Sending money across borders has become faster and more convenient thanks to digital innovations. If you’re wondering how to send money from Canada to Ghana, there are multiple safe and affordable methods available.

This post may contain affiliate links. If you sign up or make a purchase through these links, we may earn a commission — at no extra cost to you. Learn more.

International money transfer services offer payment methods like bank transfers, debit and credit cards, direct debits, and wire transfers. Each comes with different costs and transfer speeds. For example, a bank transfer may be slower but cheaper, while credit card transfers might be instant but include cash advance fees.

Canada has no official legal limit on international money transfers. However, individual banks or platforms may impose their own limits. It’s essential to check both Canadian and Ghanaian regulatory requirements to ensure compliance.

A typical transfer includes a service fee, an exchange rate markup, and possibly third-party costs. For example, using a credit card might result in an extra cash advance fee that significantly increases the total cost.

Thanks to fintech, reliable digital platforms have emerged to make transfers not only more accessible but also more secure. Leading platforms also offer transparency in costs and tracking options.

To learn more about digital banking trends, check out our article on Global Trends in Neobanking or visit Wise for transparent rates.

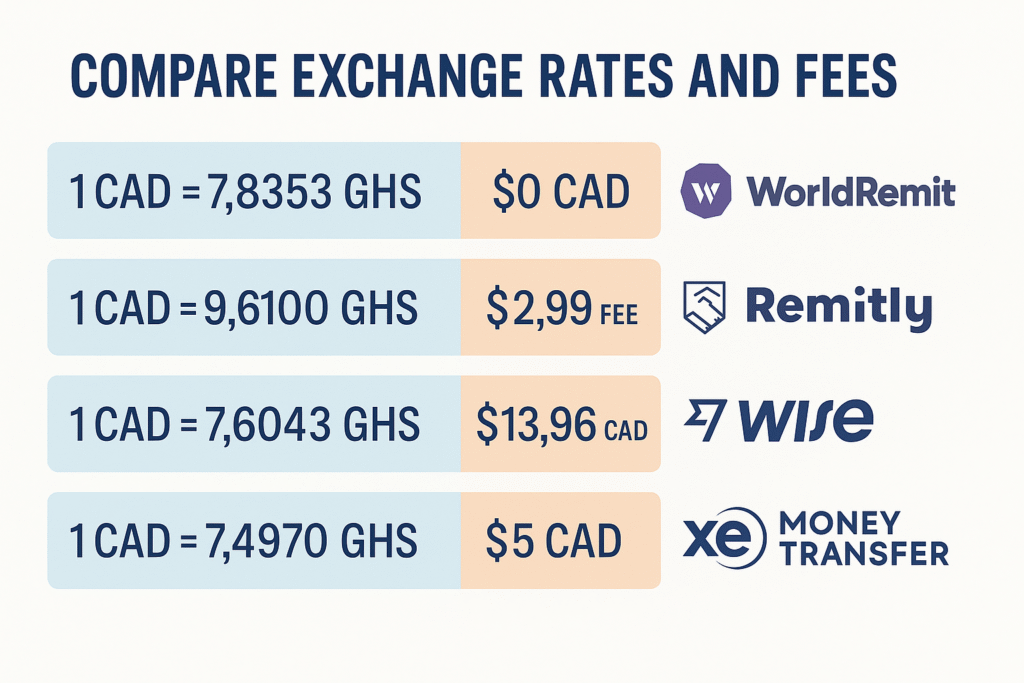

Compare Exchange Rates and Fees

Exchange rates vary significantly between providers. The mid-market rate for CAD to GHS currently sits at 7.60429, which platforms like Wise use without markup. Others may show higher or lower rates — from 9.6100 to 7.4970 GHS per CAD.

Remittance services such as Wise, Remitly, WorldRemit, Ria Money Transfer, and XE Money Transfer lock-in or offer indicative exchange rates. This variability makes it crucial to compare options before sending funds.

For example, some platforms offer zero-fee transfers for new users or special first-time promotional rates. Others include bonuses or credits for referrals, which can add to your savings.

Comparing multiple platforms saves money and ensures the recipient gets the best possible value in GHS. This is key when figuring out how to send money from Canada to Ghana affordably.

Selecting a Reliable Money Transfer Provider

Choosing the right provider is essential. You must review their fees, exchange rates, security features, and customer reviews. Payment methods also influence costs — credit cards tend to be more expensive due to additional charges.

Before initiating a transfer, collect the recipient’s bank account details or mobile wallet info. Then, sign up with your chosen provider and securely enter the details.

You can use RemitFinder, a comparison tool, to evaluate multiple providers based on rates and fees for CAD to GHS transfers.

Each transfer includes a unique tracking number (MTCN), giving you peace of mind as you monitor progress. This is an important step when exploring how to send money from Canada to Ghana reliably.

Explore more digital tools in our guide to How Fast Transactions Are Changing Finance.

Popular Platforms: WorldRemit and Western Union

WorldRemit offers a strong CAD to GHS rate of 7.8353 and has no transfer fee for Canada-to-Ghana transactions. Compared to platforms like Wise, it could save you up to $71.24 CAD.

Western Union makes transfers simple through its free online profile setup. Scheduling future payments ensures money arrives on special occasions.

Both platforms let users pre-plan, track, and manage transfers via mobile or web, making them excellent for scheduled and recurring payments.

Speed vs. Cost: Determining Your Priorities

Choosing between speed and affordability can shape your decision. Bank transfers are often the most economical but can take longer.

Online services like XE, Wise, Remitly, and WorldRemit offer quicker transfers, often at better rates than traditional banks. However, speed may come at a price, especially when using credit cards.

Promotional discounts can help strike a balance, offering both speed and cost benefits. Platforms with robust security measures add another layer of trust.

Assessing Fast vs. Economical Options

Online platforms usually beat banks in terms of rates and fees. For instance, WorldRemit offers a 1 CAD = 7.8353 GHS rate with no fee.

Wise provides the fastest service, often processing transfers in under two days but may charge more.

Platforms like RemitFinder simplify decisions by allowing side-by-side comparisons. This helps you choose what fits your priorities — speed or savings when deciding how to send money from Canada to Ghana.

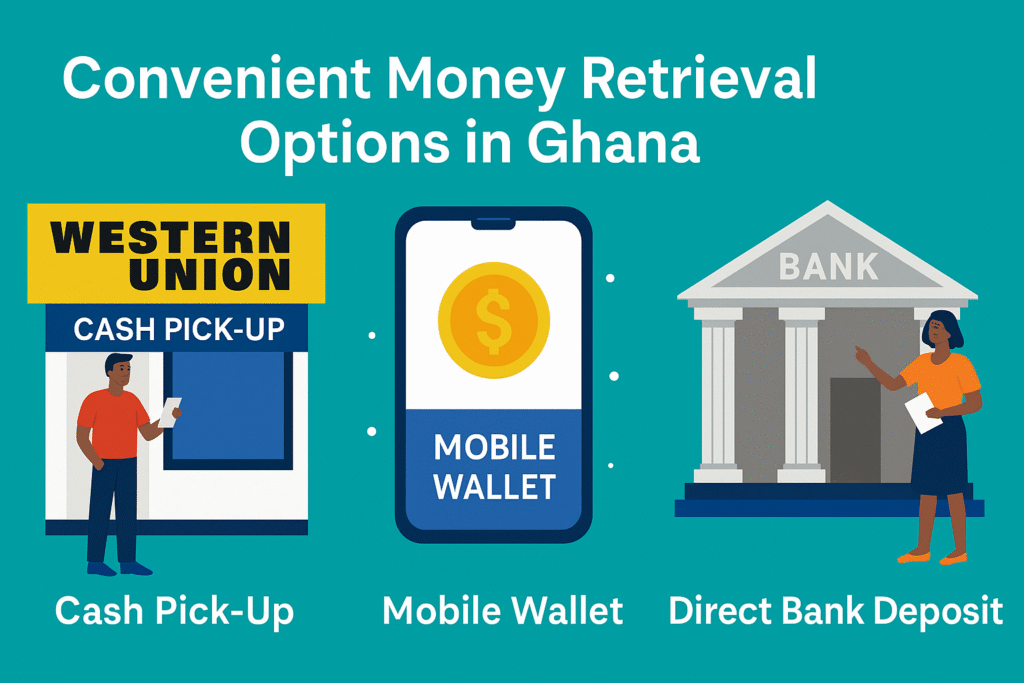

Convenient Money Retrieval Options in Ghana

Recipients in Ghana have various options to access their funds. These include cash pick-up, direct bank deposits, and mobile wallet transfers.

Platforms like Western Union, WorldRemit, and Remitly offer widespread cash pick-up services. Others enable transfers to mobile wallets or direct to bank accounts.

Money orders can also be sent and exchanged in Ghana for local currency.

Cash Pick-Up Services

Western Union boasts over 2,300 agent locations in Ghana. Whether in Accra or Cape Coast, recipients can collect funds in GHS.

Funds can be paid out using details like a transaction ID and government-issued ID. Payment methods for senders include debit, credit, or direct bank transfers.

Using Mobile Wallets and Direct Bank Deposits

Senders can also transfer directly to a mobile wallet in Ghana. Registering with providers like Western Union makes this possible.

To deposit into a bank account, enter the recipient’s name, account number, and SWIFT/BIC code. Transfers typically complete within 1–4 business days.

Tracking options are available through provider apps, giving real-time updates on your transaction. These steps are essential when learning how to send money from Canada to Ghana.

Ensuring Secure Transactions

Security is a top priority when sending money internationally. Choose platforms that use encryption and two-factor authentication.

To register, you’ll need a government-issued ID like a passport or driver’s license. This verification step adds another layer of safety.

Each transfer generates a unique tracking number (MTCN) that allows both sender and recipient to monitor progress.

During the process, you may be asked to confirm or correct details. Notifications via email or SMS help keep everything transparent and timely.

Choosing Reputable and Trusted Providers

Platforms like RemitFinder assist users in evaluating trusted services by comparing total costs and customer feedback.

Whether you’re using a bank, e-wallet, or specialist remittance company, each method has pros and cons. Evaluate their transparency and security levels.

Choosing providers with clear fees and strong customer support ensures fewer surprises during transfers. This is a must when evaluating the best way to send money from Canada to Ghana.

Read more about Security & Compliance in Digital Banking.

Staying Informed About Regulatory Requirements

Every transaction can be tracked using app alerts or email notifications. Transfer times may vary depending on the method, bank holidays, or regulatory checks.

Be aware of differences in compliance between Canada and Ghana. Staying informed prevents delays or rejections.

Services typically notify customers of delays and provide estimated timelines. This maintains transparency and control when planning how to send money from Canada to Ghana.

Utilizing Apps for Transaction Tracking

Apps enhance convenience. Ria and Paysend apps allow users to monitor transfers in real-time.

Ria provides email alerts about important updates, such as successful delivery to the recipient.

Remitly, Paysend, and others offer intuitive interfaces where you can track transactions from start to finish.

For example, Ria’s app uses a PIN and order number to track the transaction, while Remitly provides updates via text and email.

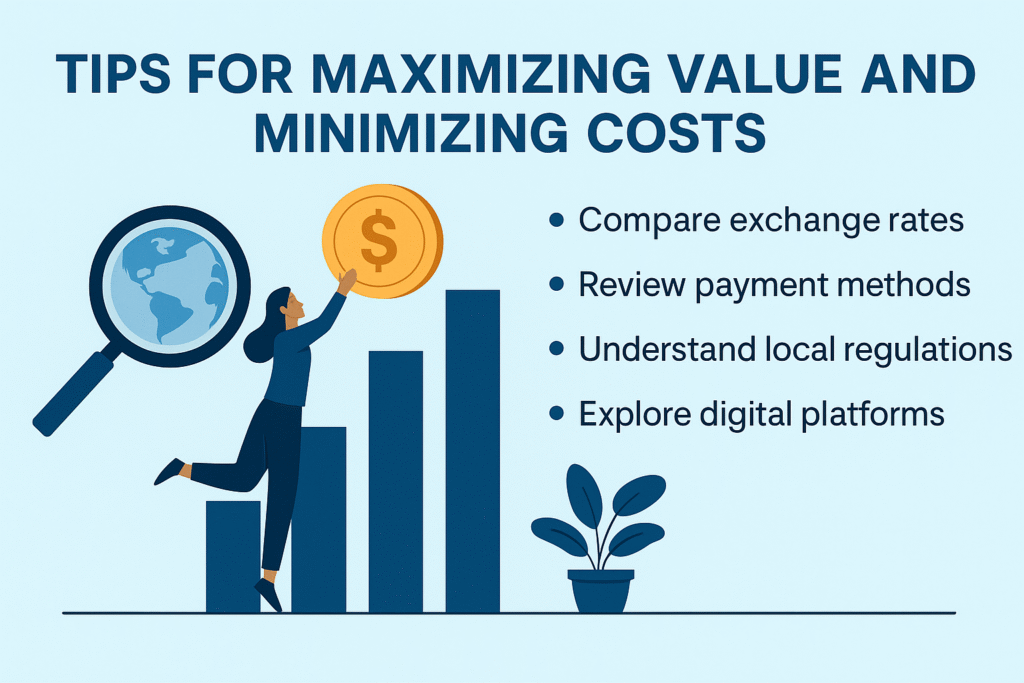

Tips for Maximizing Value and Minimizing Costs

Using online FX companies often saves you money with better exchange rates and lower fees.

Compare services using tools like RemitFinder to find the best deals and avoid unnecessary costs.

Different payment methods have distinct cost profiles. Bank transfers tend to be cheaper than credit card payments.

Understand the legal landscape for transfers in both Canada and Ghana to avoid penalties or delays.

Leveraging tech platforms not only ensures security but also enhances accessibility.

Leveraging Promotions and Discounts

RemitFinder aggregates deals and exchange rates in one place, making it easier to find cost-saving opportunities.

Promotional offers from RemitFinder partners help cut down total transfer costs significantly.

These may include waived fees, better rates, or bonus credits for referring friends.

Applying such promotions ensures you’re maximizing value every time you explore how to send money from Canada to Ghana.

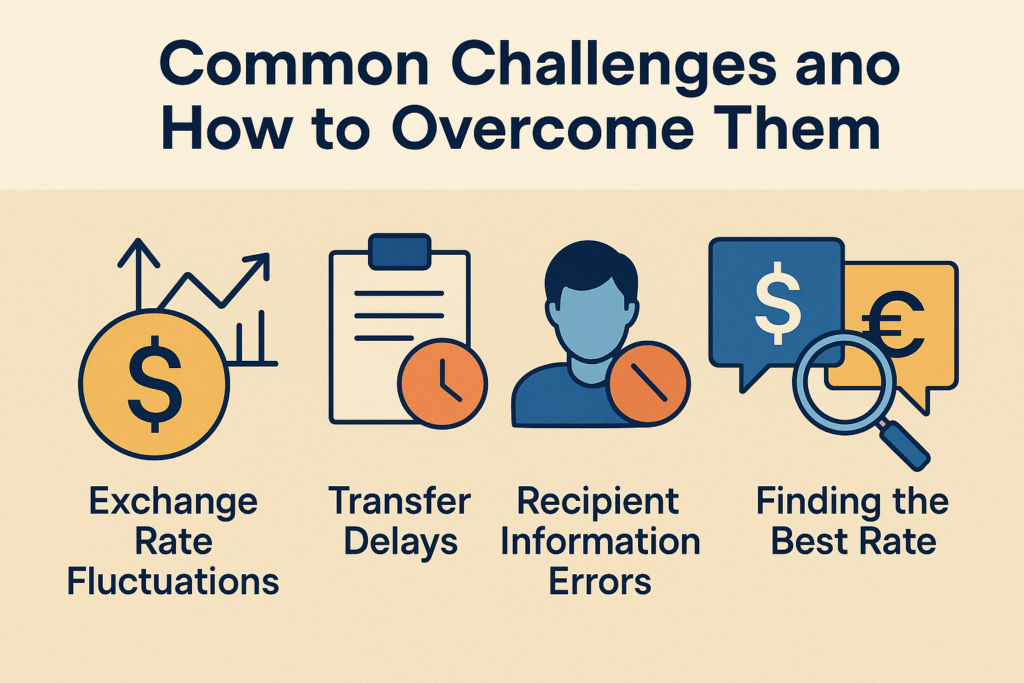

Common Challenges and How to Overcome Them

Not all transfers are created equal. Different providers have varying fee structures and exchange rates.

Transfers may be delayed due to regulatory issues, holidays, or bank processing times.

Ensure you have accurate recipient details to prevent failed transactions.

Compare services often to adapt to rate changes and provider fee adjustments.

Use platforms that require ID verification to boost the safety of your funds.

Handling Exchange Rate Fluctuations

Exchange rates can swing quickly. Some providers apply hidden markups, so it’s important to choose transparent ones like Wise.

At the time of writing, the mid-market rate stands at 7.60429 GHS per CAD.

Always compare rates before making a transfer to ensure you’re getting a good deal.

Navigating Transfer Delays

Even fast services can face delays. Processing times can range from instant to four business days.

Delays may stem from regulatory reviews, holidays, or recipient bank issues.

Most platforms provide estimated delivery times and notify users about any changes.

Apps and alerts ensure you’re always updated on the status of your transfer.

Pingback: Best International Money Transfer Services - PrimeFinanceTech

I used to be suggested this web site by way of my cousin. I am now not certain whether this publish is written by way of him as nobody else recognize such targeted approximately my trouble. You are amazing! Thanks!

Thank you so much, I really appreciate it. I’m glad you found the post helpful!

Pingback: The Top 7 Best Digital Banks in Mexico 2025 - PrimeFinanceTech