Introduction: Your Guide to Effortless Transfers to Canada

Sending an international money transfer to Canada no longer needs to feel complicated. With the right services and smart strategies, you can save on fees, benefit from better exchange rates, and ensure your recipient gets funds quickly. This comprehensive guide covers everything: why international transfers matter, how fees and rates impact you, the technology behind transfers, and how to ensure your money always arrives safely. For related insights, explore our guide on how to send money from Canada to Ghana.

This post may contain affiliate links. If you sign up or make a purchase through these links, we may earn a commission — at no extra cost to you. Learn more.

The Growing Importance of International Money Transfers

International transfers are vital for immigrants, students, freelancers, and global businesses. Whether supporting loved ones, paying tuition, or covering supplier invoices, efficient cross-border transactions are the backbone of Canada’s diverse economy. The World Bank highlights that Canada is among the top destinations for remittances. As immigration continues to rise, so does the demand for better, faster, and more transparent solutions. If you’re considering the cheapest way to transfer money to Canada online, this guide highlights all the essential steps.

For tips on which apps are best for affordable transfers, check our comparison of top remittance apps with low exchange rates.

Why Efficient Transfer Solutions Matter

Traditional banks are often slow and expensive. They use outdated systems and hide extra costs in exchange rates. A digital-first platform can make a huge difference—faster delivery, lower costs, and peace of mind. Choosing wisely ensures your hard-earned money arrives in Canada without delays. Learn from our detailed breakdown of how to send money from Canada to Ghana. Many readers searching for how to send money to Canada from abroad find that switching from banks to modern apps saves hundreds each year.

Key Advantages of Digital Transfer Platforms

Digital platforms offer:

- Transparent fees: Know exactly what you’ll pay before confirming.

- Competitive exchange rates: Keep more money in your pocket.

- Speed: Many transfers arrive within hours instead of days.

- Security: Encrypted transactions and fraud monitoring.

- Accessibility: Mobile apps allow transfers anytime, anywhere.

Learn more in our guide on best banks for remote workers in Southeast Asia.

Unbeatable Exchange Rates: Maximizing Every Dollar

How Exchange Rates Affect Transfers

Exchange rates are dynamic. Even small changes impact how much your recipient gets in CAD. A difference of 1% might not sound like much, but on a $5,000 transfer, that’s $50 lost to poor rates. Comparing rates before sending ensures maximum value. To find cost-saving strategies, read how to send money from Canada to Ghana. If you want the best apps for international money transfer to Canada, comparing exchange rates should always be the first step.

Lightning-Fast Delivery: Getting Your Money There Quickly

For emergencies like medical bills or urgent rent, speed is non-negotiable. While banks may take up to 5 business days, digital services can deliver in minutes. See comparisons in our guide on top remittance apps with low exchange rates.

Transparent & Low Fees: No Hidden Surprises

Fintech platforms show fees upfront. Some even display how much CAD the recipient will get before you confirm. Unlike banks, there are no surprises at the end. Check our in-depth example in how to send money from Canada to Ghana. If you’re looking for the cheapest way to transfer money to Canada online, these fee comparisons are critical.

Robust Security: Protecting Your Funds and Data

Your money deserves protection. Leading services like Wise and Remitly use two-factor authentication, end-to-end encryption, and constant monitoring.

User-Friendly Platforms: Designed for Everyday Use

Ease of use matters. Many providers let you sign up, input transfer details, and send money in under 10 minutes. Clear layouts and real-time updates give you confidence every step of the way. Discover ease-of-use comparisons in top remittance apps with low exchange rates.

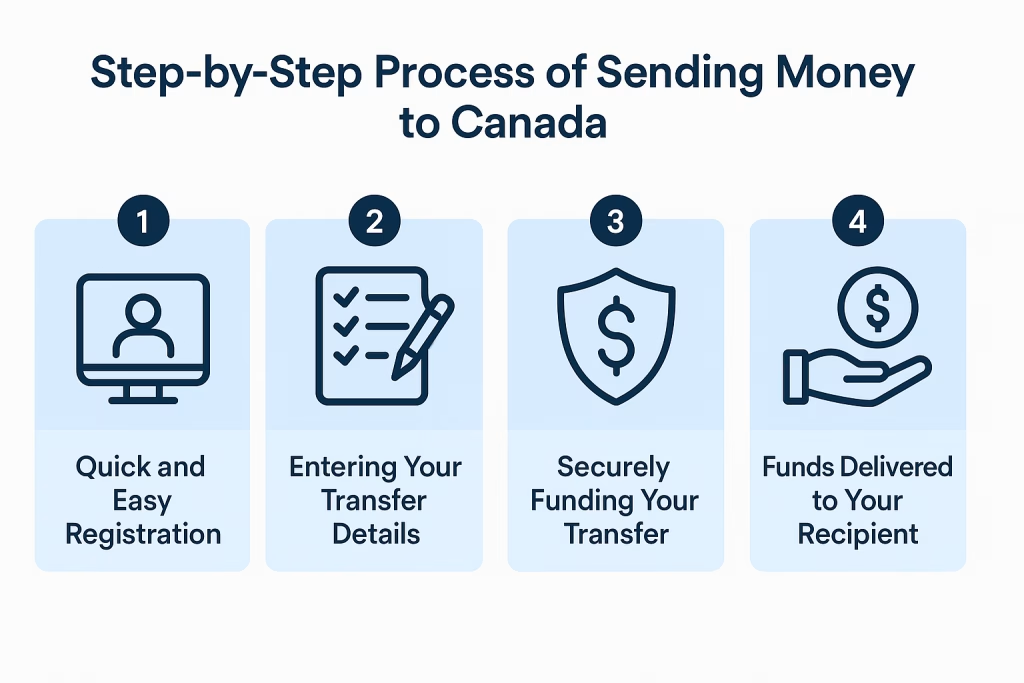

Step-by-Step Process of Sending Money to Canada

Step 1: Quick and Easy Registration

Register online or via an app. Upload identification documents to comply with regulations. The process is straightforward and usually takes less than 10 minutes. For newcomers, this is often the first step in learning how to send money to Canada from abroad.

To understand regional differences in registration processes, review our detailed guide on best banks for remote workers in Southeast Asia.

Step 2: Entering Your Transfer Details

Providing Sender and Receiver Information

Accurate recipient details are crucial. Enter the bank name, account number, and full name exactly as it appears on the account. Learn the importance of accuracy from our case study in how to send money from Canada to Ghana.

Specifying the Amount and Currency

Select the amount you’re sending and ensure the target currency is CAD. Most providers will instantly show the converted total. For country-specific examples, see how to send money from Canada to Ghana. This is one of the most common steps readers ask about when searching for best apps for international money transfer to Canada.

Step 3: Securely Funding Your Transfer

Available Payment Options (e.g., Bank Transfer, Online Banking)

Funding methods impact both speed and cost. Bank transfers are cheaper, while card payments are faster. Check our breakdown in top remittance apps with low exchange rates.

Other Payment Methods for Flexibility

Some providers support PayPal, Apple Pay, and Google Pay. These options add flexibility but may come with higher fees.

Step 4: Real-Time Tracking and Confirmation

Transparency builds trust. Once your money is sent, you’ll receive instant confirmation and tracking options via email or SMS.

Step 5: Funds Delivered to Your Recipient

The final step is delivery. Recipients can get funds directly in their bank accounts or pick them up at partner locations. For reliable apps, explore our review of top remittance apps with low exchange rates. If you’re wondering about the cheapest way to transfer money to Canada online, delivery methods play a key role in the total cost.

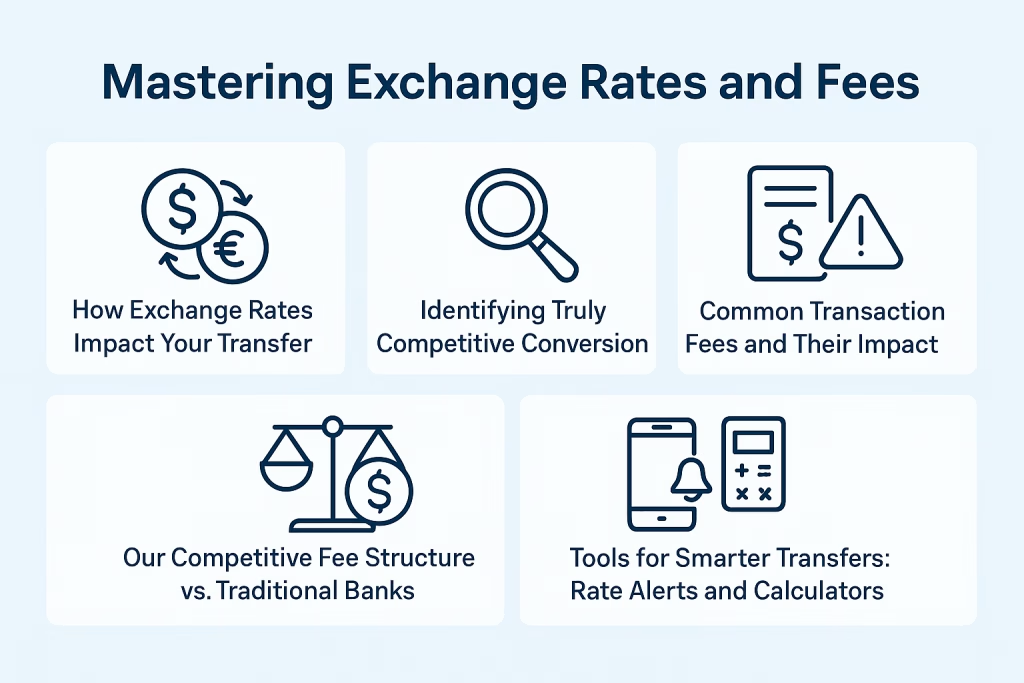

Mastering Exchange Rates and Fees

Understanding How Exchange Rates Work

Rates fluctuate constantly due to global markets, inflation, and economic policies. Smart senders monitor trends and use platforms with alerts. People seeking how to send money to Canada from abroad often learn that timing the market can save them hundreds.

Identifying Competitive Conversion Rates

Always check against trusted sources like XE Currency Converter to avoid overpaying.

Transfer Fees Explained

Common Transaction Fees and Their Impact

Fees can be flat, percentage-based, or hidden in exchange rates. Know the structure before choosing a provider.

Comparing Fintech Fees with Traditional Banks

Fintech platforms often charge less and provide better rates, making them ideal for large transfers. For real-life examples, read how to send money from Canada to Ghana. If you’re comparing the best apps for international money transfer to Canada, fintech services will likely come out ahead.

Tools for Smarter Transfers

Providers like OFX allow you to set alerts, track fluctuations, and send at the best moment.

Why Delivery Speed Matters

Quick transfers can mean the difference between paying rent on time or incurring late fees. Faster isn’t just convenient—it can save money. For more details on app speed, see top remittance apps with low exchange rates.

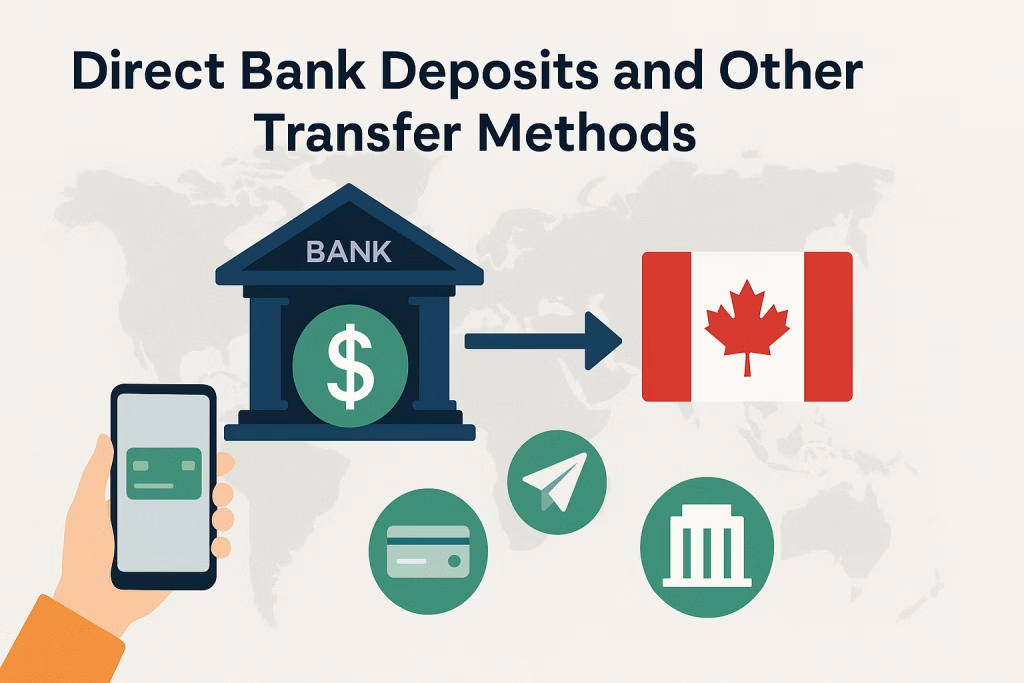

Direct Bank Deposits and Other Transfer Methods

Why Direct Bank Deposits Are Reliable

Bank deposits remain the gold standard. They are fast, secure, and accepted by nearly all Canadian institutions. Many people searching for the cheapest way to transfer money to Canada online choose direct deposits because of their low fees.

Optimizing Payment Schemes for Faster Delivery

Interac e-Transfer has revolutionized domestic payments in Canada. When paired with international transfers, it ensures recipients get money quickly.

The Rise of Digital and Mobile Payment Options

Mobile wallets and apps are increasingly popular. They offer ease of use and give recipients more control over how funds are accessed. For modern comparisons, see our guide on best banks for remote workers in Southeast Asia.

Technology Behind Lightning-Fast Transfers

APIs, blockchain technology, and machine learning improve speed and security. These innovations reduce the risk of delays and fraud.

Ensuring Secure Transfers Every Time

Regulated providers must comply with strict financial standards. Always verify that your chosen service is registered with FINTRA

Data Protection and Regulatory Compliance

Fraud Prevention Through Monitoring

AI-driven tools scan for unusual activity. Suspicious transfers are flagged instantly to protect your funds.

Compliance with Canadian Regulations

All money transfer businesses must comply with FINTRAC regulations. They are required to verify identities and keep thorough records.

Building Trust in Global Transfers

Providers that are transparent about their processes inspire confidence. Look for platforms with clear policies and responsive customer service. See which providers do this well in top remittance apps with low exchange rates.

Who Can Receive Money in Canada?

Recipients may include family members, friends, landlords, students, or businesses. Most transfers land directly in a Canadian bank account. For practical sending tips, see how to send money from Canada to Ghana.

FAQs: Everything You Need to Know Before Sending Money

What Information Is Needed for Bank Deposits?

You’ll need the institution code, branch transit number, and account number. Providing the wrong details may delay delivery.

How Do I Ensure the Receiver Gets the Right Amount?

Always confirm CAD is selected as the receiving currency. Check the provider’s fee structure to avoid extra deductions. For more insights, check top remittance apps with low exchange rates.

Are Cash Pickup Options Still Available?

Yes, some providers allow cash pickups at locations like Western Union. However, these may cost more compared to direct bank deposits.

What Are Typical Transfer Limits?

Transfer limits vary by provider. Some cap at $10,000 per transaction, while others allow $50,000 or more for verified accounts.

What Identification Do I Need?

Most services require a government-issued ID like a passport or driver’s license. Some may request proof of address for higher amounts.

How Secure Is My Payment Information?

Top providers follow PCI DSS compliance, SSL encryption, and strong fraud monitoring systems.

How Fast Will My Transfer Arrive?

Delivery can be instant with cards, or take 1-2 business days with bank transfers. Compare times before sending. For app-specific performance, see top remittance apps with low exchange rates.

What If There’s an Error in the Transfer?

Errors can happen. Always double-check details. Most services allow corrections or offer refunds if funds haven’t been claimed. Read more examples in how to send money from Canada to Ghana.

Can I Send Money from Any Country to Canada?

Yes. Providers typically cover 150+ countries, though some restrictions apply in sanctioned regions. Compare international coverage in top remittance apps with low exchange rates. Many users searching for how to send money to Canada from abroad rely on these coverage details to choose the right provider.

Final Thoughts

Choosing the right platform for your international money transfer to Canada ensures your recipient gets more money, faster, and with complete security. By understanding exchange rates, comparing fees, and leveraging modern digital platforms, you can avoid unnecessary costs and delays. Whether you’re searching for the best apps for international money transfer to Canada, exploring how to send money to Canada from abroad, or comparing the cheapest way to transfer money to Canada online, this guide gives you everything you need.

Hello there, just became alert to your blog through Google, and found that it’s really informative. I’m gonna watch out for brussels. I’ll be grateful if you continue this in future. Many people will be benefited from your writing. Cheers!

Thank you! We’re glad you found the blog helpful. We’ll definitely keep sharing more content, and I hope it continues to be useful.