Neobank vs. Traditional Bank

In today’s rapidly evolving financial landscape, the way we manage our money has significantly shifted. As digital banking becomes more widespread, neobanks are emerging as a popular alternative to traditional banks. But which one is right for you in the battle of Neobank vs Traditional Bank? In this guide, we’ll explore the key differences between neobanks and traditional banks, their advantages and drawbacks, and help you decide which banking solution fits your financial needs.

What is a Neobank?

A neobank is a completely digital bank that operates without physical branches. Neobanks leverage technology to offer a streamlined banking experience via mobile apps or websites. These banks typically offer lower fees and greater convenience but may have limited services compared to traditional banks. To learn more about NeoBanks go check out our post on Why Everyone is Switching to Neobanks: What You’re Missing Out On

What is a Traditional Bank?

Traditional banks are the long-standing financial institutions that have physical branches and offer a full range of banking services, including checking accounts, loans, mortgages, and investment options. They tend to have a more established reputation but may come with higher fees and less convenience for those who prefer mobile-first banking. The choice between Neobank vs Traditional Bank often comes down to convenience vs established reputation.

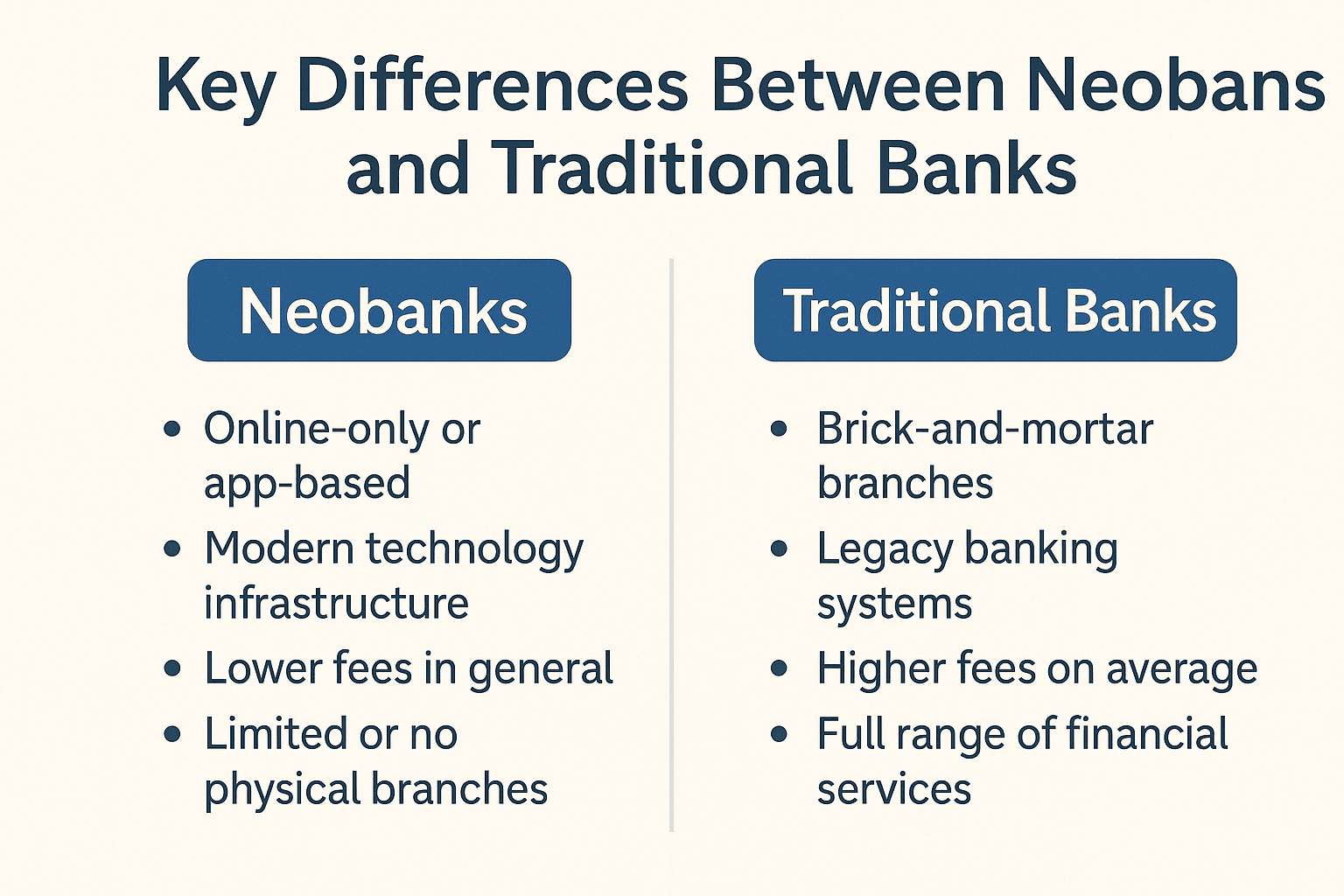

Key Differences Between Neobanks and Traditional Banks

1. Convenience

Neobanks are designed with the digital user in mind. Every interaction, from opening an account to making transfers, is done via a mobile app or website. This makes neobanks incredibly convenient, especially for those who prefer handling their finances online. Traditional banks, while offering online services, often still require in-person visits for certain tasks like getting a loan or setting up a mortgage.

2. Fees

One of the biggest advantages of neobanks is their low fee structure. Neobanks often waive account maintenance fees, ATM fees, and overdraft fees because they don’t have the overhead costs of running physical branches. Traditional banks, on the other hand, frequently charge higher fees to cover the costs of their physical infrastructure and broader service offerings.

3. Customer Support

Traditional banks offer in-person customer service at their branches, which can be beneficial for customers who prefer face-to-face interactions. They also provide phone and online support. Neobanks typically offer online-only support, which might be a drawback for those who want more direct assistance. However, some neobanks provide fast, 24/7 customer service through their apps or websites, making them accessible anytime.

4. Account Features

Neobanks tend to focus on basic banking services like checking and savings accounts, with some offering additional features like budgeting tools and automated savings. However, they often don’t offer a full range of services like loans or mortgages. Traditional banks, on the other hand, provide a comprehensive array of financial services, including investments, loans, and credit products.

5. Security

Both neobanks and traditional banks offer secure banking services. Neobanks are usually regulated and insured by institutions like the FDIC, ensuring that deposits are protected. Traditional banks, given their long history, may provide a greater sense of security for some customers, especially those who prefer working with well-established institutions.

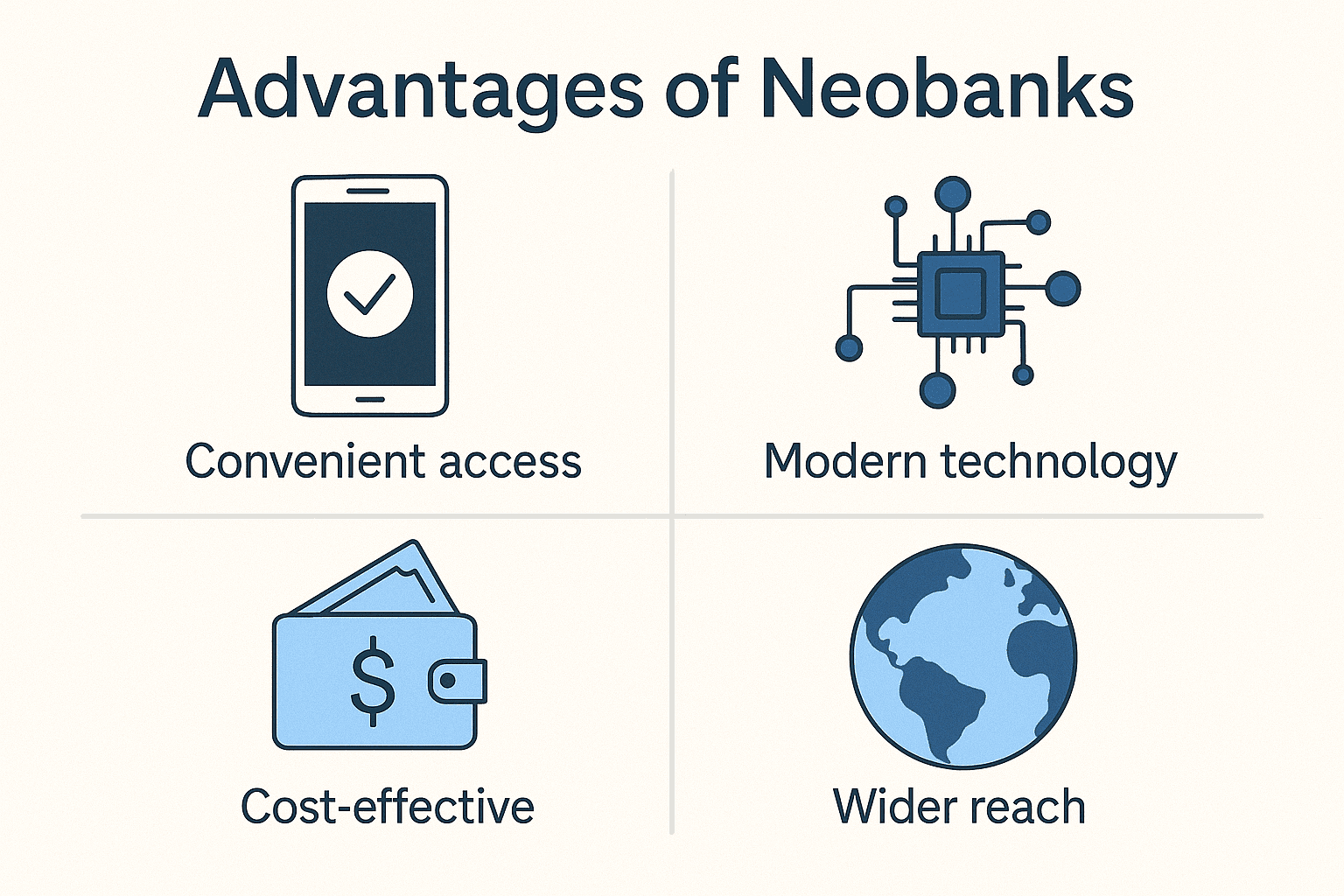

Advantages of Neobanks

- Lower Fees: With fewer operational costs, neobanks pass the savings on to customers by offering lower fees.

- Innovative Features: Neobanks often come with advanced budgeting tools, real-time spending notifications, and automated savings options.

- Accessibility: Everything can be done from your phone, making neobanks ideal for those who prioritize mobile-first solutions.

Advantages of Traditional Banks

- Full-Service Offerings: Traditional banks provide a wide range of financial products and services, from loans to credit cards and investment accounts.

- In-Person Support: For customers who prefer face-to-face interactions, traditional banks offer personalized customer service at their branches.

- Established Reputation: Traditional banks have decades or even centuries of experience, making them a trusted choice for many.

Conclusion: Which Should You Choose?

Choosing between a neobank and a traditional bank depends on your personal financial needs and preferences. Neobank vs Traditional Bank decision-making will vary based on individual needs and preferences. If you’re looking for a convenient, low-fee option and are comfortable with managing your finances digitally, a neobank could be a great fit. However, if you need access to a wide range of services, prefer in-person support, and value the security of working with a long-established institution, a traditional bank might be the better choice.

Whichever option you choose, both neobanks and traditional banks have their own unique advantages. It’s important to assess your financial goals, banking habits, and the specific services you need to make the best decision when considering Neobank vs Traditional Bank for your financial future.

For more insights on selecting the best digital banking solution, check out our article on How Neobanks Are Reducing Banking Fees for Consumers. It covers key factors to consider, from fees and features to customer service, helping you make an informed decision.

Why users still use to read news papers when in this technological world all

is existing on net?

Hi there to all, how is everything, I think every one is getting more from this website, and your views aare good for new people.

Hey there! I realize this is kind of off-topic however I had to ask.

Does operating a well-established blog like yours require a

massive amount work? I am brand new to blogging but I do write in my journal daily.

I’d like to start a blog so I can share my personal experience and thoughts online.

Please let me know if you have any kind of recommendations or tips for new aspiring blog owners.

Appreciate it!

Thanks! It takes some work but not as much as you might think. Since you already journal daily you have a great start. Just stay consistent, focus on quality posts and you’ll be fine.

I couldn’t resist commenting. Very well written!