Zero balance accounts allow you to open and maintain a savings account without any minimum balance requirement. They are ideal for individuals who want access to digital banking without facing penalties for low balances. You can easily open a zero balance digital account in India using your PAN and Aadhaar cards. This digital process removes the need to visit a physical branch and ensures a quick and smooth experience.

These accounts typically include features such as internet banking, mobile apps, and free virtual debit cards. With 24×7 account access and easy onboarding, zero balance savings accounts are perfect for anyone starting their financial journey.

The documentation required is minimal. Generally, an Aadhaar card and PAN are sufficient to get started. Even NRIs can find banks offering simplified onboarding procedures in India.

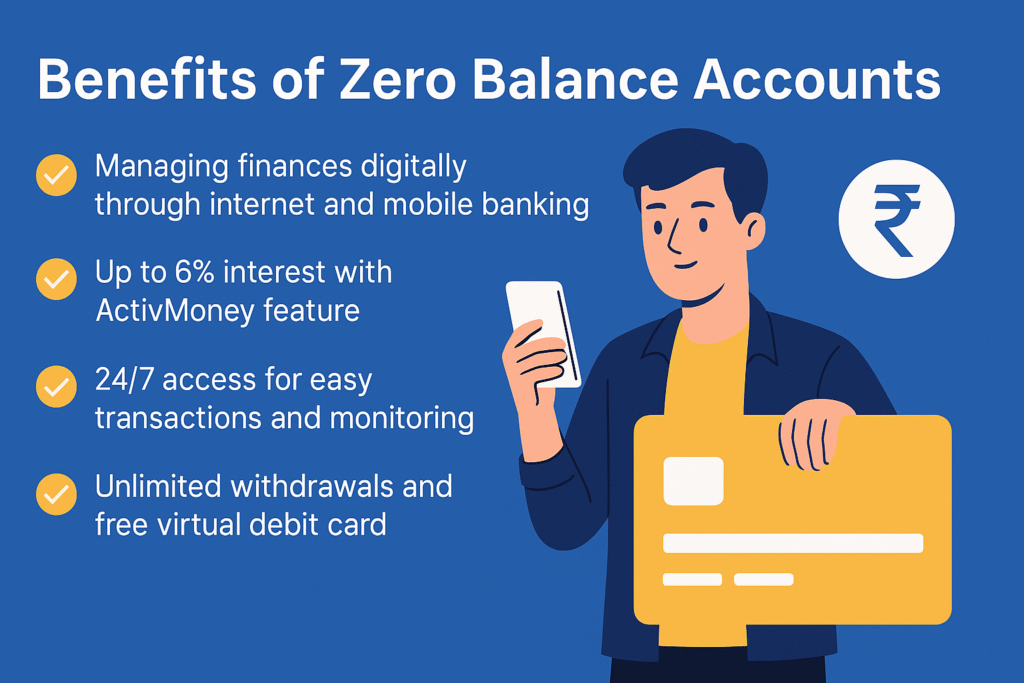

Benefits of Zero Balance Accounts

Zero balance digital accounts offer several compelling advantages:

- Digital convenience through mobile and internet banking.

- Competitive interest rates up to 6.75% p.a..

- Easy registration from the comfort of your home.

- No penalties for low balance.

- Features like free debit cards, insurance, and instant bill payments.

These features allow users to manage their accounts freely without worrying about balance maintenance. For example, Kotak811 offers attractive interest rates, and RBL Bank provides monthly interest credits.

No Minimum Balance Requirement

Accounts such as Kotak811 allow you to open a digital account without keeping a single rupee in the account. There are no non-maintenance penalties, and all digital services are available. This removes a significant barrier for low-income earners and students.

Furthermore, accounts like the Basic Savings Bank Deposit Account (BSBDA) offered by HDFC Bank offer core banking benefits without any balance constraint.

Competitive Interest Rates

- RBL Bank offers up to 6.75% per annum, which is among the highest interest rates available for zero balance digital accounts in India. For example, if you maintain an average monthly balance of ₹10,000, you could earn over ₹675 annually just through interest—credited monthly for ease of tracking.

- Kotak811 provides up to 6% per annum, enhanced further by its ActivMoney feature which auto-sweeps idle funds into fixed deposits.

- These competitive rates make zero balance accounts a viable alternative to traditional savings accounts, offering both flexibility and returns.

Banks like Axis Bank and Federal Bank also offer digital zero balance savings products with added perks like free insurance and unlimited transactions, making them a popular choice among young professionals and students.

Banks like Axis Bank and Federal Bank also offer attractive digital zero balance savings products with premium features like free insurance and unlimited transactions.

24/7 Banking Access

Many banks like Federal Bank and Axis Bank provide mobile apps with features like fund transfers, UPI, and utility payments anytime. For instance, if you remember to pay your electricity bill late at night, these apps ensure you can make the payment instantly without penalty or delay. This constant availability is especially useful for shift workers, students, and anyone with a busy schedule who may not operate during traditional banking hours.

HDFC NetBanking and BOB World App give you access to all essential functions like balance checks, mini statements, and online bill payments 24×7, making digital banking highly flexible and responsive to your lifestyle.

HDFC NetBanking and BOB World App give you access to all essential functions like balance checks, mini statements, and online bill payments 24×7.

Additional Features (e.g., Insurance, Unlimited Withdrawals)

Zero balance accounts can come packed with extra features:

- Free accident insurance up to ₹2 lakhs (Kotak811).

- Unlimited ATM withdrawals with select accounts (RBL Bank).

- Virtual debit cards for safe online payments.

- Free NEFT/RTGS services.

Digital Banking Evolution

Digital banking in India has transformed how people access financial services. Platforms like Kotak811, Paytm Payments Bank, and Fi Money offer complete banking solutions via mobile and desktop interfaces.

For readers new to digital financial tools, this beginner’s guide to digital banking provides a simple overview of how online accounts work and why they’re gaining popularity in India.

Rise of Online Platforms

- You can open zero balance digital accounts in India in just minutes using your Aadhaar and PAN.

- Account activation is instant through video KYC.

- Digital banks facilitate seamless UPI transfers, bill payments, and investment options.

Importance of Digital Solutions

Apps like Cent Mobile and FedMobile enable:

- Instant account tracking.

- Bill payments, fund transfers, and investments.

- Real-time notifications for every transaction.

- Access to loan and insurance features under one platform.

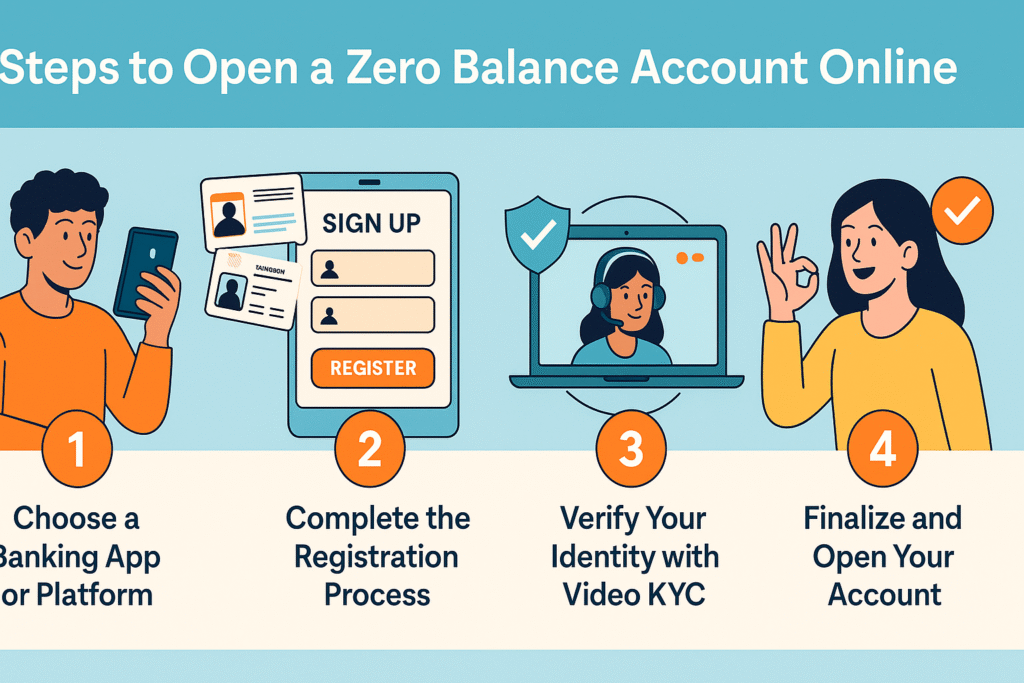

Steps to Open a Zero Balance Account Online

Choose a Banking App or Platform

Popular platforms include:

They offer app-based banking with features like:

- Instant account numbers.

- 100+ financial services.

- Secure online KYC.

- Personalized offers and rewards.

Complete the Registration Process

The process typically involves:

- Filling an online form.

- Uploading Aadhaar and PAN.

- Scheduling a video KYC.

It takes only a few minutes. Support is often available through chat or call to assist you.

Verify Your Identity with Video KYC

During the KYC session:

- Keep your original Aadhaar and PAN ready.

- Ensure proper lighting and internet.

- Speak clearly and follow the representative’s instructions.

- Done between 8 AM and 8 PM on business days.

Once your identity is successfully verified, you will typically receive a confirmation via SMS or email within minutes. The entire process is designed to be completed in under 10 minutes. Some banks also provide instant activation of your account post-KYC, allowing you to begin using your banking services—such as UPI, fund transfers, and debit card access—immediately.

- Ensure proper lighting and internet.

- Speak clearly and follow the representative’s instructions.

- Done between 8 AM and 8 PM on business days.

Finalize and Open Your Account

After identity confirmation:

- Account gets activated instantly.

- You receive a virtual debit card.

- Start transacting with no restrictions.

- Set up mobile banking and fund transfers immediately.

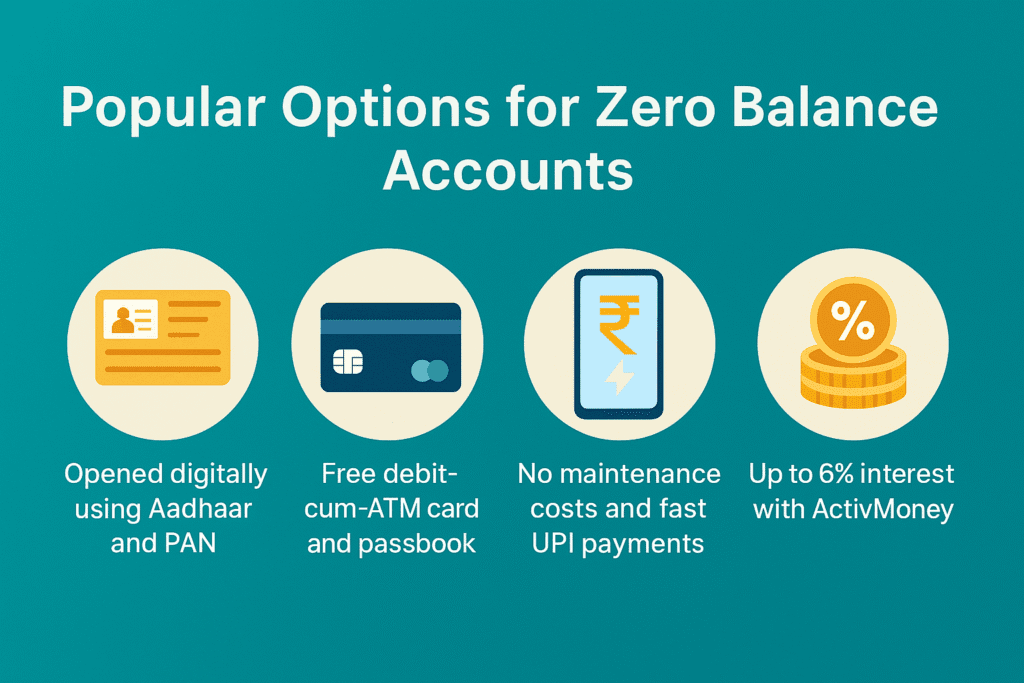

Popular Options for Zero Balance Accounts

Features of Kotak811

- 6% interest via ActivMoney

- ₹2 lakh accident insurance.

- Virtual debit card with VISA global support.

- 100+ banking features.

- No branch visits required.

Other Noteworthy Accounts

- Federal Bank FedBook Selfie – Targets students and first-time earners.

- BSBDA by HDFC – Free passbook and ATM card.

- Bandhan Super Saver – Transitions daily savings into fixed deposits.

If you’re comparing banks, this detailed review of the best neobanks in 2025 can help you choose the most feature-rich zero balance option.

Managing Your Zero Balance Account

Using Mobile Banking Apps

Apps from Kotak811, RBL, and Federal Bank offer:

- Balance check.

- UPI transfers.

- Debit card control.

- FD investments.

These apps are available on both Android and iOS platforms and have user ratings between 4.2 to 4.6 stars. They include security features like biometric login, transaction alerts, and easy locking/unlocking of debit cards. Many also let you reverse charges for failed transactions under ₹5,000, making them secure and user-friendly for daily financial activities.

Many also let you reverse charges for failed transactions under ₹5,000.

Understanding Fees and Charges

- No minimum balance fees.

- Optional charges for premium debit cards or special services.

- Axis AMAZE Account has ₹200/month for some benefits.

- RBL GO Account offers unlimited ATM usage for free.

Common Concerns and Solutions

Security of Online Banking

- Two-factor authentication is standard.

- Axis Bank Aadhaar-based KYC is secure.

- Encrypted communication for all sessions.

- 24×7 fraud monitoring systems.

Handling Technical Issues

- Never share passwords, OTPs, or personal info.

- Use only the official app or website.

- Look out for phishing scams.

- Most banks have dedicated customer care support and live chat features in their apps for resolving technical glitches quickly.

- Some issues, like failed logins or verification delays, can often be resolved by clearing app cache or updating the app version.

- If money is debited but account is not activated, refunds are issued in 15-17 business days, and you will receive confirmation messages detailing each step of the reversal.

- Use only the official app or website.

- Look out for phishing scams.

- If money is debited but account is not activated, refunds are issued in 15-17 business days.

To understand how these digital options compare to traditional banking, check out this in-depth comparison of neobanks vs traditional banks.

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your website to come back down the road. All the best