Budgeting has never been easier—or more automated—thanks to next-gen digital banking tools. Discover the best online banking features for budgeting in 2025, including AI-powered insights, smart savings algorithms, and real-time expense tracking, which help you save effortlessly, spend wisely, and grow your money faster. With the rapid rise of digital money, new banking models are transforming how people manage their finances.

This guide covers:

Best online banking features for budgeting

How to automate savings with digital banks

Personal finance apps vs. built-in bank tools

Step-by-step budgeting strategies

1. The Best Digital Banking Features for Budgeting (2025)

1.1 AI-Powered Spending Insights

Neobanks like Monzo, Revolut, and Chime now offer:

Real-time categorization (e.g., “You spent 30% more on dining this month”)

Predictive alerts (“You’re on track to overspend on groceries”)

Personalized cutback suggestions (“Switch to a cheaper phone plan, save $15/month”)

📌 Example: SoFi Relay analyzes subscriptions and negotiates better rates.

1.2 Automatic Savings Rules

Set triggers to save without thinking:

- Round-up purchases (e.g., spend 4.50→save4.50→save0.50)

- Save a % of every paycheck (e.g., 10% auto-deposited to savings)

- “Guilt-free” spending limits (e.g., block Starbucks after $50/month)

📌 Best for: Chime’s “Save When You Spend” rounds up debit purchases.

1.3 Cash Flow Forecasting

See future balances based on:

- Upcoming bills

- Expected income

- Spending trends

📌 Tool to try: N26’s “Salary Assistant” predicts if you’ll run low before payday.

2. Automating Savings: The 2025 “Set-and-Forget” Method

2.1 The 50/30/20 Rule (Automated)

| Category | % Income | Digital Banking Hack |

|---|---|---|

| Needs | 50% | Auto-pay rent, utilities via bill-splitting apps |

| Wants | 30% | Spending caps in Revolut vaults |

| Savings | 20% | AI-powered auto-transfers (e.g., Wealthfront) |

📌 Pro Tip: Use Qapital to save based on behavior (e.g., skipping Uber = +$10 savings).

2.2 High-Yield Savings Automation

- Varo Bank: Saves excess cash when your checking balance is high

- Current: “Save As You Earn” moves money at payday

- Ally Bank: “Surprise Savings” analyzes cash flow to save spare change

📈 Result: Users save 3X more with automation (2024 NerdWallet study).

3. Personal Finance Apps vs. Bank Budgeting Tools

Comparison Table

| Feature | Bank Tools (e.g., Chase, Capital One) | Finance Apps (e.g., Mint, YNAB) |

|---|---|---|

| Real-time tracking | ✅ Built into accounts | ✅ Syncs across banks |

| Custom categories | Limited | Fully customizable |

| AI advice | Basic (“Spent more on dining”) | Advanced (“Cancel unused subscriptions”) |

| Investment tracking | ❌ No | ✅ Yes (e.g., Empower) |

📌 Winner? Use both: Bank tools for daily spending, finance apps for big-picture planning.

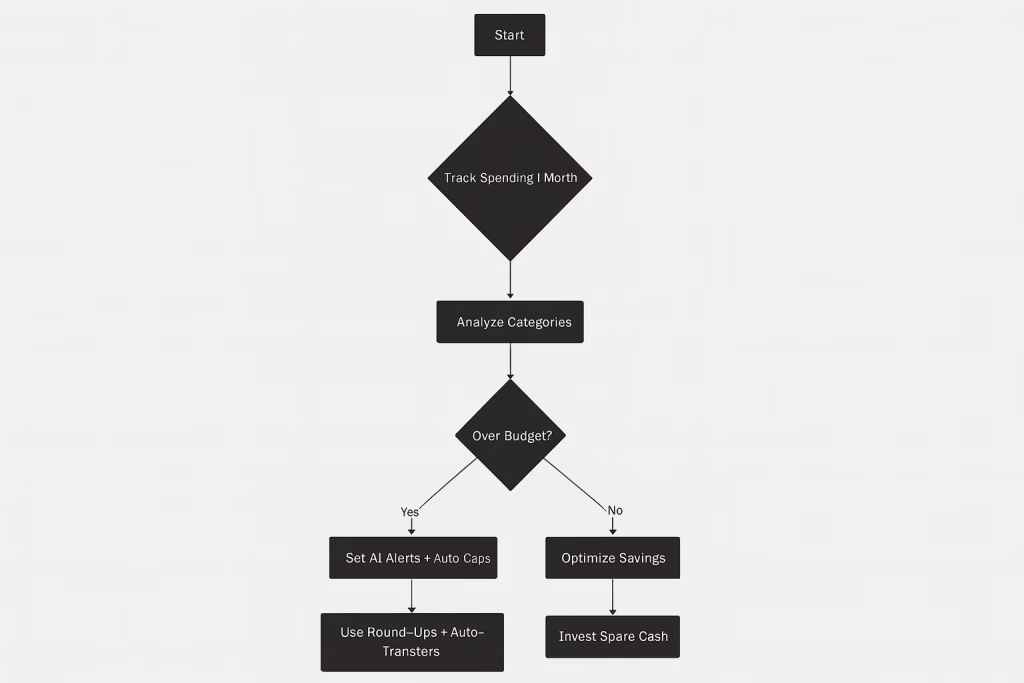

4. Budgeting Strategy Flowchart (2025)

📌 How to use:

- Export 3 months of transactions (most apps do this automatically)

- Identify 1-2 “leak” categories (e.g., food delivery, subscriptions)

- Automate cuts using banking tools

5. Top 3 Digital Banks for Budgeting (2025)

🏆 Best Overall: SoFi

- AI Insights: “Financial Heartbeat” score

- Auto-Save: Round-ups + paycheck splits

- Bonus: 4.60% APY on savings

🥈 Best for Couples: Zeta

- Shared vaults for joint goals

- Bill-splitting with auto-adjustments

- Messaging inside the app

🥉 Best for Freelancers: Lili

- Tax-saving buckets

- Cash flow forecasts for irregular income

- No overdraft fees

Key Takeaways

- AI does 80% of budgeting work (tracking, alerts, suggestions)

- Automation saves 3X more than manual efforts

- Pair bank tools + finance apps for full coverage

💡 Next Step: Pick one feature (e.g., round-ups) and automate it today.

Which tool saved you the most money? Share below! 👇

For more information about digital banking check out our post on The Future of Digital Banking: Trends to Watch in 2025 & Beyond

Hi, I check your new stuff regularly. Your story-telling

style is awesome, keep it up!

Thank you very much!