Navigating the World of Modern Money Transfers

The Essential Need for Fast and Secure Money Movement

In today’s interconnected world, people need reliable ways to move money quickly and safely. Families send remittances, freelancers receive international payments, and businesses transfer funds across borders daily. Send money services have become the backbone of this global financial flow. Without them, many individuals and companies would face unnecessary delays and high costs. For example, a migrant worker supporting loved ones abroad depends on affordable transfer methods. Similarly, an online freelancer completing projects for clients worldwide cannot afford long waiting times or excessive fees.

This post may contain affiliate links. If you sign up or make a purchase through these links, we may earn a commission — at no extra cost to you. Learn more.

What This Guide Covers: Finding Your Ideal Transfer Solution

This guide explores the best send money services, helping you choose platforms that balance speed, affordability, security, and accessibility. By comparing providers, you’ll learn which services suit international transfers, domestic payments, or simple peer-to-peer transactions. You will also discover which platforms excel in serving businesses versus individuals.

Key Factors to Consider: Speed, Cost, Security, and Convenience

When choosing a provider, you must weigh speed, transfer costs, security features, and ease of use. Each factor can determine whether your transaction is smooth or stressful. If you need urgent payments, prioritize instant delivery services. On the other hand, if your priority is saving money, look for low fee money transfer providers that keep costs down.

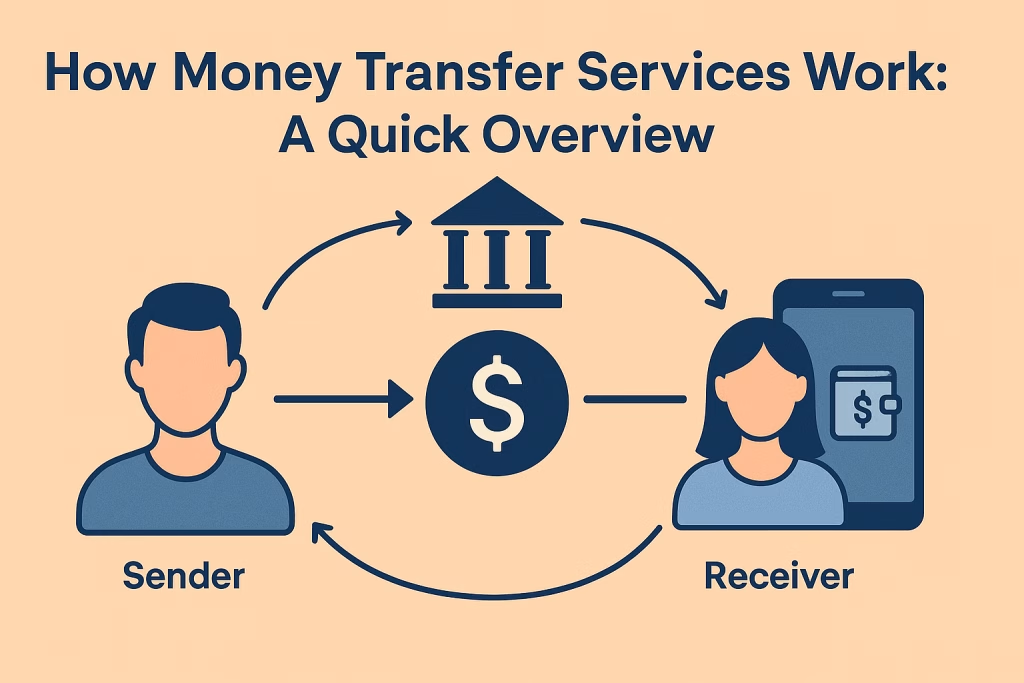

How Money Transfer Services Work: A Quick Overview

The Basic Transfer Process: Sender to Receiver

At its core, a transfer involves a sender initiating a payment, the service processing it, and the receiver accessing funds through their bank account, mobile wallet, or in cash. These steps might seem simple, but each stage requires compliance checks and transaction monitoring.

Common Transfer Methods: Bank Accounts, Mobile Wallets, and Cash

Popular transfer channels include bank-to-bank transfers, digital wallets such as PayPal, Wise, and traditional cash pickup services like Western Union. Each method has strengths and weaknesses depending on your needs. Bank transfers work best for large amounts, while mobile wallets are excellent for everyday convenience.

Digital vs. Traditional: Understanding the Landscape

Digital services dominate due to speed and lower fees, while traditional cash pickups still matter in areas with limited banking access. In fact, according to World Bank data, over 1.4 billion adults worldwide remain unbanked. For these individuals, cash services are a lifeline.

What to Look For in a Top-Tier Money Transfer Service

Speed: How Quickly Can Your Money Arrive?

Some providers deliver funds instantly, while others take several days. Fast delivery is crucial for emergencies such as hospital bills or urgent family support. If you need immediate delivery, secure online money transfer options like Wise or Zelle are ideal.

Fees and Exchange Rates: Understanding the True Cost

Low fees don’t always mean affordability. Providers may add hidden margins to exchange rates. Wise is transparent with mid-market rates, making it a favorite among best international send money services.

Security Measures: Protecting Your Funds and Data

Encryption, fraud detection, and regulatory compliance ensure your money is safe. Always confirm that the provider is licensed in your country. For example, Payoneer complies with financial regulations in multiple regions.

Ease of Use: User-Friendly Platforms and Mobile Apps

Modern send money services often come with intuitive apps, making transfers possible in just a few taps. For users in developing nations, easy access via smartphone apps is a game-changer.

Accessibility and Reach: Supported Countries and Payout Options

If your recipient lives in rural Africa or Latin America, you need services that support mobile wallets and local banks. Remitly and WorldRemit excel in this area.

Customer Support: Reliability When You Need It Most

24/7 multilingual support is a strong advantage for global senders. A reliable help desk ensures peace of mind during technical issues.

Top Send Money Services: A Comparative Breakdown

Best for International Transfers: Bridging Global Gaps

Wise and Payoneer are excellent for freelancers and small businesses needing fast international transfers with transparent rates. Both offer bank integrations and payment tracking.

Best for Domestic, Bank-to-Bank Transfers: Speed and Simplicity

Zelle and Venmo dominate the U.S. domestic market, enabling instant peer payments. They are widely integrated with banks, offering a seamless experience.

Best for Large Payment Transfers: Value and Security

Payoneer and Revolut serve companies that transfer large amounts with added safeguards. They also provide dedicated business accounts.

Best for Ease of Use & Peer-to-Peer: Everyday Transactions

Cash App and PayPal excel for casual peer-to-peer use, thanks to their intuitive interfaces. Peer payments are often free or low-cost.

Best for Cash Pickup & Traditional Services: Global Reach

Western Union and MoneyGram remain top choices for recipients in cash-only regions. They have thousands of agent locations globally.

Best for Budget-Conscious Transfers: Maximizing Your Money

Remitly and Wise stand out for low-cost transfers to developing markets. They are recognized as low fee money transfer providers.

Detailed Service Spotlights:

- Wise – Transparent, low fees, mid-market rates.

- Payoneer – Popular for freelancers in Asia and Africa.

- Western Union – Trusted brand with global cash pickup.

- Revolut – Multi-currency accounts and low fees.

- Remitly – Great for low-income households sending remittances.

Decoding Fees and Exchange Rates: Get the Best Value

Understanding Transfer Fees: Fixed vs. Percentage

Some platforms charge a flat fee, others take a percentage. For small amounts, flat fees may hurt more. For example, sending $20 with a $5 fee is highly inefficient.

The Impact of Exchange Rate Markups

Providers often earn from exchange margins. Wise publishes its exact markup, making it transparent. XE is another useful tool for comparing rates.

How to Calculate the “Total Cost” of Your Transfer

Always calculate both fees and rate differences. A $5 fee with a poor rate can cost more than a $10 fee with a fair rate. Use calculators on OFX or Wise before committing.

Tips for Finding the Best Exchange Rates

Check mid-market rates on XE before making your transfer. Timing also matters—exchange rates fluctuate daily.

Ensuring Security: Is Your Money Safe?

Essential Security Measures to Expect

Look for two-factor authentication, encrypted communication, and fraud monitoring. Without these, you risk exposure.

Identifying Reputable and Secure Services

Always verify licenses. For example, Wise is regulated by the FCA in the UK. PayPal is regulated in multiple jurisdictions.

Protecting Yourself from Scams and Fraud

Never share login codes or passwords. Scammers often target users via phishing emails. Watch out for fake apps that mimic real platforms.

Regulatory Compliance and Your Protection

Legitimate providers must comply with anti-money laundering regulations, giving you added assurance. Authorities like the FinCEN in the U.S. enforce strict rules.

Frequently Asked Questions (FAQs)

Can I send money using just a mobile number or email address?

Yes, many services like PayPal and Zelle allow transfers with just an email or phone number. This convenience makes transfers more accessible.

What are the typical limits for sending money?

Limits vary by provider. Wise may cap daily transfers at a few thousand, while Payoneer handles larger amounts. Western Union may allow higher limits in cash.

How do foreign exchange rates affect my transfer?

The exchange rate determines how much your recipient receives. Always compare rates before sending. Even small differences matter over time.

What payment methods are usually accepted?

Most services support bank transfers, credit cards, debit cards, or digital wallets. Some even support Apple Pay or Google Pay.

How is my personal and financial information protected?

Reputable services secure your data with encryption and adhere to strict privacy policies. They often undergo regular audits.

Conclusion: Choosing the Right Service for Your Needs

Recap: The Best Services for Different Scenarios

Wise is best for transparent fees, Western Union for global reach, and Payoneer for freelancers. Revolut works well for businesses, and Remitly excels for cost savings.

Final Advice: Prioritizing Your Transfer Requirements

Always match the service to your exact needs—speed, affordability, or global availability. For freelancers, secure online money transfer options like Payoneer may be perfect. For family remittances, Remitly or Western Union might be best.

The Future of Money Transfers: Staying Informed

The industry evolves rapidly. Mobile wallets, blockchain solutions, and AI-powered fraud prevention will continue to shape send money services. Stay updated through resources like PrimeFinanceTech, which regularly covers fintech trends.