Deciding between wise vs payoneer matters today. Costs squeeze margins. Delays hurt cash flow. Therefore, you need precise facts and clear guidance. This guide follows your outline exactly. It also embeds many trusted sources and actionable tips. Finally, it shows where to place charts.

This post may contain affiliate links. If you sign up or make a purchase through these links, we may earn a commission — at no extra cost to you. Learn more.

Overview of Payoneer and Wise

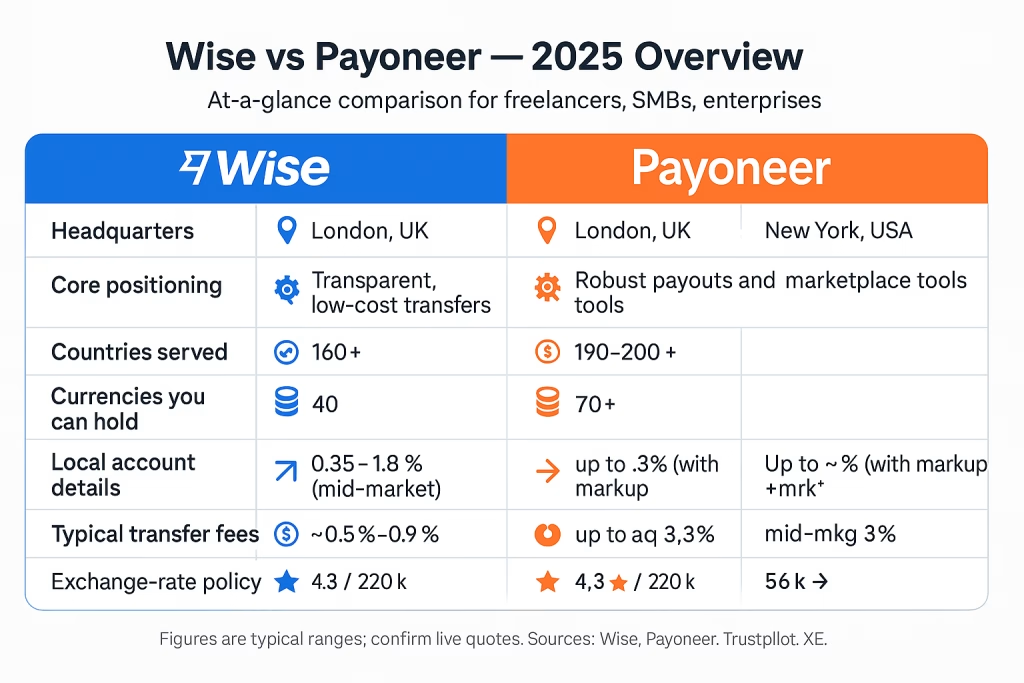

Wise and Payoneer are leading online payment platforms. Wise operates from London. Payoneer is based in New York. Both companies handle global money movement at scale.

Wise is known for transparency and cost-effectiveness. You see fees upfront. You also get the real mid-market exchange rate. Meanwhile, Payoneer offers a robust interface for complex operations. Teams manage payroll, marketplaces, and multiple revenue streams in one place.

Both platforms support B2B and B2C payments. They serve small businesses and freelancers who run international transactions daily. As a result, the wise vs payoneer choice affects real earnings every month.

Wise integrates with banks and online platforms. Transfers run efficiently. However, some routes have transfer limits. You should check your corridor before sending.

Social proof also guides decisions. Wise has over 220,000 reviews on Trustpilot. Its rating stands near 4.3 stars. Payoneer holds over 53,000 reviews on Trustpilot. Its rating sits near 3.9 stars. These numbers inform any wise vs payoneer fees comparison.

For general product details, review the official pages at Wise and Payoneer. For macro context, you can also scan global remittance trends from the World Bank and cross-border payments research from the OECD and IMF.

Target Users of Payoneer and Wise

Payoneer is frequently chosen by freelancers and online businesses. Its payment collection features work well with Upwork, Fiverr, and Amazon. Consequently, wise vs payoneer for freelancers becomes a real discussion on every marketplace forum.

Wise is recognized for transparent, low-cost multicurrency transfers. It suits international money transfers for people who need predictability.

Both Wise and Payoneer serve business, personal, and freelancer accounts. However, they approach segments differently. Payoneer leans toward complex business use. Wise leans toward simple sends with low friction.

Payoneer is especially popular for business payments. Freelancers and online businesses rely on its requests and payout tools. Meanwhile, Wise is advantageous when you seek lower transfer fees. It is also widely accepted across many regions.

Therefore, wise vs payoneer for freelancers usually hinges on where money originates. If earnings flow from marketplaces, Payoneer integrates well. If payments come from clients directly, Wise often saves on fees. This dynamic repeats in every wise vs payoneer fees comparison thread.

Supported Currencies and Global Coverage

Payoneer supports transactions in over 190 countries. It allows withdrawals in more than 70 currencies. You can hold balances in multiple currencies within accounts. This setup facilitates easier conversions later.

Wise enables multicurrency management in 40 currencies. It provides services in over 160 countries. Wise accounts also provide local account details for 10 currencies. Payoneer accounts provide local details for 9 currencies.

Moreover, Payoneer’s global coverage extends to more than 200 countries. It supports about 150 currencies for diverse business needs. As a result, the wise vs payoneer landscape favors Payoneer on raw coverage. However, coverage alone does not decide the best platform for international money transfers. Cost and speed matter even more.

For cross-checking particular corridors, confirm supported routes on the official Wise coverage page and the Payoneer support pages. You can also compare indicative FX with the XE currency converter.

Costs and Fees Comparison

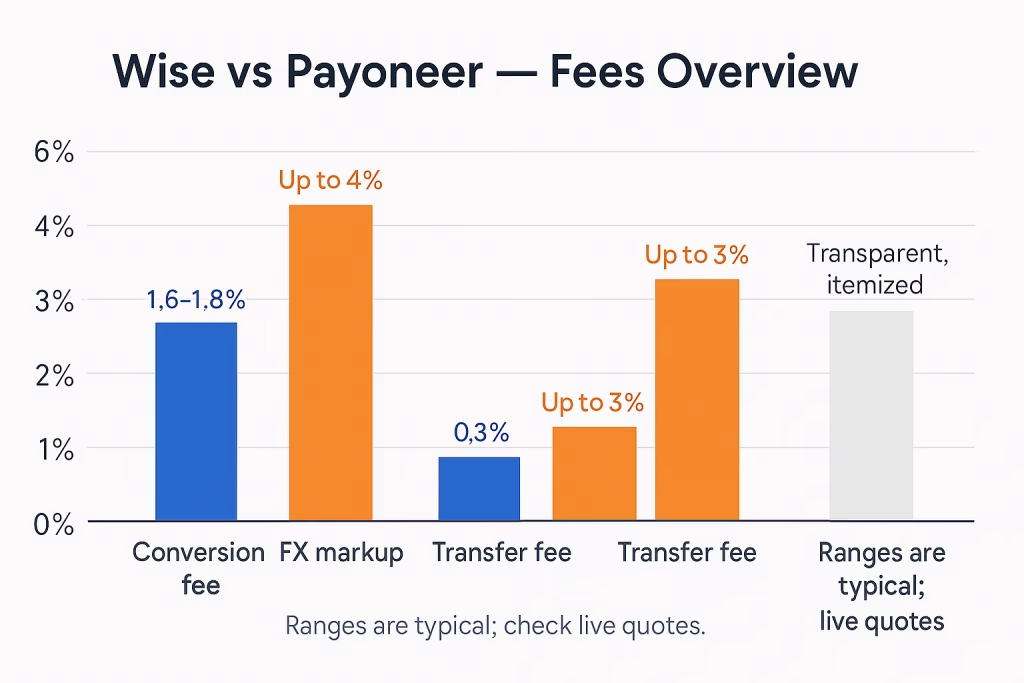

Wise offers lower fees for converting currencies. Typical conversion fees range from 1.6% to 1.8%. In practice, many routes cost even less. Payoneer can charge up to 4%, depending on the transfer method.

Payoneer’s exchange rates include a 3% forex markup. Wise uses the real mid-market rate with no hidden markup. That difference drives every wise vs payoneer fees comparison online.

Payoneer incurs transfer fees up to 3% for international transactions. Wise fees for similar services often start at 0.35%. Consequently, Wise becomes cheaper on many small and medium transfers.

Sometimes, Payoneer’s pricing can reach 6.2%, depending on payment mode. Wise remains more structured and transparent. Therefore, Wise delivers a cost-effective solution for larger payments. The gap becomes clear when you run a wise vs payoneer fees comparison on a live quote.

If you want a deeper playbook on cross-border fee optimization, read your in-house guide on Top Remittance Apps with Low Exchange Rates. It supports the best platform for international money transfers decision across corridors.

Transaction Charges Breakdown

Wise typically charges between 0.5% and 0.9% of the transfer amount. That range helps larger transactions as well. No hidden FX markup sneaks in later.

Payoneer charges a 2% fee on incoming payments. It also charges a 3.5% fee on cash withdrawals using its Mastercard. These costs accumulate if you withdraw often.

Both platforms implement varying fees by route and method. Wise favors lower, straightforward percentages. Payoneer may include subscription-style benefits and add-on charges for currency conversion.

Despite Wise offering a straightforward model, Payoneer’s potential subscription or negotiated model can help some firms. Frequent users may capture value through volume agreements. However, Wise still wins many wise vs payoneer fees comparison scenarios under $5,000.

Therefore, users repeat the same theme. For quick client invoices, Wise saves more. For marketplace payouts and card access, Payoneer can still shine. This holds for wise vs payoneer for freelancers decisions as well.

Exchange Rate Analysis

Wise applies the mid-market rate for conversions. There are no markups and no hidden fees. Consequently, customers often receive the best available retail rates.

Payoneer uses a mid-market base with an additional 0.5% fee. That fee creates a small markup over the base rate.

Users can track fluctuations with the Wise rate tracker. Alerts help time a transfer for a better yield. Payoneer bases its rates on wholesale market feeds and leverages XE data for conversions. Still, the markup remains part of the model.

Therefore, for businesses watching cents and seconds, Wise usually wins any wise vs payoneer fees comparison on FX. However, marketplace sellers may still prioritize Payoneer’s integrations. Even then, they often open Wise as a backup. That hybrid setup supports the best platform for international money transfers across use cases.

Value for Money

Wise offers transparent, low-cost multicurrency transfers. That approach makes Wise a cost-effective solution for many international payments.

Both Wise and Payoneer support multicurrency operations. However, their fee structures and processing times differ. The net amount received, therefore, can diverge sharply.

Wise fees range from 0.5% to 0.9% of the transfer volume in many cases. That focus on transparency keeps costs predictable. On a $10,000 payment, the choice can shift results by more than ₹15,000 after fees. That difference feels real on slim freelance margins.

Wise is typically more favorable under $5,000. The combination of lower fees and predictable rates helps individuals and micro-businesses. That is why many creators search “wise vs payoneer for freelancers” before opening accounts. They also compare options under the best platform for international money transfers umbrella.

For additional setup advice, your primer on How to Open a Wise Business Account in Nigeria helps global readers. It also reinforces the wise vs payoneer fees comparison section with practical KYC notes.

Speed and Reliability of Transfers

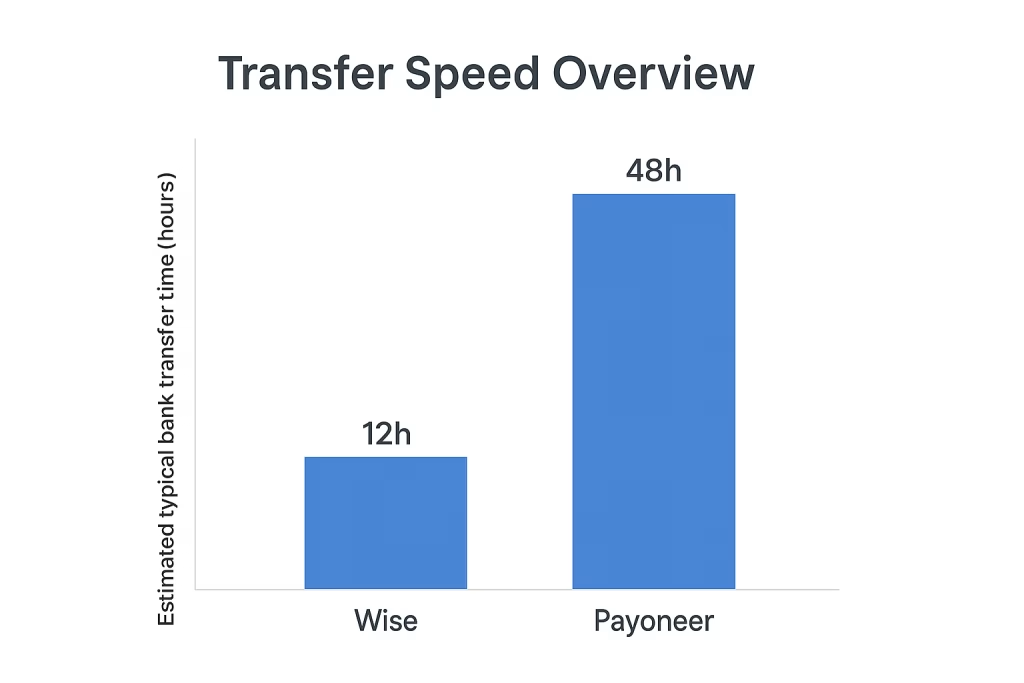

Payoneer typically takes one to three business days for cross-border bank transfers. However, it offers instant P2P payments within Payoneer. Many general transactions land within zero to two business days.

Wise is known for fast transfers. International transactions often complete within hours. Same-day or next-day delivery happens frequently across popular routes.

The speed of Payoneer transfers varies by type and destination. That variance can limit urgent access to funds. Wise, meanwhile, publishes clear delivery estimates in the app. Consequently, users plan cash flow better.

Both platforms deliver credible transfer services. However, Wise’s lower fees and clear timelines boost reliability perceptions. Therefore, many blogs now call Wise the best platform for international money transfers for bank-to-bank routes.

Average Transfer Speeds

Payoneer typically takes one to three business days to bank accounts. The exact time depends on the recipient’s country and bank.

Wise often completes transfers within hours. More than 50% of Wise payouts arrive instantly. About 90% arrive within 24 hours.

Payoneer transactions can take up to five days in some corridors. However, Payoneer-to-Payoneer transfers can be fast. Wise also offers same-day or next-day delivery for many routes.

These facts drive the wise vs payoneer fees comparison beyond fees. Time is money. Faster settlement reduces stress and supports growth. That point matters in every Wise vs Payoneer for freelancers thread online.

Consistency and Reliability

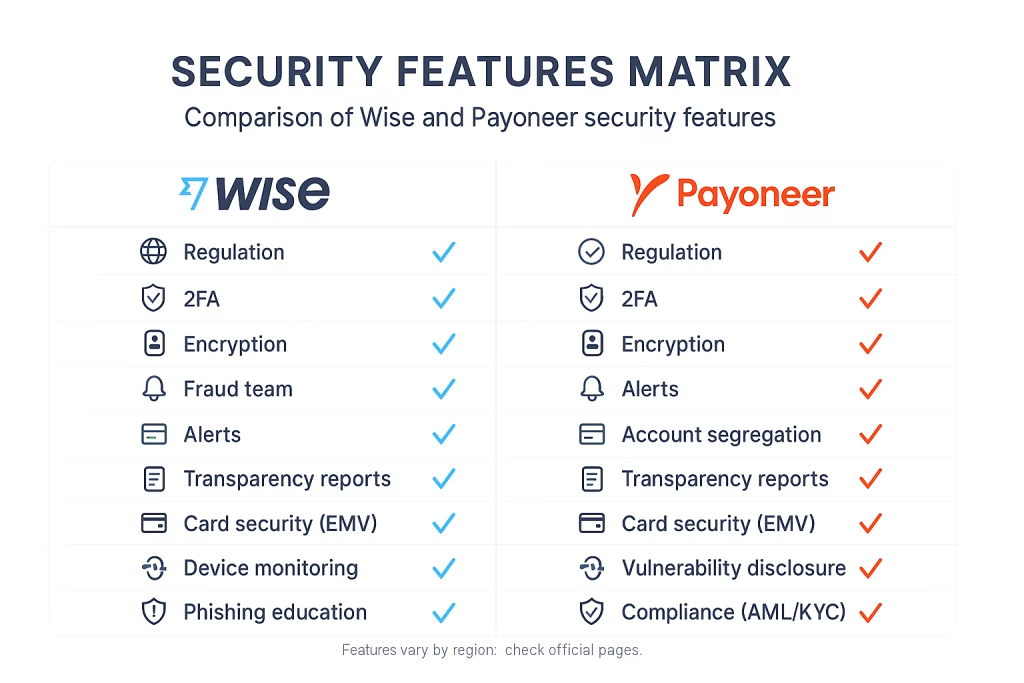

Both Wise and Payoneer face regulation in many regions. That oversight ensures consistent safety and reliability in many currencies. Each platform runs dedicated fraud teams. Both support two-factor authentication and real-time alerts.

Wise provides reliable service through web and mobile apps. Users without finance teams still manage flows efficiently. Payoneer shines with complex operations. Payroll, marketplaces, and multi-entity setups all find a home there.

Wise also encourages security research and disclosure. That transparency builds trust. As a result, users view Wise favorably when debating the best platform for international money transfers.

Security Measures

Payoneer employs robust fraud detection and global compliance. Those tools protect accounts and transactions at scale.

Both Wise and Payoneer are fully regulated by multiple oversight bodies. Funds move under strict rules. Users benefit from layered protections.

Payoneer offers encryption and two-factor authentication. Wise runs in nearly all countries, under many regulators. Both companies explain their controls clearly on their help pages.

Payoneer emphasizes transparency in its transactions. It employs high-level encryption for financial data. Wise also explains how funds route and settle. That openness supports confidence in a wise vs payoneer evaluation.

For broader security education, check the Wise Help Centre and the Payoneer Resources hub.

Protecting User Funds

Wise earns recognition for strong customer support. That support enhances trust around fund safety. Clear status updates help, too.

Both platforms support multicurrency account management. That setup can add a layer of control for global transactions. You decide when to convert. You decide when to withdraw.

Wise’s straightforward fee model improves transparency. You know what leaves and what arrives. Payoneer supports over 200 countries. That network reassures users running global operations.

Both platforms let you link and withdraw to local bank accounts securely. Those links simplify daily cash management. Consequently, they strengthen any best platform for international money transfers shortlist.

Fraud Prevention Techniques

Payoneer relies on standard features like two-factor authentication. It runs fraud detection and strict encryption. It also holds compliance across many regions. These layers help block account takeovers and fake invoices.

Wise adopts a digital-first strategy. The interface empowers users to spot issues early. Device checks and step-up verification add protection. Coverage limits can exist, but controls remain strong.

Payoneer educates users with phishing guides and security tips. Knowledge reduces risk. Each platform invests in safety content. That content improves outcomes for wise vs payoneer for freelancers who work alone.

You can also compare wallet safety in this internal primer on global apps: Top Remittance Apps with Low Exchange Rates. It supports your wise vs payoneer fees comparison with practical guardrails.

Ease of Use and User Experience

Wise offers a clean, intuitive interface. It simplifies the transfer process end-to-end. Quotes show fees and delivery times upfront. Therefore, you send with confidence.

Payoneer provides a comprehensive dashboard. It supports multiple revenue streams and payout types. Consequently, teams manage complexity in one place.

Wise wins on simplicity and speed. Freelancers appreciate that approach in daily workflows. Reviews also back this up across many blogs and on Trustpilot.

Platform Navigation and Interface

Payoneer offers a clean interface across desktop and mobile. Users navigate dashboards without much friction. However, the feature depth introduces a learning curve.

Wise and Payoneer both enable borderless transactions. They serve freelancers who invoice global clients. Due to its variety of services, Payoneer can feel dense. Prepaid cards, balances, payouts, and funding options all live there.

Wise focuses on low-cost, transparent multicurrency transfers. The path from quote to confirmation remains short. That clarity helps the best platform for international money transfers debate.

Account Setup and Verification

Opening a Payoneer account is straightforward. You sign up, choose an account type, and complete verification. Freelancers submit minimal documents. Companies often provide more.

Wise runs a digital-first onboarding flow. Success depends on clear ownership structures and document quality. KYC requirements can vary by country. However, most users complete setup quickly.

If you need a practical checklist, see How to Open a Wise Business Account in Nigeria. It supports wise vs payoneer for freelancers who want a fast start.

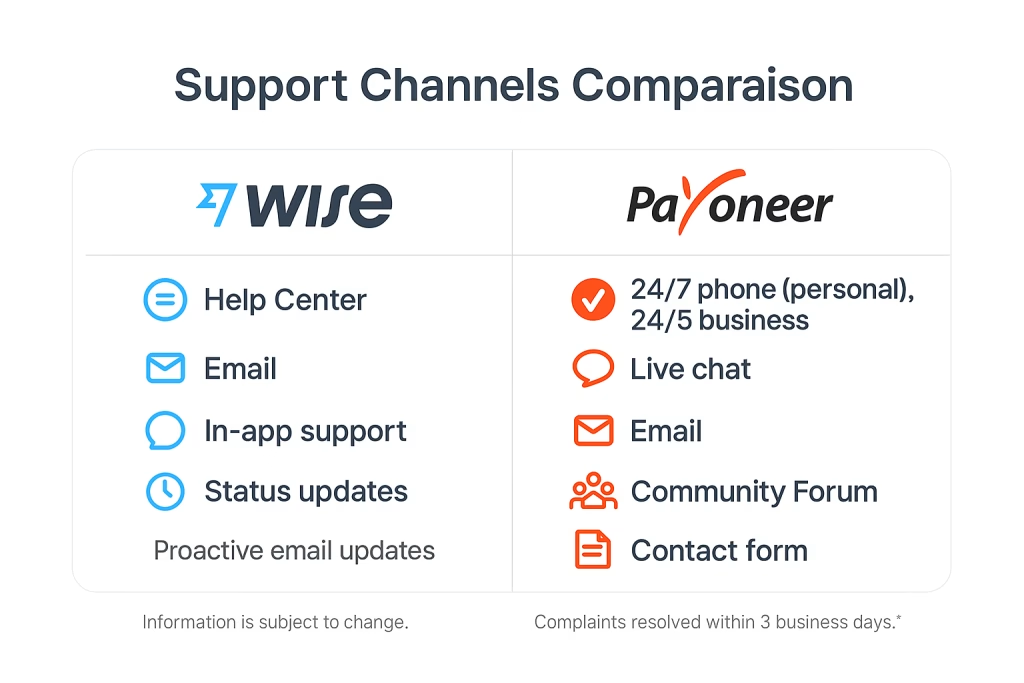

Customer Support

Both Wise and Payoneer support customers through multiple channels. Wise runs a deep help center and responsive email support. It communicates service issues clearly. That transparency builds trust.

Payoneer offers AI-assisted support, live chat, and email. It also provides 24/7 phone support for personal users. Business users get 24/5 phone support. Therefore, urgent matters reach human agents quickly.

Wise earns praise for fee clarity and exchange transparency. Payoneer users highlight straightforward navigation once they learn the tools.

Availability and Response Time

Payoneer offers 24/7 support for personal customers. Business customers get 24/5 access. Users reach Payoneer by phone, email, live chat, and online forms. US customers benefit from a toll-free number.

Wise employs a dedicated fraud team. It uses real-time spending alerts and two-factor authentication. Those alerts support faster responses when something looks wrong.

Payoneer also aims to resolve complaints within three business days. This target helps set expectations for resolution times.

These points influence the best platform for international money transfers debate. Speedy support matters when funds are stuck.

User Satisfaction

Wise’s support often earns remarkable feedback. Clear fees and real rates reduce surprises. Users feel respected and informed.

Payoneer offers multilingual Customer Care. It handles email, phone, and chat inquiries. A community forum also drives self-help and peer learning.

Wise’s digital-first strategy empowers users. However, complex cases can require more live assistance. Therefore, some users still prefer Payoneer’s phone support model.

These patterns surface in every wise vs payoneer fees comparison thread. They also shape Wise vs Payoneer for freelancers’ decisions at scale.

Special Features

Wise offers a Borderless account. You pay, get paid, and spend with a Wise debit card globally. There are no hidden rate markups. Business accounts add batch payments, multi-user access, and expense cards.

Payoneer provides a comprehensive business dashboard. It includes working capital, marketplace payouts, and free transfers between Payoneer accounts. These features support complex operations end-to-end.

Therefore, wise vs payoneer often becomes a stack decision. Many users hold both. Wise handles bank-to-bank value. Payoneer handles marketplace flows and card access. This blend supports the best platform for international money transfers across unique needs.

Multi-Currency Account Options

Payoneer’s multicurrency accounts let you hold and manage balances in 70+ currencies. Wise supports management in 40 currencies.

Both platforms provide free multicurrency accounts. That policy helps freelancers and businesses operate globally. Payoneer issues local bank details for nine currencies. Wise issues local details for ten. Each approach reduces friction when getting paid.

Wise’s multicurrency accounts help businesses minimize unnecessary conversions. Users can wait for a better rate. That strategy aligns with the wise vs payoneer fees comparison principle.

Available Payment Methods

Payoneer offers many payout options. You can withdraw to a local bank account. Also you can transfer to another Payoneer account. You can also spend with the Payoneer Prepaid Mastercard.

Wise provides fee-free transfers if both parties have Wise and use the same currency. Charges apply for cross-currency sends. Wise integrates with key accounting software. It enables low-fee international payments from a single multicurrency account.

Payoneer adds a payment request feature. Clients can pay by card, direct bank payment, local transfer, or Payoneer Balance. Therefore, wise vs payoneer for freelancers depends on client preferences, too.

For broader banking options that pair well with these tools, see Best Banks for Remote Workers in Southeast Asia. It helps round out the best platform for international money transfers stack.

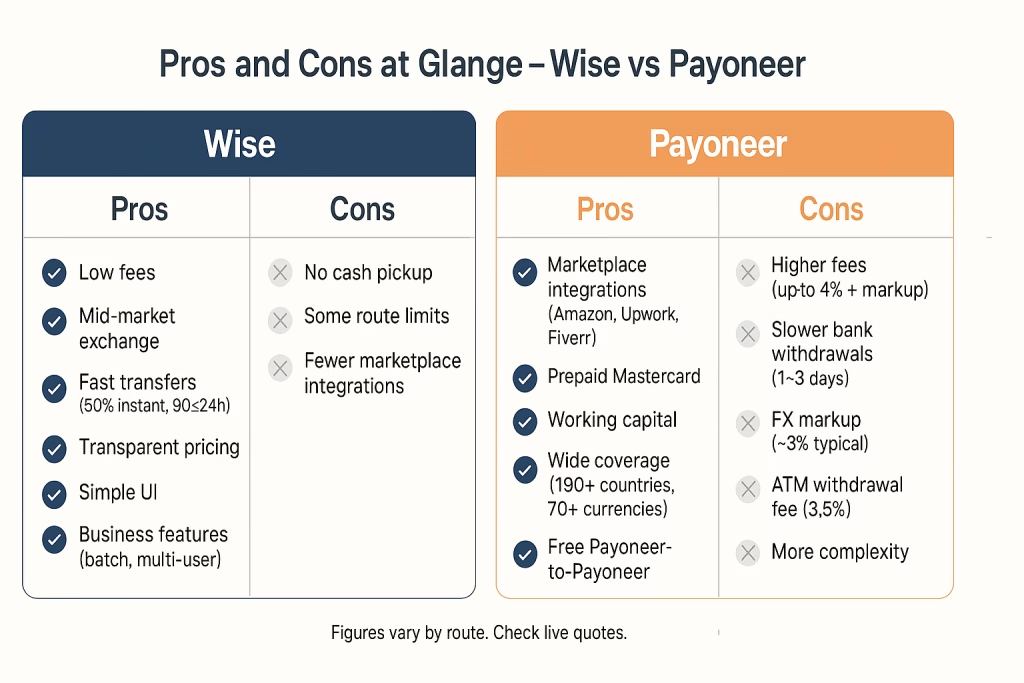

Pros and Cons Summary

Payoneer provides a wide range of services. It offers multicurrency accounts and prepaid cards. Therefore, it suits businesses and freelancers managing cross-border payments at scale.

One downside of Payoneer is higher fees. Withdrawals and FX markups raise costs. Cost-conscious teams feel that pain.

Wise is recognized for low fees and competitive rates. Transparent costs make it an economical option for many small businesses. Simplicity also helps teams without finance staff.

Overall, Wise wins on transparency and cost. Payoneer wins on network and extra business resources. That balance defines wise vs payoneer in 2025. It also shapes the wise vs payoneer fees comparison across regions.

Payoneer: Benefits and Drawbacks

Payoneer offers flexibility for cross-border sellers and agencies. Multicurrency accounts and prepaid cards support many workflows. Users also request payments through multiple methods. Clients pay by card, bank, or balance.

However, fees can bite. Typical transactions may reach 4% once markups apply. Extra charges can tag along for FX and withdrawals. Processing also takes two to three days in many corridors.

Still, marketplace sellers love the integrations. They also appreciate working capital and reporting. As a result, wise vs payoneer for freelancers sometimes ends with Payoneer for marketplace-heavy operations.

Wise: Benefits and Drawbacks

Wise is renowned for a transparent fee structure. You see the full cost before you click send. No hidden FX markup distorts results.

The platform often matches the mid-market rate. That policy helps users with multicurrency accounts. It also drives savings at volume.

Wise suits businesses of all sizes. There are no monthly account fees. Users access major local details to receive payments easily.

Wise works especially well for transfers under $5,000. Low fees and strong FX often beat rivals. Therefore, the best platform for international money transfers shortlist always includes Wise.

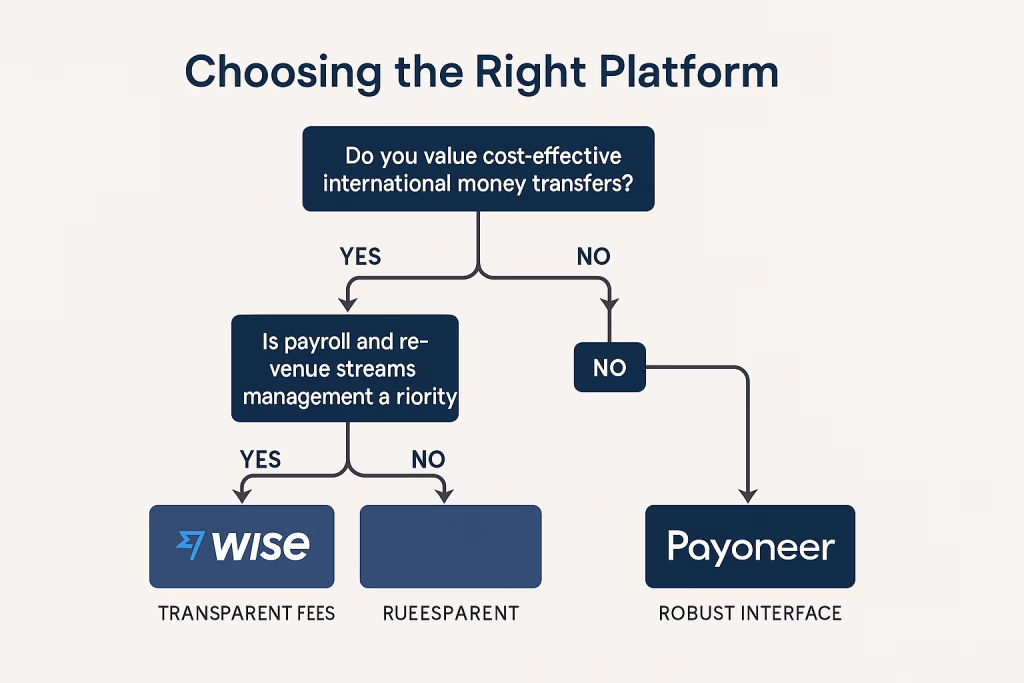

Choosing the Right Platform

Wise delivers real mid-market exchange rates. Transparent fees help planners. For cost-focused users, Wise often wins.

Payoneer provides a robust business interface. It manages payroll, multiple revenue streams, and marketplaces. Extra resources help complex operations at scale.

Wise is accepted widely. It reaches almost all countries, with a few exceptions. Payoneer covers even more countries in raw count. However, you still need to test your primary corridors.

Both platforms support borderless experiences. You can pay, get paid, and reconcile from anywhere. Still, running a quick wise vs payoneer fees comparison before big transfers is smart.

Needs of Small Businesses

Non-bank providers power about 24% of SMB payment flows today. There is room to grow. Providers keep tailoring features for SMBs every quarter.

Small businesses need low fees and quick transfers. Cash flow depends on both. Mass payments should avoid heavy FX. That rule protects margins across borders.

A platform must support multiple currencies. It must offer cost savings, speed, and flexibility. Wise checks those boxes well. Payoneer also helps with marketplace and card flows. Therefore, wise vs payoneer for freelancers and SMBs remains a case-by-case call.

Priorities of Large Enterprises

Large enterprises prioritize tax and compliance support. They also demand reliable mass payments. Reporting and controls matter at audit time.

Some enterprises use Payoneer or alternatives like PayQuicker for programs. Financial robustness drives those picks. Reliability and cost both matter.

Cross-border operations introduce risk. Minimizing cost while keeping uptime high remains crucial. Consequently, enterprise teams still run a wise vs payoneer fees comparison before locking standards.

Freelancers’ Considerations

Payoneer serves freelancers, online sellers, and small businesses well. It connects to marketplaces like Upwork and Airbnb. That saves setup time and emails.

Wise offers lower transfer fees and strong currency tools. It helps freelancers who invoice clients directly. They pay less and receive faster. Many guides now label Wise the best platform for international money transfers for bank-to-bank sends.

Payoneer’s prepaid Mastercard helps with quick spending. ATM access also matters in some regions. Free payments between Payoneer accounts reduce internal friction. However, rarer currencies may incur higher costs.

Onboarding for Payoneer is straightforward for freelancers. Documentation stays light. Wise onboarding is also quick for individuals. KYC varies by country but usually moves fast.

Therefore, wise vs payoneer for freelancers hinges on your pipeline. If marketplaces dominate, Payoneer integrates better. If direct clients dominate, Wise usually puts more money in your pocket.

Internal Resources to Help You Decide

For practical banking stacks, see Best Banks for Remote Workers in Southeast Asia. For corridor-by-corridor app picks, review Top Remittance Apps with Low Exchange Rates And for Wise onboarding specifics, see How to Open a Wise Business Account in Nigeria. These internal guides support the wise vs payoneer fees comparison and the best platform for international money transfers decision.

Final Word

The wise vs payoneer choice depends on your revenue sources and cash flow needs. Wise wins on fee transparency, FX fairness, and speed. Payoneer wins on marketplace integrations, card access, and business tooling.

Run a quick live quote on both before big transfers. Confirm route times. Check FX spreads. Then move with confidence. That workflow consistently reveals the best platform for international money transfers in your situation.

I love forgathering utile information , this post has got me even more info! .