The use of mobile microloan apps for rural farmers is revolutionizing agricultural finance. These tools are becoming indispensable in developing and developed markets alike, unlocking critical funding for those historically excluded from formal banking systems.

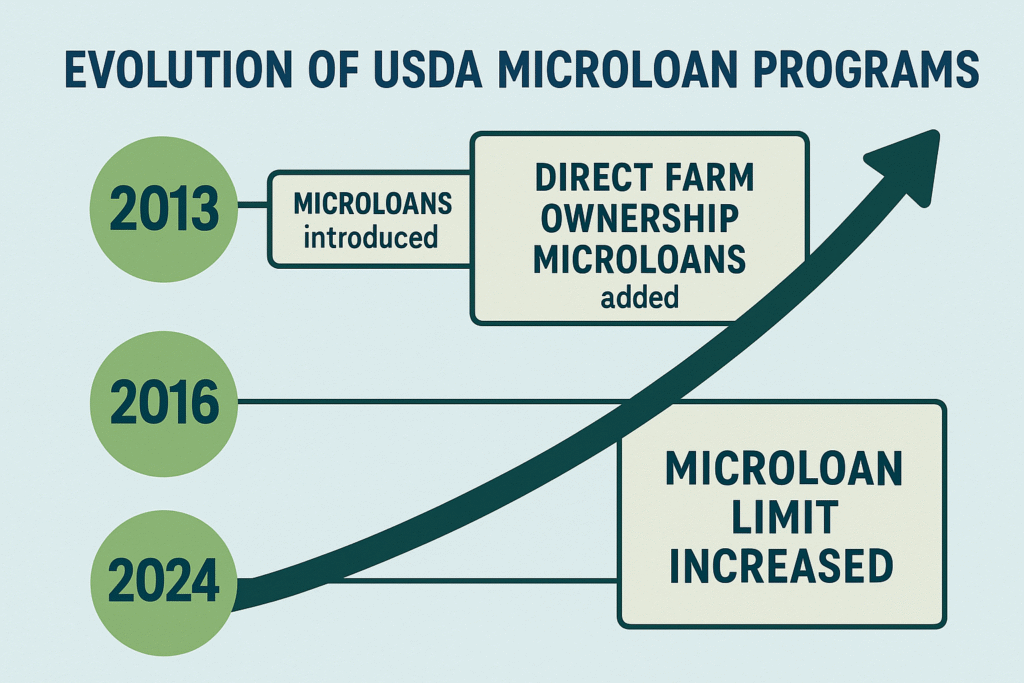

Evolution of USDA Microloan Programs

The USDA’s Direct Farm Operating Microloan program has become a financial lifeline for small-scale and beginning farmers, particularly those who face challenges qualifying for traditional loans. These microloans are specifically tailored for new entrants in agriculture, socially disadvantaged groups, and farmers needing minimal capital to launch or maintain operations.

What sets USDA microloans apart is their simplicity. With loans capped at $50,000, applicants are only required to provide a 5 percent down payment and can self-certify their production history. This dramatically reduces the barrier to entry for aspiring farmers. Compared to conventional financing options, the application process for USDA microloans involves less paperwork and fewer eligibility requirements.

Interest rates are tied to U.S. Treasury securities, offering a low and stable alternative to commercial rates. Operating microloans must be secured with a first lien on either farm property or agricultural products. The value of the collateral must be 100 to 150 percent of the loan amount, depending on what’s available.

Learn how to qualify for USDA farm loans

The Role of Mobile Apps in Microloan Accessibility

In countries like Kenya, Mozambique, and Tanzania, mobile apps have become essential tools for enabling smallholder farmers to access financial services. Apps like CAMAgriMarket in Cambodia are bridging the gap between farmers and agri-businesses, offering platforms for digital trading, microloans, and micro-insurance.

The Connected Farmer Alliance (CFA) is one such initiative. By lowering transaction costs and minimizing risk, CFA ensures more inclusive financial practices. Their use of mobile and web-based services makes it easier for agribusinesses to source from smallholder farmers, while also enabling farmers to receive timely loans.

These innovations are especially impactful for farmers without formal credit histories. Mobile loans offer instant access to capital—ideal for rural areas where traditional banking infrastructure is sparse. Initiatives like these also engage multiple stakeholders, demonstrating their viability on a commercial scale.

Read more about how technology boosts access to rural finance and check out our deep dive on financial inclusion via mobile apps. You can also explore how smartphone banking apps support smallholder financing.

Advantages of Mobile Microloan Apps

Mobile microloan apps for rural farmers are redefining rural finance by giving farmers direct access to critical resources. These tools empower farmers to purchase land, invest in inputs, and make operational improvements with confidence.

Satellite-based crop monitoring tools embedded in many apps provide real-time agricultural insights. AI-driven recommendations further optimize crop management, leading to improved productivity. Features like water usage tracking and fertilizer optimization reduce operational costs while also promoting sustainable practices.

Another major advantage is streamlined access to funds. Many rural farmers lack the financial literacy or documentation required for traditional loans. Mobile apps cut through the red tape, offering intuitive interfaces and simplified processes.

These benefits have a tangible impact. Farmers can scale operations, invest in quality seeds or livestock, and increase yields without waiting weeks for loan approval.

Explore our guide on digital lending innovation.

Bridging the Gap for Unbanked Farmers

Unbanked rural populations represent both a challenge and an opportunity. Mobile microloan apps for rural farmers reduce costs and risks associated with lending in remote regions. The Connected Farmer Alliance has been pivotal in promoting financial inclusion, especially among underserved communities.

Apps like Kilimo Booster offer tailored repayment schedules aligned with crop cycles, ensuring farmers can repay loans during harvest periods. This aligns loan repayments with income flow, minimizing defaults.

Despite the promise, challenges remain. Many lenders view rural lending as too costly, especially when transactions are small and logistics complex. But mobile technology is steadily turning this narrative around by automating assessments and reducing costs.

Current Landscape of Microloans

Technological integration with the USDA Direct Farm Operating Microloan program has expanded the scope and efficiency of rural financing. Farmers now benefit from streamlined applications, improved tracking, and better communication.

FSAs microloan offerings have evolved to include financing for on-farm storage and equipment. This increases flexibility and supports more comprehensive farm operations.

Meanwhile, mobile applications like CAMAgriMarket are linking farmers with sellers and buyers digitally. These platforms contribute not just to financial inclusion but also to more sustainable agriculture.

For new farmers within their first 10 years of operation, microloans are often the only accessible form of financing. These programs prioritize inclusivity and adaptability.

Check out the Top 10 Mobile Banking Features that are setting trends for 2025

Key Players in the Microloan Sector

The Farm Service Agency (FSA) leads USDA’s microloan initiatives. With a focus on supporting beginning and underserved farmers, FSA has tailored programs that offer manageable, low-interest loans.

The FSA doesn’t rely on credit scores, opting instead to assess repayment history. This opens doors for those previously excluded from formal finance.

Microloans are capped at $50,000 but have a disproportionately large impact. They fund land acquisition, livestock, and sustainable farming tools. By targeting farmers in their early years, FSA supports long-term rural development.

Impact on Rural Economies

Microloans contribute directly to rural job creation and local economic stimulation. New farms mean more local food production, jobs, and economic activity.

These loans also encourage environmental stewardship. Many recipients use funds to adopt sustainable practices, including crop rotation and organic farming.

USDA microloans also prioritize socially disadvantaged groups, promoting diversity in agriculture. Veterans, women, and minority farmers benefit from targeted outreach and support.

The cumulative effect is clear: increased rural vitality and a more resilient agricultural economy.

Technology’s Influence on Sustainable Farming

Digital tools like the Agriculture Market Mobile App connect farmers to markets, ensuring better pricing and access. These platforms make agricultural trade more efficient and inclusive.

Programs such as the Amret-MAFF partnership show how tech can power sustainability. From connecting buyers to farmers to promoting best practices, these collaborations strengthen agricultural value chains.

Mobile microloan apps for rural farmers further drive sustainability by financing tools and techniques that conserve resources. They also encourage diversification, ensuring farmers aren’t overly dependent on a single crop or market.

See how fintech supports sustainable farming.

Future Prospects for Mobile Microloan Integration

Agtech innovations are transforming how farmers access and use loans. As more stakeholders adopt mobile tools, efficiency and impact will increase.

Apps now support crop diversification, resource tracking, and income stabilization. These functions reduce risk for both lenders and farmers.

Mobile microloan apps for rural farmers are expanding across Africa and Southeast Asia, driven by public-private partnerships. These initiatives prove mobile platforms are scalable and sustainable.