Wondering how to open a digital bank account in the Philippines? Imagine accessing your bank account, transferring funds, and paying bills all with just a tap on your phone. That’s the convenience digital banking offers in today’s fast-paced world, and the Philippines is catching up swiftly with this trend. With increasing internet accessibility and smartphone usage, digital banks are revolutionizing the way Filipinos manage their finances.

Digital banking in the Philippines offers numerous benefits, such as ease of use, lower fees, and enhanced accessibility, distinguishing it from traditional banking. Its growing popularity is driven by the ability to conduct financial transactions securely from anywhere. More Filipinos are making the switch, drawn by features like rewarding savings products, virtual cards, and seamless fund transfers.

This article will guide you on how to open a digital bank account in the Philippines. We’ll explore the benefits and provide safety tips to ensure a secure banking experience.

Understanding Digital Banking in the Philippines

Digital banking in the Philippines is rapidly evolving, offering ease and convenience for many Filipinos. Regulated by the Bangko Sentral ng Pilipinas (BSP), Digital banks such as Maya and UNObank provide secure platforms for managing finances. An attractive feature of these banks is their deposit insurance through the Philippine Deposit Insurance Corporation (PDIC), which insures deposits up to ₱1,000,000 per depositor.

Opening a digital bank account is simple, often requiring just the download of a bank app and a valid ID. This seamless process enhances access to banking services without needing to visit physical bank premises. Moreover, digital-only neobanks like Tonik provide a wide array of financial products, including deposit accounts and payment services, fully online.

RCBC’s digital platform, RCBC Pulz, features advanced capabilities such as seamless fund transfers and real-time transaction alerts. This makes digital banking an appealing choice for Filipinos looking to convert foreign currencies and handle various financial tasks via secure, user-friendly platforms.

Benefits of Digital Bank Accounts

Digital bank accounts in the Philippines offer numerous advantages, making financial management more accessible and efficient. One of the key benefits is the ability to manage and grow your finances from anywhere. Users can deposit checks, convert foreign currencies, and transfer funds directly through the mobile banking app. This convenience allows for easily handling financial activities, thus promoting financial health and wellbeing.

Another significant advantage is the potentially higher interest rates compared to traditional banks. By offering competitive rates on savings and time deposits, digital banks allow users to enhance savings growth over time. Transactions are executed seamlessly using transfer systems like PESONet and InstaPay, ensuring efficiency and speed. Furthermore, deposits in these digital accounts are protected by PDIC insurance, providing peace of mind for account holders. Discover how fintech apps can enhance your savings in our 2024 guide to the best fintech app for saving money.

Key Differences from Traditional Banking

Digital banks stand out from their traditional counterparts through their innovative approach and distinct operational model. Operating entirely online, digital banks like Tonik and RCBC offer a fresh banking experience, free from the constraints of physical branches. This gives users the flexibility to open accounts with minimal requirements—just a smartphone and a valid ID, making banking accessible to a wider audience.

A highlight of digital banking is its innovative savings tools, such as Tonik’s Group Stash, designed to encourage collaborative saving. These platforms offer features like real-time fund transfers, online foreign exchange transactions, and QR code-powered deposits and withdrawals, simplifying finance management. Explore the top neobank features to watch in 2025 that are redefining digital banking experiences. Enhanced security measures, including biometrics logins, real-time notifications, and one-time password (OTP) confirmations, provide users with confidence and security. These aspects collectively illustrate how digital banks are redefining the financial landscape, offering a modern, secure, and convenient banking solution for Filipinos, bypassing many traditional banking requirements such as maintaining a minimum balance.

Choosing the Right Digital Bank

Selecting the perfect digital bank account in the Philippines involves understanding key factors such as security, convenience, and service offerings. Licensed by the Bangko Sentral ng Pilipinas, digital banks like UNObank Inc. and Maya Savings adhere to strict regulations to protect their customers. Moreover, deposits of up to ₱1,000,000 per depositor are insured by the Philippine Deposit Insurance Corporation, providing peace of mind. A digital bank account can usually be opened with just one valid ID, allowing you to enjoy their services through various platforms such as the Apple App Store, Huawei App Gallery, and Google Play Store. These banks often offer features like high-interest savings accounts, real-time notifications, and biometric log-in for secure and convenient transactions. For more insights, visit our About page to learn about our expertise in digital banking.

Comparing Features and Services

Digital banks in the Philippines offer a wide range of features that cater to various financial needs. For instance, RCBC Pulz provides seamless account management, bill payment, and fund transfers, alongside competitive interest rates. Customers can also handle foreign currencies such as US Dollars, Euros, and Japanese Yen through these digital platforms. Maya Savings and UNObank are among those offering up to 6.75% per annum in interest, making them attractive for savings growth. All digital banks in the country, including Tonik and RCBC, ensure that robust security features are implemented, such as biometrics login and OTP for transaction verification. These features make banking both easy and secure.

Evaluating Ease of Use and Accessibility

Opening and managing a digital bank account in the Philippines is made simple through intuitive mobile apps like RCBC’s, which requires only one valid ID to get started. There’s no need to visit a physical branch, as everything can be done on your device. The app’s user-friendly interface ensures even those new to digital banking find it easy to navigate and use. With functions such as seamless fund transfers to local and international banks and PH e-wallets, the app adapts to diverse financial needs. Learn how real-time payments are changing finance and improving cash flow for users. Users can also enroll in online bill payments and set up scheduled payments to manage their finances more effectively. These features allow for the hassle-free management of your accounts.

Checking Security and Privacy Measures

Security and privacy in digital banking are critical. Deposits are insured by the Philippine Deposit Insurance Corporation up to ₱1,000,000 per depositor, ensuring financial protection. Moreover, digital banks enhance safety with tools like biometric log-in and device registration. Real-time email and SMS notifications, along with OTP verifications, add layers of security to every transaction. Understand the security measures digital banks employ to protect user data and transactions. Personal and account information remains confidential, with disclosures made only to comply with legal requirements. Additionally, strict standards set by the Bangko Sentral ng Pilipinas govern these digital banks, ensuring they adhere to rigorous guidelines for customer protection. With these measures in place, users can trust that their financial data is safe and secure.

Required Documents and Information

Opening a digital bank account in the Philippines is straightforward and convenient, allowing individuals to manage their finances without the need to visit a physical branch. This entire process can usually be completed online through a mobile banking app, making it accessible and simple. Important features when considering the right bank include factors like debit card options, minimum deposit requirements, and the availability of customer support. Numerous digital banks, such as RCBC and GoTyme Bank, provide easy account setup through their respective apps. Most banks necessitate just one valid ID for account creation, emphasizing ease of access. It is notable that all these banks operate under the regulation of the Bangko Sentral ng Pilipinas, offering a secure banking environment.

List of Commonly Needed Documents

The process of opening a digital bank account in the Philippines typically requires minimal documentation. For banks like RCBC and Tonik, a single valid ID is enough to open an account. This approach aims to simplify the account opening procedure, reducing the hassle for potential customers. For Filipino citizens who wish to apply for a BDO account online, a valid ID and a Philippine mobile number are necessary, regardless of their current location, whether domestic or abroad.

This ease of access is matched by the application processes through bank apps like RCBC Pulz, designed for straightforward registration. Additional features like connecting multiple bank accounts and managing prepaid cards further enhance the user experience, facilitating seamless management of financial activities without needing to visit bank premises.

Understanding Eligibility Criteria

Digital banks in the Philippines have set simple eligibility criteria to extend banking services to a broader audience. For instance, RCBC allows individuals to open multiple accounts online, even for those who have already established an account in person, providing flexibility and convenience. BDO, on the other hand, makes it possible for Filipino citizens to apply for savings or checking accounts online with the basic requirement of a Philippine mobile number. This provision is valid for clients irrespective of their residence, be it within the Philippines or overseas.

Another important aspect is the assurance provided by the licensing and regulation from the Bangko Sentral ng Pilipinas. Banks like UNObank, being under this regulation, ensure clients that they adhere to strict financial norms and safety standards. Furthermore, financial protection is reinforced by the Philippine Deposit Insurance Corporation, which insures deposits up to ₱1,000,000 per depositor. This insurance gives account holders peace of mind, knowing their funds are safeguarded within the Philippine banking system.

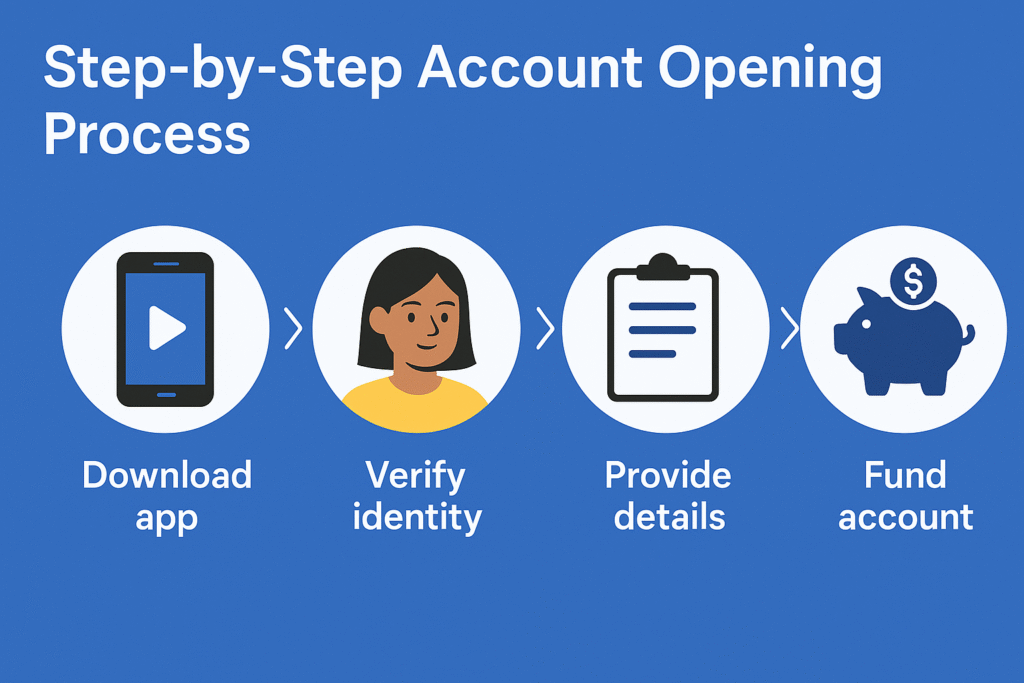

Step-by-Step Account Opening Process

Opening a digital bank account in the Philippines is a simple and convenient process. Many banks now offer digital banking services that allow you to manage your finances entirely online. These digital banks, like Tonik and RCBC, enable users to open accounts through their mobile apps, avoiding the need to visit a branch or ATM. With digital banking, you can enjoy features like mobile banking apps, real-time fund transfers, and top-notch security. Here’s a clear guide to help you understand the process of opening your digital bank account step-by-step.

Step 1: Download the Bank’s App or Visit Their Website

The first step in opening a digital bank account is downloading the bank’s app, which is easily accessible on platforms like the Apple App Store, Huawei App Gallery, and Google Play Store. Some digital banks, like Tonik, operate fully online, meaning they don’t have physical branches. Instead, everything you need can be accessed through their mobile apps. It’s important to note that some banks, like BPI, might require the use of their specific app rather than a website or a tablet. Usually, a single valid ID is needed to initiate the account opening process, ensuring that getting started is as simple as possible.

Step 2: Register for an Account

Once you have downloaded the app, the next step is to register for a bank account. Most digital banks in the Philippines streamline this process by requiring just one valid ID for registration. This makes it accessible to many people, regardless if they already have a physical bank account with the same bank. You can complete the registration using various devices such as a desktop, tablet, or mobile phone, making it flexible and easy for everyone. Additionally, these banks allow you to open an account regardless of your location within the Philippines, provided you have a local mobile number.

Step 3: Verify Your Identity

Verifying your identity is a crucial part of opening a digital bank account, ensuring that your personal information is kept secure. In the Philippines, the Bangko Sentral ng Pilipinas regulates the verification process to ensure strict compliance with security standards. Typically, you will need a valid ID for this step. Many digital banks have adopted advanced features like biometrics log-in and device registration for added security. These features, along with real-time email and SMS notifications, help confirm identity and monitor transactions and account activities, offering a safe and user-friendly banking experience.

Step 4: Set Up Your Initial Account Preferences

After verifying your identity, you’ll set up your initial account preferences to customize and manage your banking activities. For example, using the RCBC Pulz app, you can link various banking products such as savings accounts, credit cards, and loans. Additionally, you can enroll billers to automate payments, ensuring you never miss important deadlines. Enhanced security features like biometrics log-in and one-time passwords add an extra layer of safety. For convenience, fund transfers to local and international banks or e-wallets can be done seamlessly through the app, complete with real-time notifications for every transaction.

Exploring Additional Features and Services

Digital banking offers a wide range of features and services that make banking easier and more convenient. In the Philippines, the rise of digital banks like UNO Digital Bank and Security Bank Online has provided customers the flexibility to manage their finances from anywhere. These banks are regulated by the Bangko Sentral ng Pilipinas, ensuring they meet strict financial standards. One of the greatest benefits of digital banks is the ability to open and manage bank accounts entirely online, often in just a few minutes. Some banks, like RCBC, even allow you to open additional accounts if you already have one opened in a branch. Moreover, deposits in digital banks are typically insured by the Philippine Deposit Insurance Corporation, giving you peace of mind up to ₱1,000,000 per depositor.

Virtual Cards and Digital Wallets

Virtual cards and digital wallets are integral parts of online banking in the Philippines. Many digital banks offer the option to create a virtual card, which can be used for online shopping and in-store payments without the need for cash or physical cards. To open a digital bank account, you may need to provide a valid ID and complete a face scan for identity verification. Recognized IDs include a passport or a driver’s license. This process ensures both security and ease of use. Once set up, a digital wallet allows seamless transactions, with funds easily added or withdrawn as needed. As with regular accounts, deposits are insured by the Philippine Deposit Insurance Corporation up to ₱1,000,000, providing an extra level of security.

Savings Products and Interest Rates

Digital banks in the Philippines often offer competitive interest rates on savings products, which can significantly enhance your savings experience. For instance, some banks provide interest rates as high as 14% per annum, though this can vary widely. Popular options like Maya Savings and CIMB Bank PH’s GSave offer unique products with attractive rates. Interest earned from savings accounts in these banks is usually credited at the start of each month, minus applicable taxes. As with all digital banking in the Philippines, these products are insured by the Philippine Deposit Insurance Corporation. UNObank Inc., another example, is regulated by the Bangko Sentral ng Pilipinas, ensuring compliance with financial standards and maximizing the trustworthiness of their savings options.

Fund Transfers and Payment Options

Fund transfers and payment options in digital banking are designed for maximum convenience and flexibility. Digital banks like RCBC and PNB allow users to transfer funds both locally and internationally. Whether you need to pay bills or send money to e-wallets, these platforms enable seamless transactions. You can schedule recurring payments through their mobile banking apps, ensuring bills are paid on time without visiting a bank branch. Moreover, contactless transactions are supported for in-store and online payments, allowing you to pay using a QR code. Each transaction is accompanied by real-time notifications via email and SMS, offering security and transparency. Enhanced security features like one-time passwords provide added protection for each fund transfer.

Reward Programs and Loyalty Benefits

Many digital banks in the Philippines offer reward programs to encourage and reward customer loyalty. For example, Maya cardholders can earn rewards by depositing at least ₱250 and spending at least ₱500. Maya also offers boosted interest rates of up to 15% per annum for savings account holders. GoTyme Bank enhances the shopping experience with a Visa debit card that earns Go Rewards points for every purchase. Additionally, the RCBC Pulz app provides easy bill payment management and loyalty rewards, ensuring stress-free digital banking. Tonik, a digital-only bank, offers competitive interest rates and unique saving options to help accelerate your savings goals, demonstrating how digital banks continuously innovate to provide customers with valuable benefits.

Ensuring Continuous Account Management

Managing your bank account is easier than ever with digital banking. With banks like RCBC, you can link various financial products, such as savings accounts and credit cards, through their banking app. This setup allows you to perform tasks like bill payments and fund transfers quickly from your mobile device. Enhanced security measures such as biometric log-ins and real-time transaction monitoring also ensure your account remains secure. Additionally, stress-free deposit transactions and international fund transfers are possible, so your account management remains smooth and hassle-free. Instant updates through email and SMS keep you informed on all account activities.

Regularly Updating Your Information

In the digital era, keeping your banking information up-to-date is crucial. Regular updates to your digital banking app can enhance security. For instance, features like biometric log-ins and device registration get improved with updates. This means transactions can remain seamless, and you’ll receive timely notifications about your account. Ensure your contact details, like phone numbers, are current to receive OTPs and alerts. Moreover, periodic updates of personal and account details can protect against unauthorized access. Staying informed on new banking features, such as bill payment enrollments and fund transfers, can help you make the most of your banking experience.

Understanding Fees and Charges

When managing a digital bank account, understanding the fees and charges involved is important. For example, if you’re using Chinabank, keeping your account’s average daily balance above P2,000 avoids a P300 fee. If you fall below for two months in a row, the fee applies. Another consideration is transferring money through InstaPay, which incurs a one-time fee of ₱15 per transaction. Moreover, RCBC’s Gold Circle membership imposes a Php1,000 fee if the required Total Relationship Balance (TRB) isn’t met for three consecutive months. It’s also helpful to know that Chinabank ATM Peso Savings Accounts require a maintaining balance of P2,000 to avoid fees or losing interest earnings. Understanding these terms helps in managing your bank account effectively and avoiding unnecessary costs.

Tips for Safe and Secure Digital Banking

Digital banking offers the convenience of managing your finances anytime, anywhere. However, this convenience comes with the responsibility of ensuring your account’s security. Critical security features such as Online Activation Codes (OAC) and One-Time Pins (OTPs) are used to authenticate transactions, adding an extra layer of protection. Also, advanced security measures like fingerprint/Touch ID and Face ID capability in banking apps can provide enhanced login security. Additionally, these apps are designed to log users out automatically during periods of inactivity to prevent unauthorized access. Regularly updating your contact details in these apps ensures you receive all necessary security alerts and codes. In case you lose your device, it’s crucial to report it to customer support to safeguard your account from unauthorized uses.

Protecting Your Credentials

Digital banks in the Philippines operate under strict guidelines set by the Bangko Sentral ng Pilipinas to protect customer credentials and financial information. They provide a safety net for deposits through the Philippine Deposit Insurance Corporation, insuring deposits up to ₱1,000,000 per depositor. Incorrect OTP entries can lead to account locking, underlining the importance of safeguarding login details. Regular monitoring of bank accounts via electronic statements is encouraged to maintain financial accuracy and security. Secure internet and mobile connections facilitate effective management of finances, ensuring transactions and account details are protected from unauthorized access.

Recognizing and Avoiding Scams

Recognizing potential scams and learning how to avoid them is crucial for safe digital banking. Digital banks in the Philippines, governed by BSP regulations, ensure customers’ deposits are safe with insurance provided by the PDIC for up to ₱1,000,000 per depositor. Enhanced security features like biometric log-ins and device registration help prevent unauthorized access. Keeping track of transactions through real-time notifications via email and SMS allows quick identification and response to suspicious activities. It’s vital to download banking apps only from official app stores to safeguard personal and financial information from potential scams. These practices bolster your confidence, enabling you to enjoy the benefits of digital banking without falling victim to fraud.