services, from deposits to investments, into a single dashboard.

According to Statista, 48% of in-store shoppers in Brazil now use contactless or wallet-based payments. This represents a huge opportunity for efficiency and cost savings.

With contactless methods now used by nearly half of in-store shoppers, understanding how contactless payment works can help small businesses stay ahead of trends.

Cost Reduction and Financial Management

Digital wallets slash the overhead associated with traditional banking. No more costly point-of-sale systems, paper receipts, or teller visits.

The market’s projected $53.42 billion size reflects growing demand — and increasing efficiency. As digital adoption grows, so too does the potential for reducing transaction fees and improving customer service.

With a projected 11.1% CAGR from 2025–2029, these platforms offer not just cost savings but scale advantages. The more businesses that adopt, the more affordable the infrastructure becomes.

Enticing Tech-Savvy Consumers

Brazilian consumers are digitally native. Over 50% use smartphones to find deals or compare prices while shopping, according to EBANX.

Additionally, many consumers use multiple wallets simultaneously, often choosing the one that offers the best cashback, loyalty program, or payment convenience.

By adopting digital wallets, small businesses can align with the habits and preferences of these modern shoppers — gaining a crucial competitive edge in a saturated market.

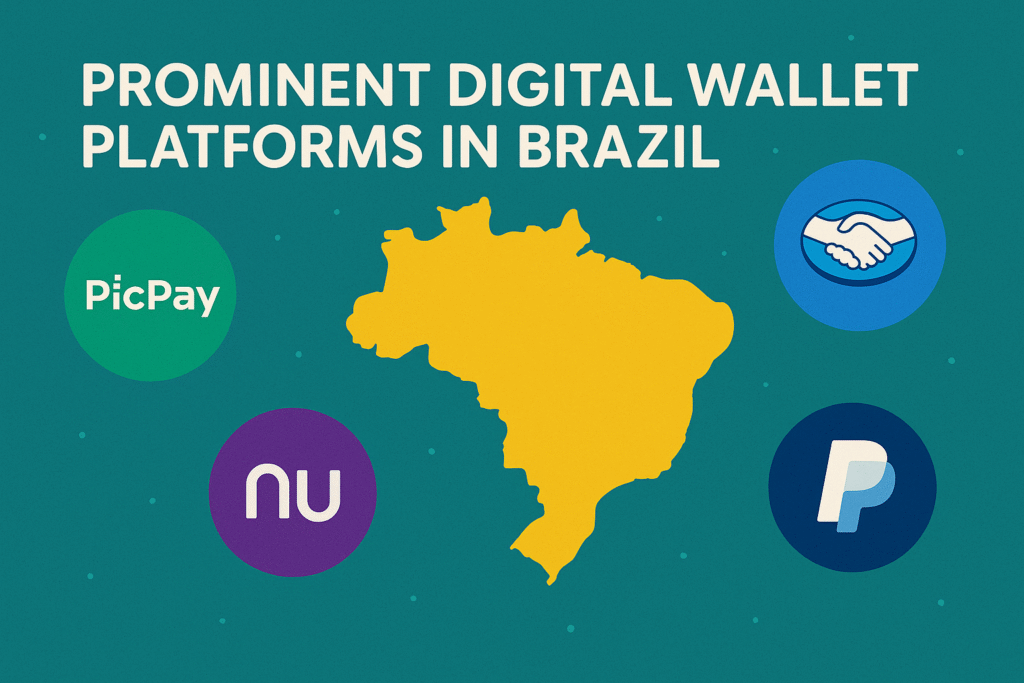

Prominent Digital Wallet Platforms in Brazil

Several digital wallets dominate Brazil’s fintech landscape. Their popularity shows just how central these platforms have become.

Nubank

Nubank serves over 59.6 million users across Brazil, Mexico, and Colombia. Of those, 46.5 million are active.

In 2023, Nubank introduced NuPay for e-commerce and NuCripto for crypto transactions. The acquisition of Akala strengthens its ability to issue credit cards and diversify offerings to underbanked communities.

Mercado Pago

Mercado Pago, a unit of Mercado Libre, has 36 million unique users. It has lent over $2.4 billion across Latin America and remains a pillar in Brazil’s mobile payment scene.

Its appeal lies in both retail and consumer services, and it plays a vital role in cross-border and regional commerce.

PagBank PagSeguro

PagBank PagSeguro reported $4 billion in deposits in 2023. It launched a credit card that ties spending limits to user investments, even for users with poor credit histories.

This type of innovation expands access to credit for microbusinesses and consumers alike, reinforcing PagBank’s reputation for financial inclusivity.

Brazil’s leading platforms like PicPay and Mercado Pago reflect broader regional trends in fintech. The rise of mobile wallets in Latin America shows how demand for digital payments is reshaping commerce.

Challenges and Considerations

Despite growth, challenges remain. Many rural areas still suffer from poor internet access, limiting wallet usage.

High transaction fees and security concerns also hinder adoption, especially among lower-income populations. Trust in digital platforms is essential, and not all users feel their data is safe.

Traditional banks such as Banco do Brasil and Bradesco still dominate, posing stiff competition for new entrants in the space.

Security and Privacy Concerns

Approximately 29% of Brazilian users report issues with internet connectivity when accessing digital wallets. However, over 77% say they’re satisfied with services like ID verification, showing high trust in the platforms’ security protocols.

Still, concerns about data misuse remain. As wallets store more personal information, users are rightfully cautious. Robust encryption, transparent policies, and regulatory compliance will be critical going forward.

Integration with Existing Systems

Digital wallets work seamlessly with existing platforms. For example, Pix and PicPay are already integrated into many Brazilian banking and e-commerce systems.

Even traditional banks now offer wallet-compatible QR codes and real-time transfers. This shows how deeply integrated digital wallets for small businesses in Brazil have become within the financial ecosystem.

The Future of Digital Wallets in Brazil

Looking ahead, the digital wallet market in Brazil is on a strong upward trajectory. Government and private sector efforts are focused on expanding inclusion and reducing cash dependency.

While security and fee-related concerns persist, ongoing investments in infrastructure and education should help ease consumer hesitancy.

For small businesses, the opportunity is clear: adopt now or risk falling behind.

Growth Trends and Market Potential

By 2030, Brazil’s prepaid card and digital wallet market will be worth $53.42 billion. Adoption is already widespread, with 20% of the population using wallets daily.

This growth is supported by a shift in behavior — consumers now expect fast, digital-first experiences, and businesses must adapt to stay competitive.

Innovations in Cross-Border Payments

Cross-border commerce is another frontier. Over 12 million Brazilians receive global disbursements exceeding US$18 billion annually. Services like EBANX help businesses offer compliant, efficient payment options to these users.

Digital wallets provide a fast, low-cost way to manage international transactions — a major plus for small businesses with global ambitions.

Role in Economic Transformation

Brazil is steadily moving toward a cashless economy. Fintech platforms are not only modernizing payments but democratizing access to financial services.

This evolution is helping lift millions into the formal economy, boosting economic growth and enabling smarter policymaking through data transparency.

Final Thoughts

Digital wallets for small businesses in Brazil are more than a convenience — they’re a revolution. As adoption grows and the ecosystem evolves, these platforms will continue to transform commerce, empower entrepreneurs, and reshape Brazil’s economic future.

Now is the time for small enterprises to integrate these tools — or risk being left behind.